Is gold ready to drift north?

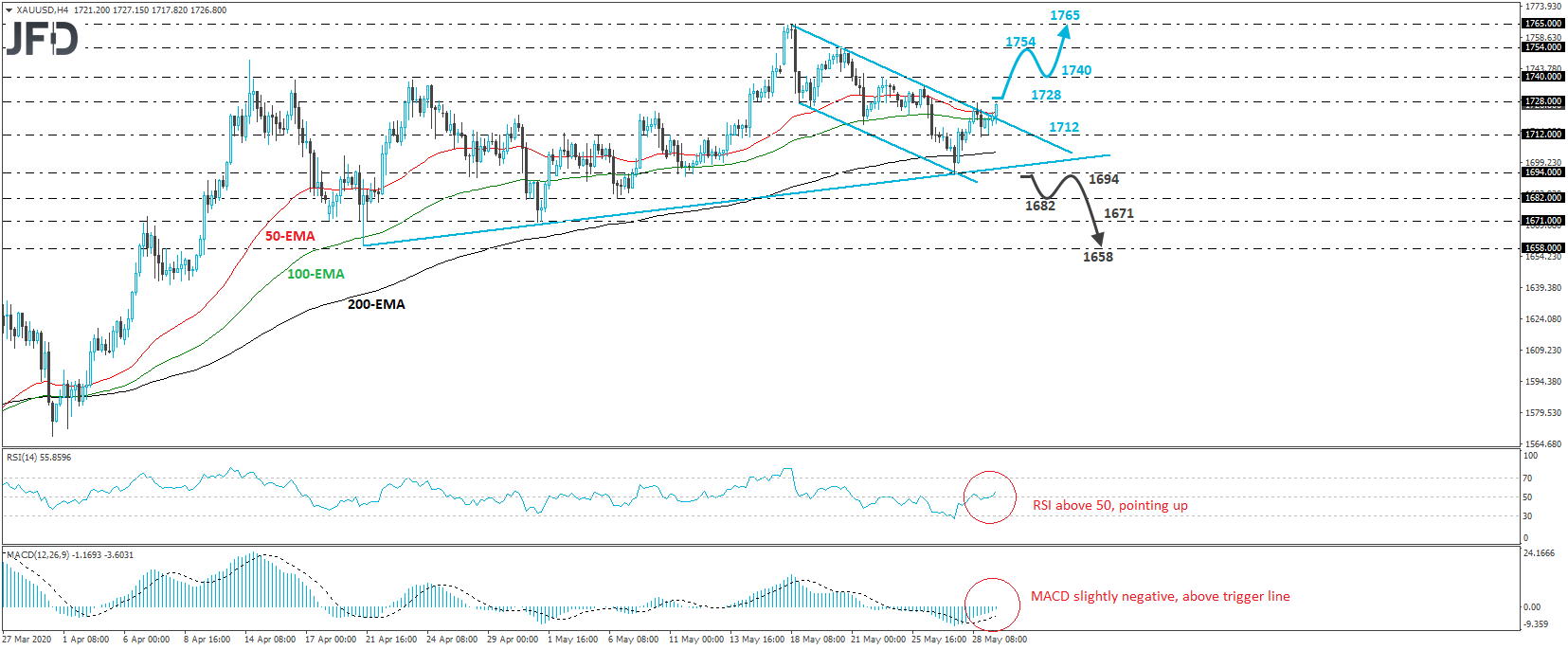

XAU/USD traded higher on Friday, after it hit support near the 1712 level. The recovery drove the price above the downside resistance line drawn from the high of May 18th, which combined with the fact that the precious metal continues to trade above the upside support line taken from the low of April 21st, suggests that more advances may be on the cards for now.

If the bulls manage to overcome yesterday’s high of 1728, then we may see them aiming for the peak of May 22nd, at 1740, where another break may extend the gains towards the high of May 21st, at 1754. The bulls may decide to take a break after hitting that zone, thereby allowing the price to correct lower. However, as long as it remains above the aforementioned diagonal lines, we would see decent chances for another leg north and a break above 1754. This may encourage the bulls to put the 1765 zone on their radars, which is the peak of May 18th. Read more...

