Gold Price News and Forecast: XAU/USD – Tests 1,950.00 level

US presidential elections are coming: Should we vote for gold?

Over the past few months, we have focused – for obvious reasons – on the pandemic and the following economic crisis. However, there are also other important developments happening in the background, apart from media attention that still focuses on the coronavirus. As they can substantially affect the gold prices, precious metals investors should be aware of them.

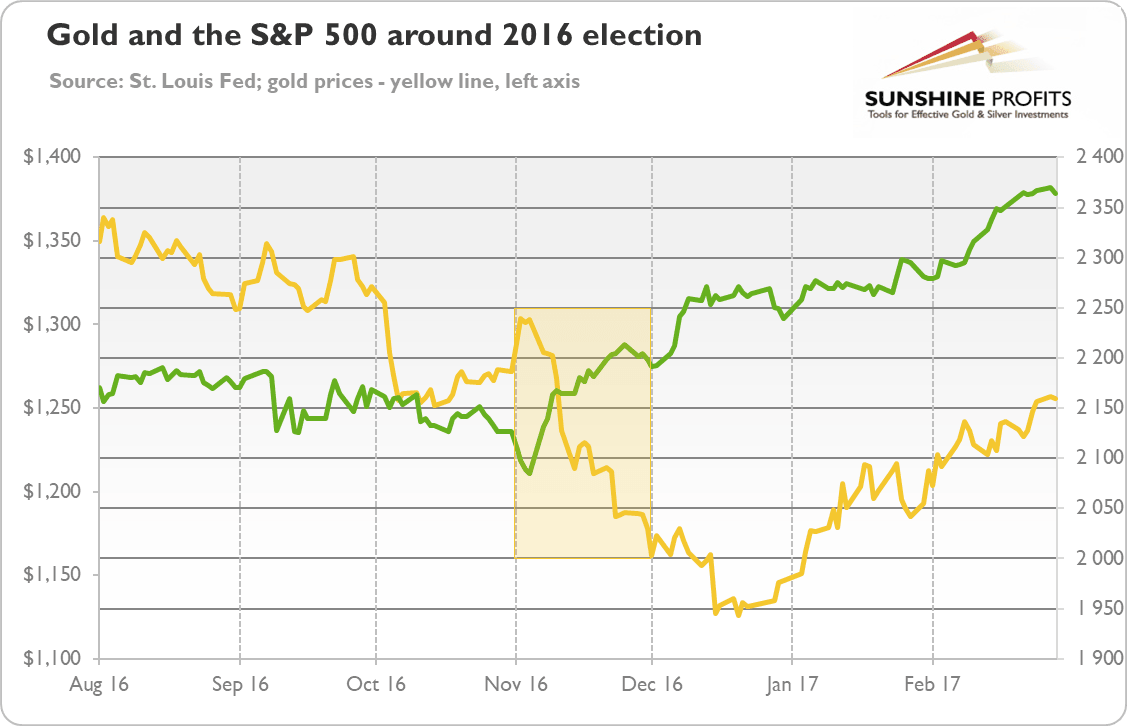

One of the most important of such issues is the U.S. presidential election that is approaching fast. And the polls suggest that we could see the change of the President in the White House. As the chart below shows, Joe Biden (blue line) has an average polling margin of 9 percent over incumbent President Donald Trump (red line). Read More...

Gold analysis: Tests 1,950.00 level

After experiencing a sharp surge and decline on Thursday, on Friday morning, the yellow metal's price was testing the resistance of the 1,950.00 level. The 1,950.00 level was also strengthened by the 200-hour simple moving average.

If the 1,950.00 mark fails to keep the rate down, the metal could surge and test round price level resistances until it reaches the 2,000.00 level.

On the other hand, the 200-hour SMA and the 1,950.00 level could cause a decline. A decline would immediately look for support in the 55 and 100-hour SMAs near 1,935.00.

Gold climbs to session tops, around $1960 region

Gold continued gaining positive traction through the first half of the European trading action and shot to fresh daily tops, around the $1960 region in the last hour.

The precious metal managed to regain positive traction on the last trading day of the week and reversed the previous day's intraday retracement slide from over one-week tops. The Fed Chair Jerome Powell's dovish comments continued weighing on the US dollar, which, in turn, extended some support to the dollar-denominated commodity. Read More...

Author

FXStreet Team

FXStreet