Gold price steadies while high US Q1 GDP Inflation dents Fed rate cut hopes

- Gold price holds intraday gains above $2,300 amid higher US Q1 GDP Price Index.

- The Fed will maintain the “higher for longer” interest rates argument.

- The easing of tensions in the Middle East has improved the demand for risky assets.

Gold price (XAU/USD) sustains above the crucial support of $2,300 in Thursday’s early New York session. The US Dollar and bond yields strengthened after the United States Bureau of Economic Analysis (BEA) reported a significant rise in the Q1 Gross Domestic Product (GDP) Price Index to 3.1% from the former reading of 1.7%. This has deepened the risks of the Federal Reserve (Fed) delaying rate cuts later this year. The US Dollar Index (DXY), which tracks the US Dollar's value against six major currencies, recaptures 106.00. 10-year US Treasury Yields jump to 4.70%. Historically, higher yields on interest-bearing assets increase the opportunity cost of holding investment in Gold.

While a stubbornly higher price index has deepened fears of interest rates remaining higher, a sharp decline in GDP growth has raised concerns over the US economic outlook. The US economy expanded at a significantly slower pace of 1.6% from expectations of 2.5%. In the last quarter of 2023, the economy grew strongly by 3.4%.

A significant fall in the GDP growth rate is unlikely to scrap the speculation for the Fed to achieve the so-called soft landing, in which the central bank achieves price stability without triggering a recession. However, this indicates that the economy struggles to bear the consequences of higher interest rates by the Fed and is expected to dampen investors' confidence in the strong economic outlook.

Going forward, investors will focus on the core Personal Consumption Expenditure Price Index (PCE) data for March, which will guide the next move in the Gold price. A significant change in the above-mentioned economic indicator will likely force traders to reassess expectations for the timing of Fed rate cuts. Currently, financial markets anticipate the first cut in September.

Daily digest market movers: Gold price holds steady while US Yields rise

- Gold price maintains auction above $2,300. The US Dollar rises amid hopes that the Fed will maintain its current interest rate framework for a longer period.

- The week is full of volatile events as the core PCE inflation data will follow the Q1 GDP data – the Fed’s preferred inflation measure – for March, which will be published on Friday. Core PCE inflation is expected to have grown steadily by 0.3% on a month-on-month basis, with annual figures softening to 2.6% from the 2.8% recorded in February.

- The underlying inflation data will significantly influence the Fed’s interest rate outlook ahead of its next meeting on May 1. In the May policy meeting, the Fed is widely anticipated to keep interest rates unchanged in the range of 5.25%-5.50%.

- The near-term outlook for Gold remains uncertain as safe-haven demand has weakened due to waning fears of widening Middle East conflict. Also, Fed policymakers see no urgency for rate cuts due to higher inflationary pressures and tight labor market conditions

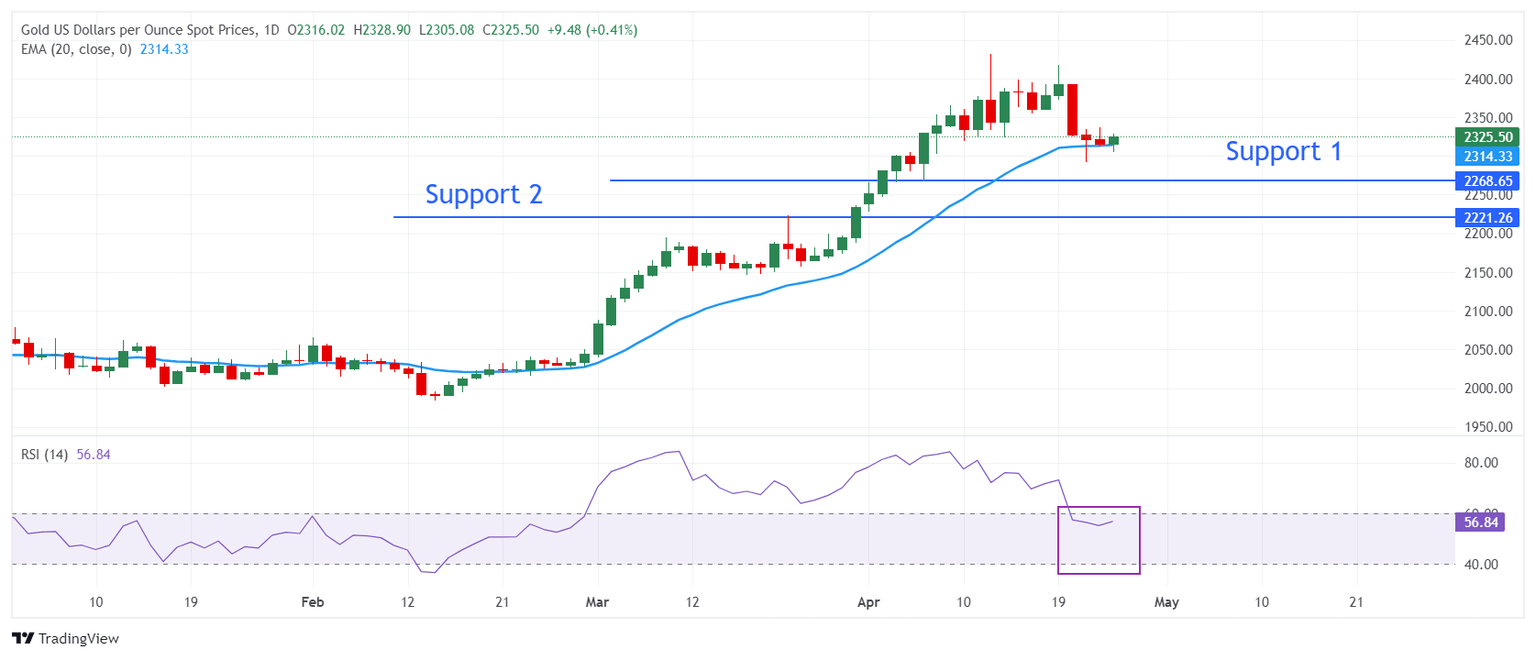

Technical Analysis: Gold price aims to hold auction above $2,300

Gold price trades above the round-level support of $2,300 ahead of crucial US data. The 20-day Exponential Moving Average (EMA) at $2,314 provides support to the precious metal, suggesting that the near-term outlook has turned volatile.

On the downside, a three-week low near $2,265 and March 21 high at $2,223 will be major support zones for the Gold price.

The 14-period Relative Strength Index (RSI) falls below 60.00, suggesting that a bullish momentum is weakening. However, the upside bias is intact until the RSI sustains above 40.00.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.