Gold price rises above $2,300 despite strong US NFP boosts US Dollar, bond yields

- Gold price exhibits strength even though US NFP remains robust.

- The US Dollar rises as Fed Kashkari said he sees no rate cuts if inflation remains stubborn.

- Escalating Middle East tensions keep safe-haven bids strong.

Gold price (XAU/USD) refreshes all-time highs above $2,300 in Friday's early New York session, even though the United States Bureau of Labor Statistics (BLS) has reported that labor market conditions have further strengthened in March. The Nonfarm Payrolls (NFP) report has shown that hiring remained robust while annual Average Hourly Earnings slowed as expected. US employers recruited 303K jobs, significantly higher than expectations of 200K and the prior reading of 270K, slightly revised down from 275K. The Unemployment Rate falls to 3.8% from the consensus and the prior reading of 3.9%.

As expected, annual wage growth grew by 4.1%, slower than the former reading of 4.3%. The monthly Average Hourly Earnings also grew at an expected pace of 0.3%, remained higher than February's reading of 0.2%, revised higher from 0.1%.

Robust labor demand is expected to slow the progress in inflation declining towards 2%, which could negatively influence market expectations for the Federal Reserve (Fed) to begin reducing interest rates in June. This will increase the opportunity cost of holding an investment in non-yielding assets such as Gold increase, weighing on its price. 10-year US Treasury jumps to 4.37% as strong labor market conditions will allow the Fed to keep interest rates higher for a longer period.

Currently, the CME FedWatch Tool shows that traders are pricing in a 58% chance that the Fed will trim interest rates in June. Traders bets for Fed rate cuts drops after upbeat US NFP data.

The US Dollar Index (DXY), which tracks the Greenback's value against six major currencies, extends its recovery to 104.50 as strong Employment conditions indicate an upbeat economic outlook.

This week, the US Dollar faced a sharp sell-off after the US Services PMI for March turned out weak. The Services PMI fell to 51.4 in March, from expectations of 52.7, and the former reading was 52.6.

Daily digest market movers: Gold price advances further despite robust hiring data

- Gold prints fresh highs near $2,310 despite the US NFP report for March indicates strong labor demand. Expectations for the Federal Reserve pivoting to rate cuts have dropped, as upbeat labor market conditions will not force Fed policymakers to rush to reduce interest rates sooner.

- Average Hourly Earnings remain broadly mixed. Annual figures slowed as expected while monthly data grew in line with expectations. Going forward, strong labor demand would push wage growth higher. Employers offer higher wages to offset robust demand for workers.

- On Thursday, Minneapolis Fed Bank President Neel Kashkari said rate cuts won’t be required this year if inflation stalls. Kashkari said he forecasted two rate cuts by 2024 in the latest Fed dot plot. “The Fed needs to keep interest rates higher in the range of 5.25%-5.50% if inflation remains stronger than hoped,” Kashkari warned. He added that if that still did not work, further rate increases are not off the table, but they are also not a likely scenario given what we know right now," Reuters reports.

- Meanwhile, the near-term appeal of Gold is strong due to escalating Middle East tensions. Air strikes from Israeli forces on the Iranian embassy in Damascus, situated near Syria’s capital, have deepened fears of Iran’s participation in the Israel-Palestine war. Rising geopolitical tensions lead investors towards safe-haven assets such as Gold.

