Google (GOOG Stock) shallow corrective pattern indicates more uptrend soon

-

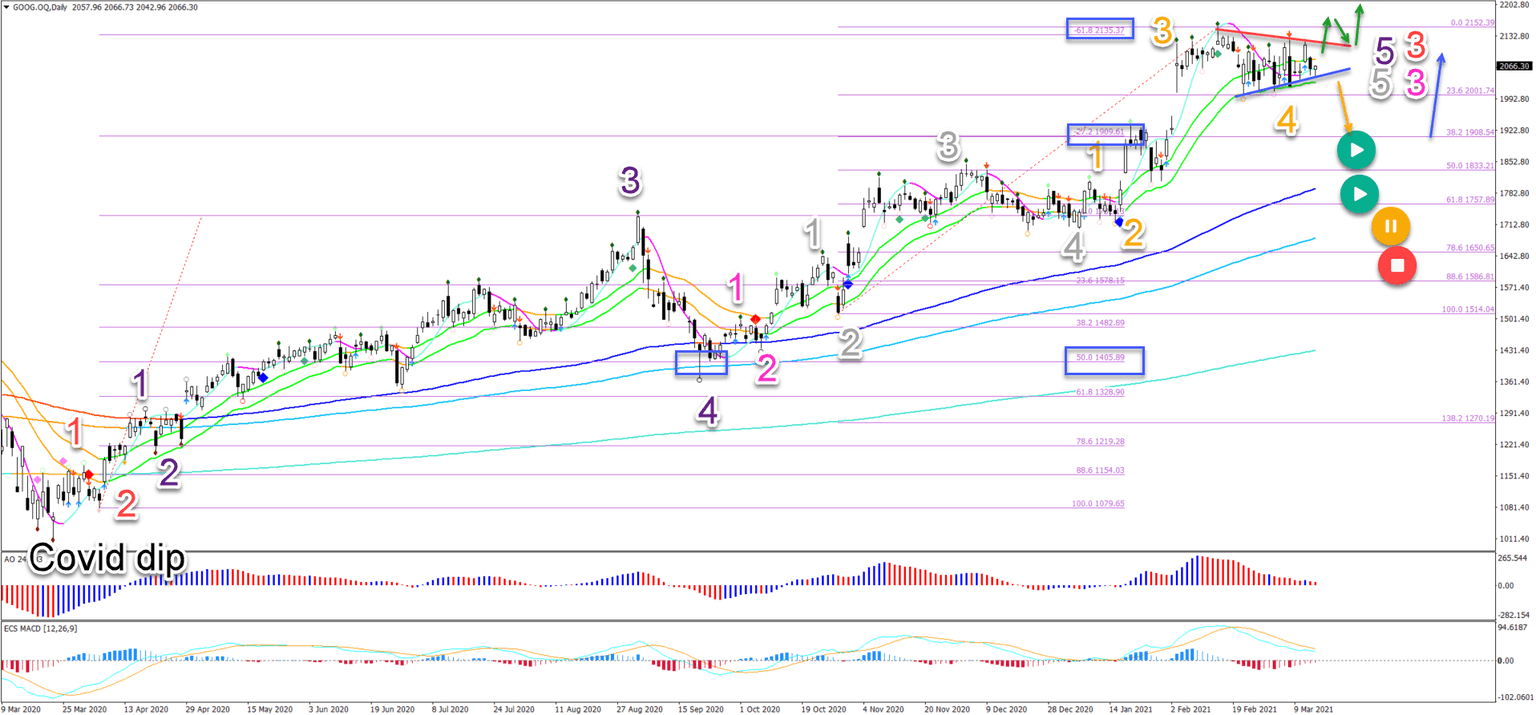

GOOG stock (Alphabet / Google) has been in a very strong bullish trend. The uptrend is valid since price action made a deep dip in March 2020 because of Covid.

-

The 21 emas have been a strong support ever since price action made a dip one year ago - with the exception of the pullback during September 2020.

-

Price action is expected to either make a bullish breakout (green arrows) or build a pullback towards the Fibonacci levels (orange arrow) and bounce (blue arrow).

Currently price action is showing another pauze. Is the chart ready for a reversal or will the uptrend persist?

Price charts and technical analysis

The GOOG stock is building a consolidation zone at the 21 ema support zone.

The 21 emas have been a strong support ever since price action made a dip one year ago - with the exception of the pullback during September 2020. Let’s review:

-

The consolidation zone is probably a wave 4 correction (orange).

-

Waves 4 usually respect shallow Fibonacci levels like the 23.6%, 38.2% or max 50% Fib.

-

A bullish breakout (green arrows) indicates an immediate uptrend continuation within the wave 5 (grey) within wave 3 (pink).