Gold: Bulls are heading towards north side, buy on dips

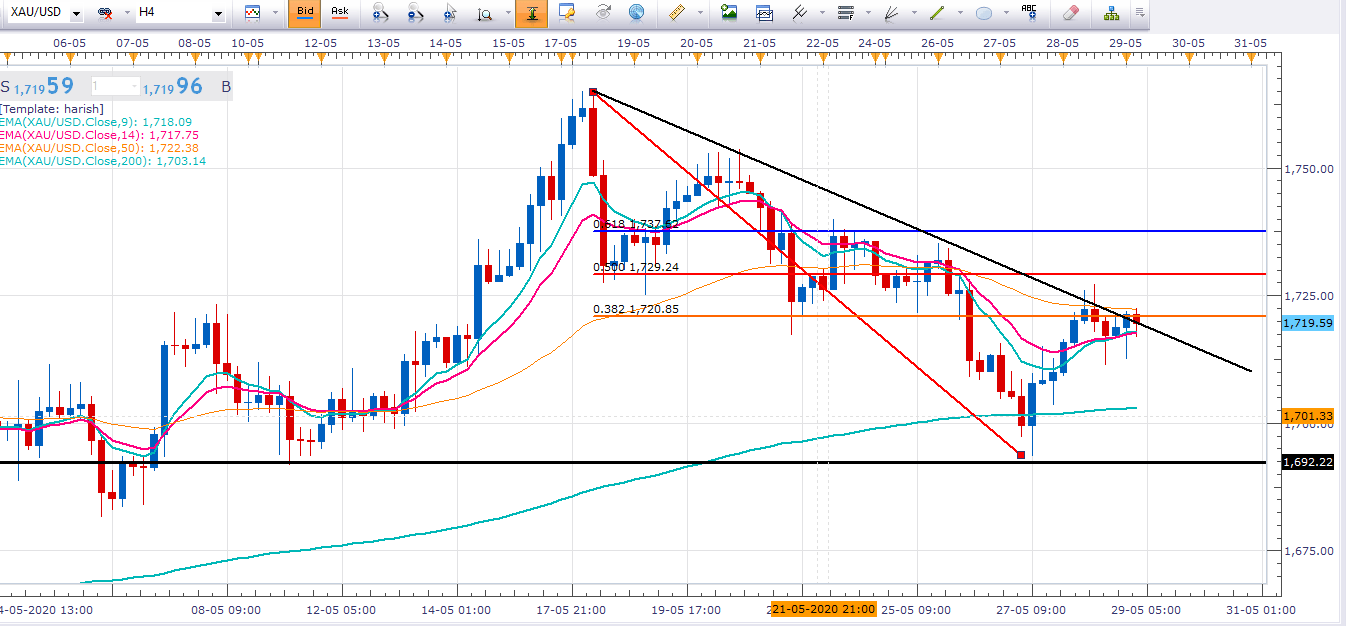

Overview: Day before yesterday we have seen a dip in the gold at $1693 level which was a perfect level to buy as we can see that the $1690 is a strong support level and our bias remains bullish on the gold as long as $1690-85 support zone remains intact on daily closing basis. The primary, as well as secondary trend, is up so in an uptrend market buy on dips will be a profitable strategy.

Gold has been consolidating its gains after recovering from a dive below $1,700. Can it extend its gains on the last day of May? We have to be cautious today as its monthly closing so it may give us a massive rally which is on cards; however, we will get clear confirmation above $1735 level where bulls will get momentum once again and they will approach the $1765 and $1790 level. Read more...

Gold clings to gains near session tops, around $1725 region

Gold edged higher during the early European session and climbed back closer to the previous day's swing high, around the $1727 region.

The precious metal gained some positive traction for the third consecutive session on Friday and was being supported by escalating diplomatic tensions between the United States and China. It is worth reporting that China's parliament on Thursday approved a national security law for Hong Kong, which further fueled worries about a standoff between the world's two biggest economies. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.