Gold Price News and Forecast: XAU/USD battles 50-HMA on the road to recovery

Precious Metal prices surge on U.S. stimulus deal: What’s next?

Precious metal prices surged on Monday – driven by news that U.S. lawmakers reached an agreement on a $900 billion aid package, while lockdowns in the United Kingdom soured appetite for riskier assets and added to safe-haven demand.

The $900 billion U.S stimulus deal is one of the largest economic relief bills US history, second only to the $2.2 trillion Cares Act in March of this year.

Last week, Gold and Silver prices skyrocketed following the FOMC’s final policy meeting of 2020, when Fed Chairman Jerome Powell “made it very clear that interest rates will remain near zero until 2024 and they are fully committed to pushing inflation higher”.

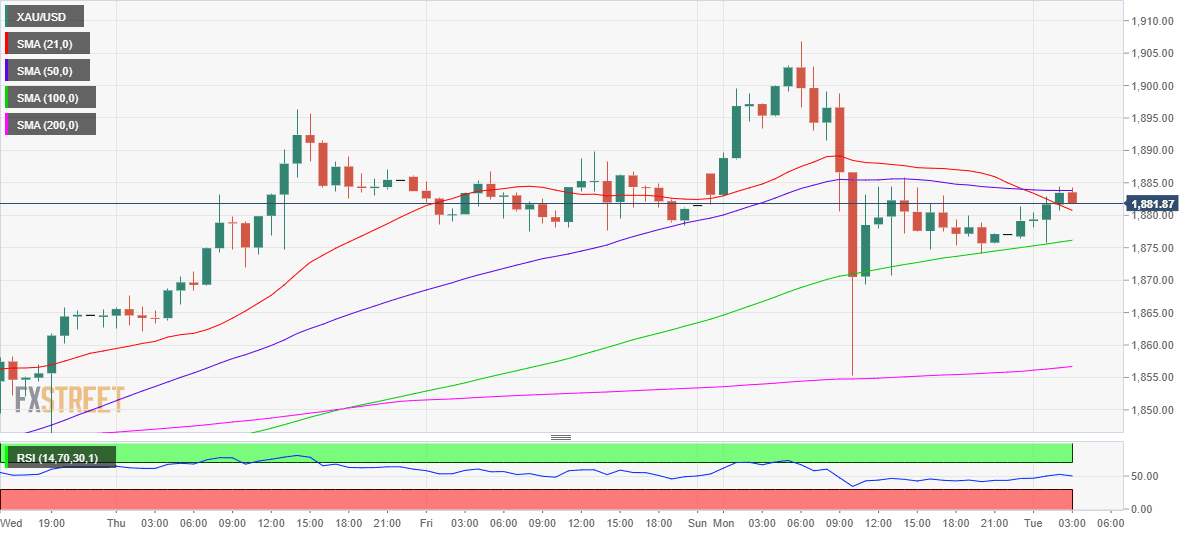

Gold Price Analysis: XAU/USD battles 50-HMA on the road to recovery

Gold (XAU/USD) witnessed good two-way businesses on Monday, as traders danced to the tune of the optimism on the agreement of a US stimulus deal in the first half of the day.

Meanwhile, in the latter part of the day, gold slumped nearly $50 from weekly tops of $1907 to $1855 levels on the narrative of a new covid strain found in the UK, which fuelled heavy risk aversion across the board and pumped the greenback against its major rivals.

Author

FXStreet Team

FXStreet