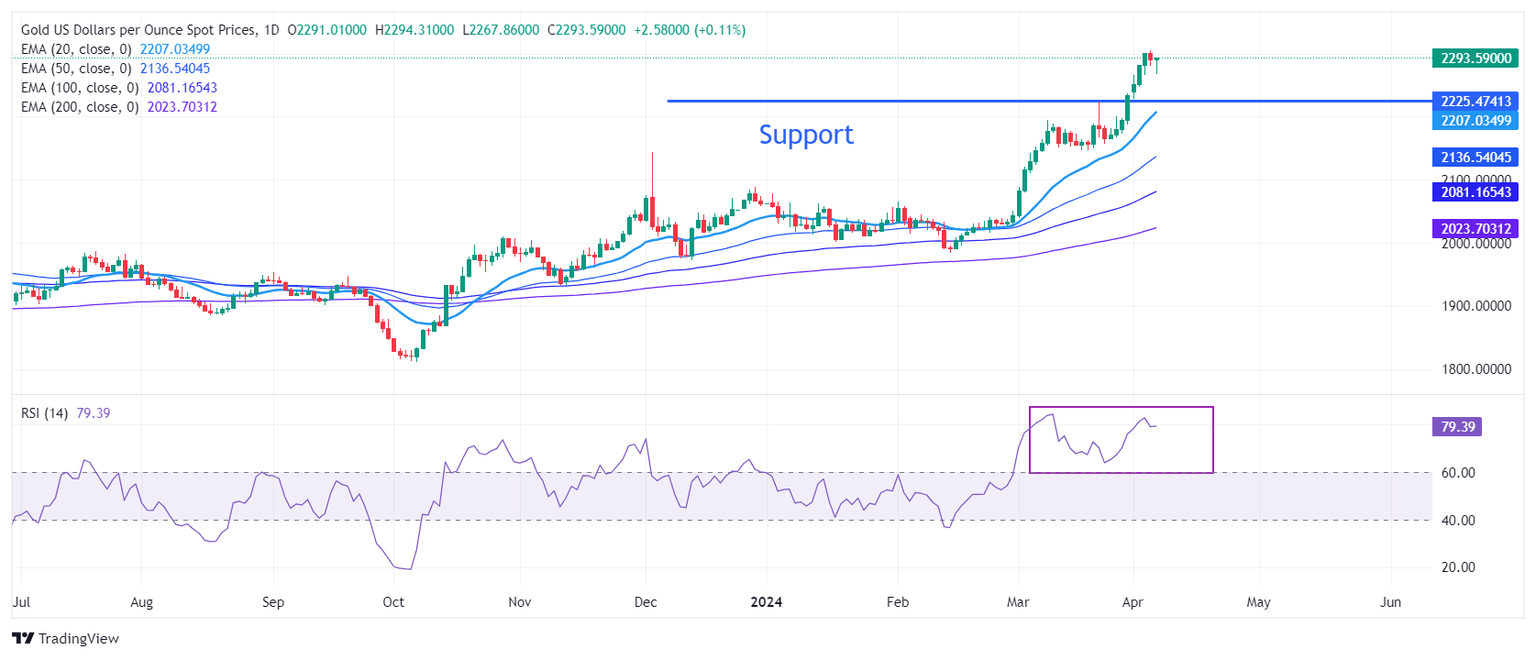

Technical Analysis: Gold price rises above $2,300

Gold price falls slightly after achieving the $2,300 milestone. The near-term demand remains unabated as all short-to-long term Exponential Moving Averages (EMAs) are sloping higher. On the downside, March 21 high at $2,223 will be a major support area for the Gold price bulls.

The 14-period Relative Strength Index (RSI) near 80.00 indicates that a bullish momentum is still active. However, overbought signals have emerged.

Nonfarm Payrolls FAQs

Nonfarm Payrolls (NFP) are part of the US Bureau of Labor Statistics monthly jobs report. The Nonfarm Payrolls component specifically measures the change in the number of people employed in the US during the previous month, excluding the farming industry.

The Nonfarm Payrolls figure can influence the decisions of the Federal Reserve by providing a measure of how successfully the Fed is meeting its mandate of fostering full employment and 2% inflation. A relatively high NFP figure means more people are in employment, earning more money and therefore probably spending more. A relatively low Nonfarm Payrolls’ result, on the either hand, could mean people are struggling to find work. The Fed will typically raise interest rates to combat high inflation triggered by low unemployment, and lower them to stimulate a stagnant labor market.

Nonfarm Payrolls generally have a positive correlation with the US Dollar. This means when payrolls’ figures come out higher-than-expected the USD tends to rally and vice versa when they are lower. NFPs influence the US Dollar by virtue of their impact on inflation, monetary policy expectations and interest rates. A higher NFP usually means the Federal Reserve will be more tight in its monetary policy, supporting the USD.

Nonfarm Payrolls are generally negatively-correlated with the price of Gold. This means a higher-than-expected payrolls’ figure will have a depressing effect on the Gold price and vice versa. Higher NFP generally has a positive effect on the value of the USD, and like most major commodities Gold is priced in US Dollars. If the USD gains in value, therefore, it requires less Dollars to buy an ounce of Gold. Also, higher interest rates (typically helped higher NFPs) also lessen the attractiveness of Gold as an investment compared to staying in cash, where the money will at least earn interest.

Nonfarm Payrolls is only one component within a bigger jobs report and it can be overshadowed by the other components. At times, when NFP come out higher-than-forecast, but the Average Weekly Earnings is lower than expected, the market has ignored the potentially inflationary effect of the headline result and interpreted the fall in earnings as deflationary. The Participation Rate and the Average Weekly Hours components can also influence the market reaction, but only in seldom events like the “Great Resignation” or the Global Financial Crisis.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.