-

The next target is located at the round level of $2,250.

-

A bearish breakout (orange arrow) indicates a deeper pullback. The main target is the 38.2% Fib.

-

The 38.2% or 50% is likely to act as support and send price action up again (blue arrow) within the larger uptrend.

-

Only a break below the 61.8% Fib places the uptrend on hold (yellow circle).

-

Whereas a very deep pullback invalidates the current uptrend (red circle).

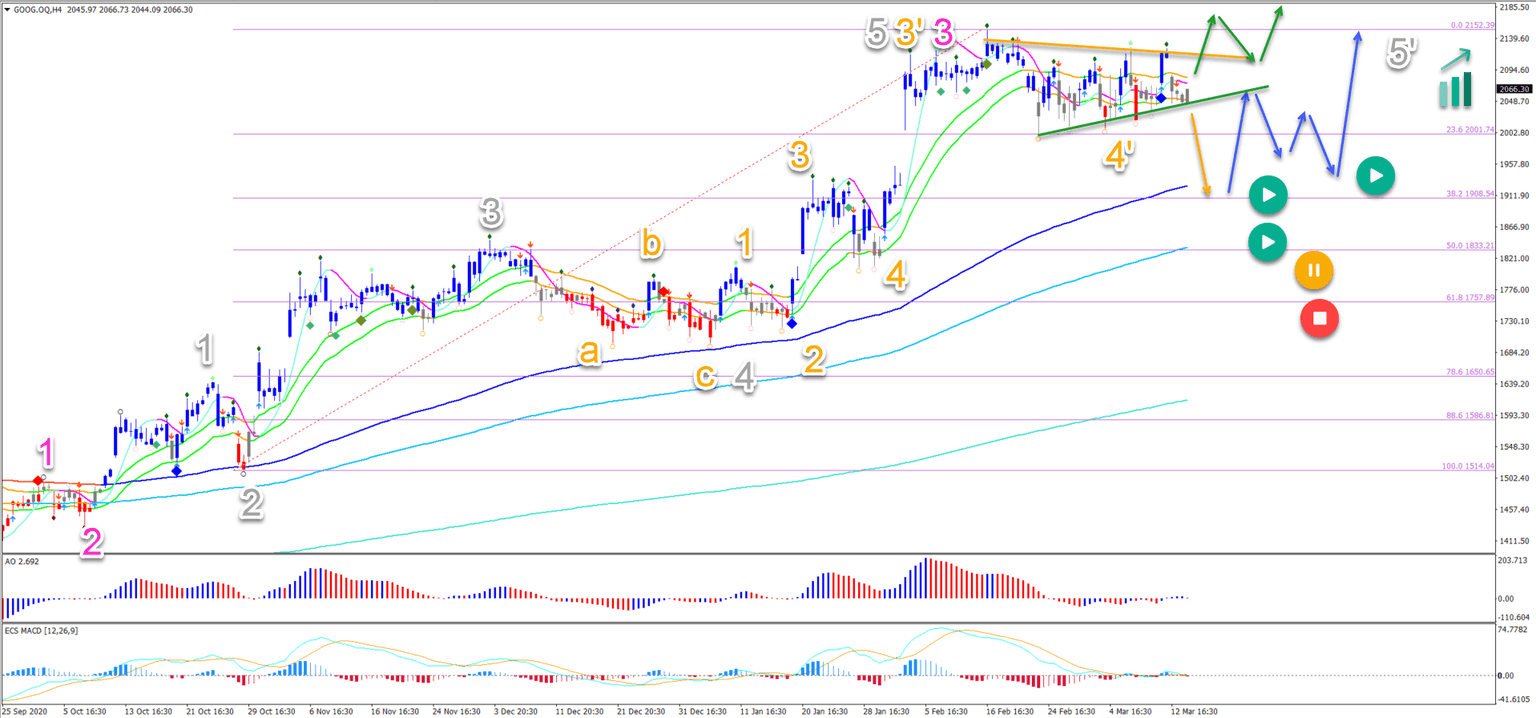

On the 4 hour chart, there are two wave variants added.

One shows a wave 1-5 (orange) completed at the recent high within wave 5 (grey) in wave 3 (pink). The other scenario is that price is now in a wave 4’ (orange) pullback.

In any case, price action is expected to either make a bullish breakout (green arrows) or build a pullback towards the Fibonacci levels (orange arrow) and bounce (blue arrow).

The analysis has been done with the ecs.SWAT method and ebook.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Chris Svorcik

Elite CurrenSea

Experience Chris Svorcik has co-founded Elite CurrenSea in 2014 together with Nenad Kerkez, aka Tarantula FX. Chris is a technical analyst, wave analyst, trader, writer, educator, webinar speaker, and seminar speaker of the financial markets.