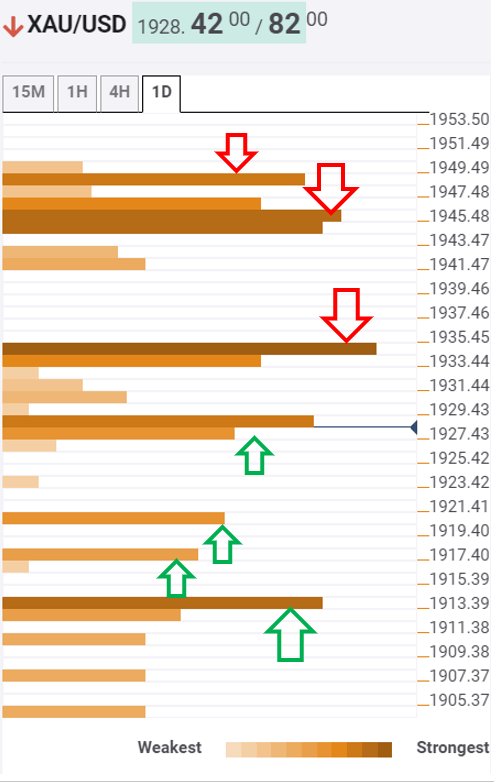

Gold Price Analysis: XAU/USD’s path of least resistance is down, $1913 back in sight – Confluence Detector

Following Tuesday’s two-way wild swings, Gold (XAU/USD) returns to the backseat, as the haven demand for the US dollar remains in vogue amid the risk-off action in the global stocks. The sentiment soured on rising US-Sino tensions, US fiscal deadlock and pessimism over the coronavirus vaccine. AstraZeneca COVID-19 vaccine trial was put on hold over safety concerns.

Although the dovish ECB expectations and falling Treasury yields offer some support to the yieldless gold. Combined. Let’s take a look at the key technical levels for trading gold amid a light US docket and heading towards Thursday’s crucial ECB policy decision.

Gold Price Analysis: XAU/USD fades pullback from 50-day EMA as market sentiment worsens

Gold prices extend the late-US session weakness while staying heavy around $1,931/30 amid the early Wednesday in Asia. In doing so, the yellow metal fails to portray the rush to risk-safety, despite bounding off 50-day EMA, as the US dollar becomes the market favorite. Among the major catalysts, the Sino-American tussle and Brexit talks preceded pessimism surrounding the US stimulus talks and the EU-UK negotiations over post-Brexit trade relations. It should also be noted that the US dollar’s gains were the major burden on the yellow metal despite the risk-off mood.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.