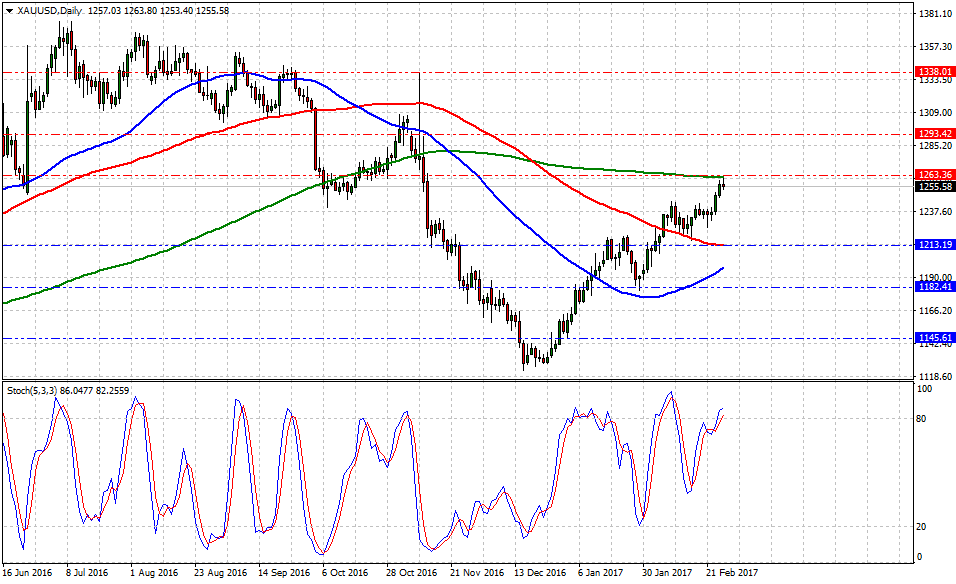

Currently, the Gold spot is trading at 1257.25, down -0.05% or (63)-pips on the day, having posted a daily high at 1263.90 and low at 1253.39. On the other hand, the US 10yr treasury yields have traded from 2.36% to 2.31%, up +2.31% on the day, as of writing an impressive comeback at 2.36% or +0.0533.

The shiny metal seems to be exhausted after a robust recovery from the 2016 lows near $1122 adding $123 in gains. However, there is evidence to expect a short profit-taking as prices trade closer to the 200-DMA.

On the other hand, if Trump's stimulus package were to be in the position to impact markets before the end of 2017, then Gold prices could retrace to retest the 100-DMA near $1210 as other asset classes become more attractive to investors starving for higher yields.

The Fed is the only thing that might upstage Trump

Historical data available for traders and investors indicates during the last 9-weeks that Gold spot had the best trading day at +1.41% (Jan.5) or 1664-pips, and the worst at -1.11% (Jan.18) or (1331)-pips.

Technical levels to watch

In terms of technical levels, upside barriers are aligned at $1263 (200-DMA), then at 1290 (high Nov.10) and above that at $1330 (high Nov.9). While supports are aligned at $1213 (100-DMA), later at $1190 (50-DMA) and below that at $1140 (low Jan.3).

On the other hand, Stochastic Oscillator (5,3,3) seems to slightly change direction inside the overbought territory to head south. Therefore, there is evidence to expect Gold losses in the near term.

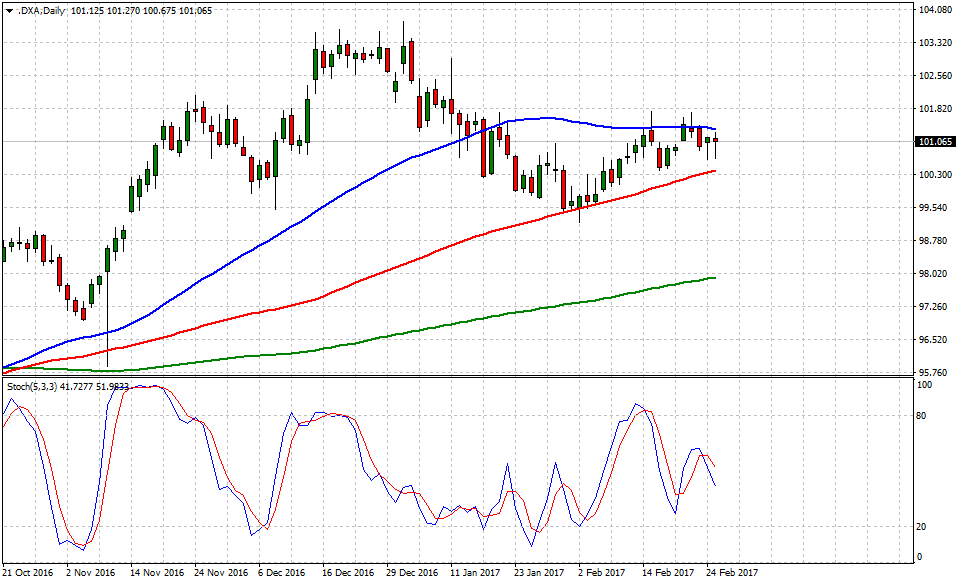

The greenback – gauged by the US Dollar Index seems muted 'at 50-DMA gates' which contributed to a sell-off across the board (this represents the 5th attempt during the last 9 trading sessions). However, the bullish tone hasn't been diluted as long as the buck holds 100.20 handle. Now, there is technical evidence to expect either a break above 101.60 or sell-off towards the 100-DMA near 100.20.

In term of technical levels, upside barriers are aligned at 101.40 (high Feb.23), then at 102.10 (high Jan.16) and above that at 102.40 (high Jan.9). Meanwhile, supports are aligned at 100.20 (100-DMA), later at 99.60 (low Feb.6) and finally below that at 98.54 (low No.11). On the other hand, once again, today's daily candlestick seems to emulate a 'bullish pin bar' could translate in one more attempt to challenge its 50-DMA; short-term bottom?

AUD/USD analysis: consolidating, but downward potential increasing

© 2013 "FXstreet.com. The Forex Market" Todos los Derechos Reservados. Todos nuestros esfuerzos están destinados a proporcionar información precisa y completa. Aún así, con los centenares de documentos disponibles, a menudo publicados con poco margen de tiempo, no podemos garantizar la falta de errores en los mismos. Cualquier publicación o redistribución de contenido de FXstreet.com está absolutamente prohibido sin el consentimiento previo por escrito de FXstreet.com.

Recommended content

Editors’ Picks

AUD/USD drops toward 0.6500 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is extending losses toward 0.6500, hit by an unexpected drop in the Australian Retail Sales for March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data failed to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY holds rebound to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold price traders remain on the sidelines ahead of FOMC decision on Wednesday

Gold price remains confined in a narrow range as traders prefer to wait on the sidelines. Reduced Fed rate cut bets revive the USD demand and act as a headwind for the metal. Investors now await the FOMC decision and US macro data before placing directional bets.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.