Gold Price News and Forecast: XAU/USD hit an eight-year high before falling down back to previous levels

Gold Price Analysis: XAU/USD faces wall of resistance as silver remains in focus – Confluence Detector

The frenzy in stock markets has moved from GameStop and AMC to silver prices. XAG/USD hit an eight-year high before falling down back to previous levels. In the meantime, President Joe Biden is pushing to "go big" on stimulus, but instead of boosting gold, it is causing a sell-off in bonds. In turn, higher Treasury yields make the dollar more attractive.

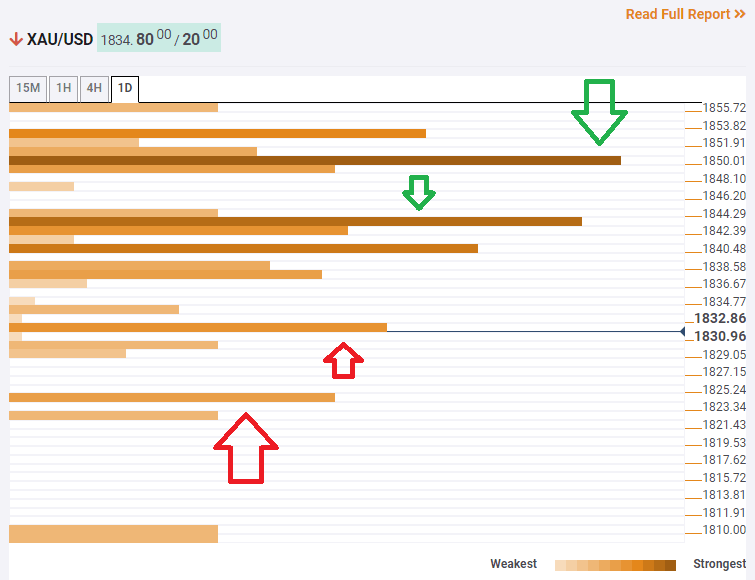

How is XAU/USD positioned on the technical graphs?

The Technical Confluences Indicator is showing that the precious metal faces some resistance around $1,843, which is a cluster including the Bollinger Band 1h-Upper, the Simple Moving Average 10-4h and the Fibonacci 38.2% one-day.

ADP impresses, Crude rally continues, Gold stumbles on strong US data

US stocks initially pushed higher on big-tech earnings, expectations Senate Democrats will pass Biden's stimulus plan on a party-line vote, and after the ADP private payroll report shows the labor market rebounded in January. The morning rally fizzled at the open as some investors quickly headed for the sidelines and cashed out on their FAANG stocks now that tech is done with all their major earnings results. Adding to the market nervousness was the nice pop that the Reddit-fueled retail army gave to GameStop, AMC, Koss, and silver bets. The conviction behind these social-media driven retail trades look more like a dead-cat bounce, except for silver. Silver has strong fundamentals given the industrial demand outlook for the remainder of the year.

Author

FXStreet Team

FXStreet