Gold Price Analysis: XAU/USD battles 50-HMA on the road to recovery

- Gold consolidates Monday’s sharp drop to $1855.

- 50-HMA challenges the recovery mode after the bearish crossover.

- Bullish RSI keeps the buyers hopeful in the near-term.

Gold (XAU/USD) witnessed good two-way businesses on Monday, as traders danced to the tune of the optimism on the agreement of a US stimulus deal in the first half of the day.

Meanwhile, in the latter part of the day, gold slumped nearly $50 from weekly tops of $1907 to $1855 levels on the narrative of a new covid strain found in the UK, which fuelled heavy risk aversion across the board and pumped the greenback against its major rivals.

Gold Price Chart: Hourly

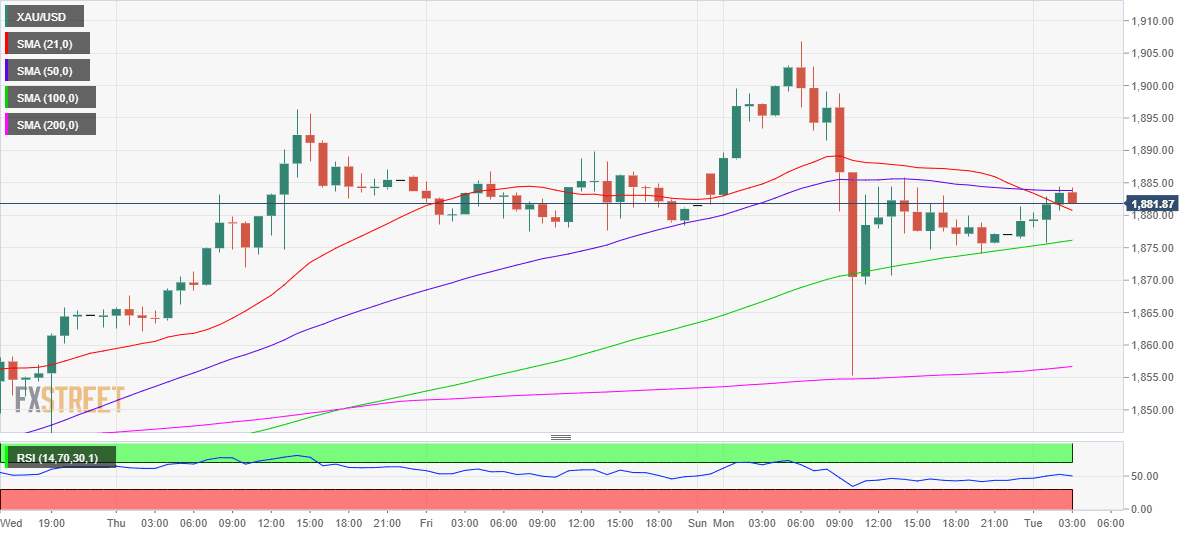

Looking at the hourly chart, gold is trying hard to extend the overnight recovery, facing stiff hurdle at the horizontal 50-hourly moving average (HMA) at $1884.

The bearish crossover spotted on the said timeframe is likely capping the upside attempts in the spot. The 21-HMA crossed the 50-HMA from above post-Tokyo open.

The immediate support is seen at the 21-HMA, now at $1880, below which the upward-sloping 100-HMA at $1876 could be tested. Further south, the critical 200-HMA at $1856 will be a tough nut to crack for the bears.

On the flip side, the Relative Strength Index (RSI) still holds above the midline, keeping the bias for a rebound intact.

Acceptance above the 50-HMA barrier could expose the $1900 level. The next resistance awaits at Monday’s high of $1907.

Gold Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.