Gold Price News and Forecast: XAU/USD poised to explode, and soon [Video]

![Gold Price News and Forecast: XAU/USD poised to explode, and soon [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Crosses/XAUUSD/gold-ingot-19143567_XtraLarge.jpg)

Gold continues to struggle for any sustained direction [Video]

Gold continues to struggle for any sustained direction. It had looked mid-last week that the bulls were beginning to flex their muscles again. A breach of the two month downtrend was seen, but resistance at $1933 (the October high) proved too much. The market has since been dragged back to the six month uptrend support. The bulls will point to the uptrend still holding, but the apex of the two old trendlines has now been reached, without any real breakout. So both trends could easily now be broken simply by the market consolidating sideways (as it has done now for over three weeks). Momentum indicators remain almost entirely neutral, whilst the shorter moving averages (21, 55, 89 day moving averages) which illustrate short to medium term trends, are all clustered and flat. Read more...

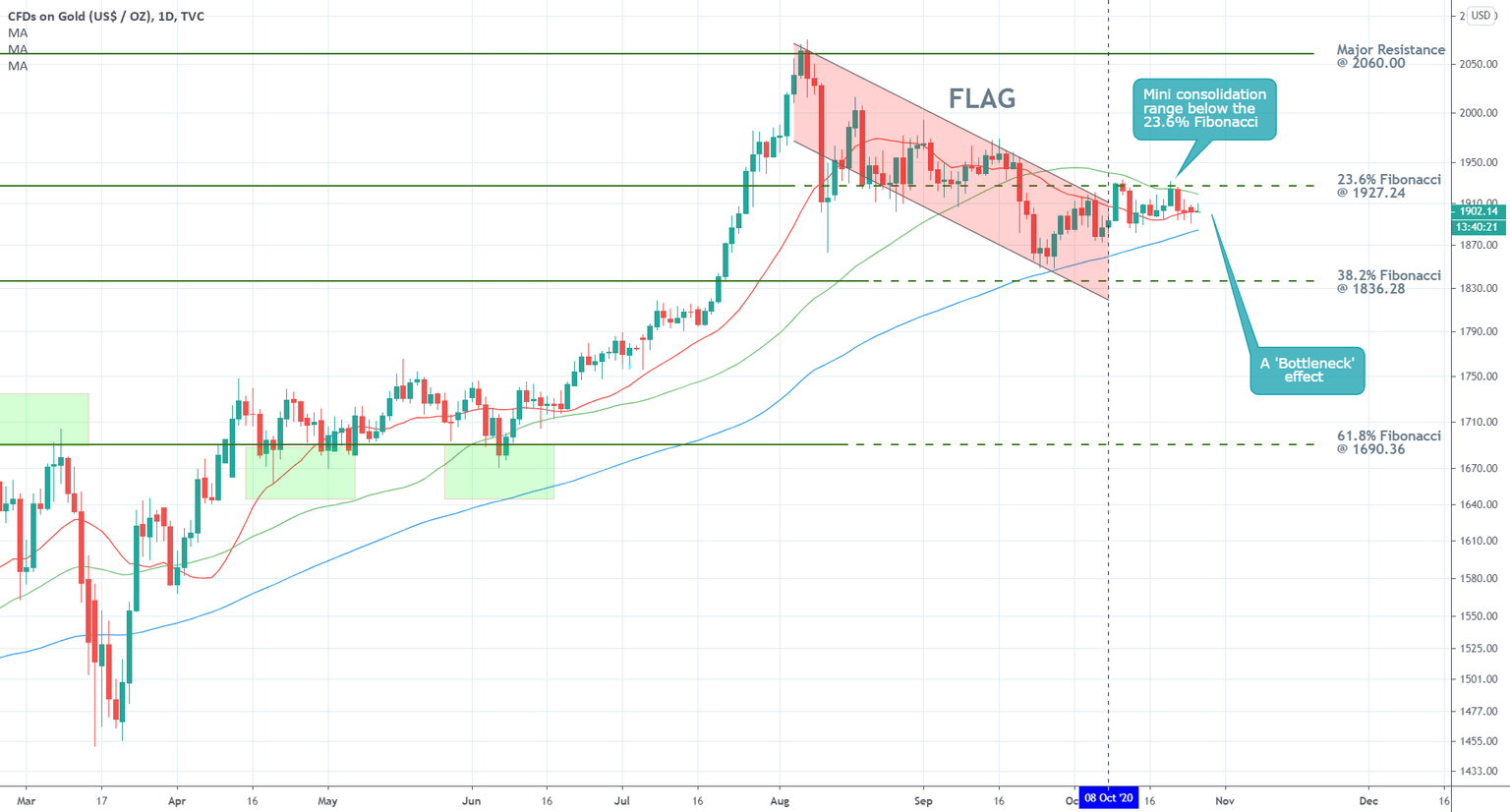

Gold poised to explode, and soon

Gold continues to be Wall Street's good old and reliable workhorse, in the sense that it maintains its role as the most sought after safe-haven asset. The next few months look like are going to be quite turbulent and eventful, with the US election looming nearer, and the global pandemic continuing to worsen relentlessly. So, the precious metal would most certainly play a pivotal role for investors in surviving these tough and unpredictable times ahead.

In a sense, little has changed in gold's fundamental outlook since our previous analysis of the asset. The coronavirus crisis and the uncertainty stemming from the Presidential race continue to be the most significant determinants for gold's underlying supply and demand dynamic. The only difference is that the impact of those two has become more pronounced over the last few weeks. Read more...

XAU/USD analysis: Revealed short-term descending trend

The XAU/USD exchange rate has revealed a short-term descending channel.

From a theoretical point of view, it is likely that yellow metal could depreciate against the US Dollar within the predetermined trend in the short term. However, if the given channel does not hold, the rate could target the 1,885.00 mark. Read more...

Author

FXStreet Team

FXStreet