Gold price prints fresh all time highs ahead of US core PCE inflation

- Gold price climbs above $2,220, exhibiting strength ahead of US core PCE Price Index data.

- The US Dollar falls back after refreshing a six-week high despite Fed Waller's hawkish rate guidance.

- 10-year US bond yields rise as Fed rate cut bets for June have dropped.

Gold price (XAU/USD) rallies above $2,220 in Thursday’s early American session. The precious metal exhibits firm footing ahead of the United States core Personal Consumption Expenditure (PCE) Price Index data for February, which will be published on Friday.

The Federal Reserve (Fed) could dial back rate cut expectations if the underlying inflation data suggests price pressures persist. Such a scenario would lead to an increase in yields on interest-bearing assets, such as Treasury bonds, whose appeal strengthens in a high-inflation environment. On the contrary, softer-than-expected inflation could boost expectations for a Fed rate cut in the June meeting, and support the broad narrative of three rate cuts for overall 2024.

The Fed is expected to maintain a cautious approach to rate cuts as initiating them too soon or lowering them too much could reinforce price pressures again. Meanwhile, a delay in cutting interest rates could result in unnecessary pressure on the labor market and the economy.

The US Dollar Index (DXY), which measures the US Dollar’s value against six major currencies, retreats after refreshing a six-week high at 104.72. The USD index fails to maintain strength despite the final estimate from the US Bureau of Economic Analysis (BEA) for the final quarter of 2023 showed that the economy grew by 3.4%. As per the preliminary estimates, the economy expanded by 3.2%.

Daily digest market movers: Gold price soars while US Dollar falls from fresh six-week high

- Gold price jumps above $2,220 ahead of the US core PCE Price Index data for February. The Federal Reserve’s preferred inflation gauge is expected to have grown at a steady pace of 2.8% on year. The monthly underlying inflation data is forecasted to have increased by 0.3%, slowing from January’s 0.4% advance. Investors will keenly focus on the inflation data to gauge when the Fed may begin trimming interest rates.

- Stubborn inflation data could allow the Fed to maintain a hawkish rhetoric. Fed policymakers have been reiterating that rate cuts are only appropriate when they are convinced that inflation will return sustainably to the 2% target. Sticky price pressures, in turn, would weaken the Gold’s appeal as it would increase the opportunity cost of investing in it.

- According to the CME FedWatch tool, traders are pricing in a 60% chance that a rate cut will be announced in June. The chances for Fed pivoting to rate cuts in June have dropped from 70% on Thursday after a slightly hawkish guidance from Fed Governor Christopher Waller.

- Christopher Waller said in a speech at an Economic Club of New York on Wednesday that the Fed needs not to rush for rate cuts. However, he keeps hopes of rate cuts alive saying, “Further progress expected on lowering inflation will make it appropriate for the Fed to begin reducing the target range for the federal funds rate this year," reported Reuters.

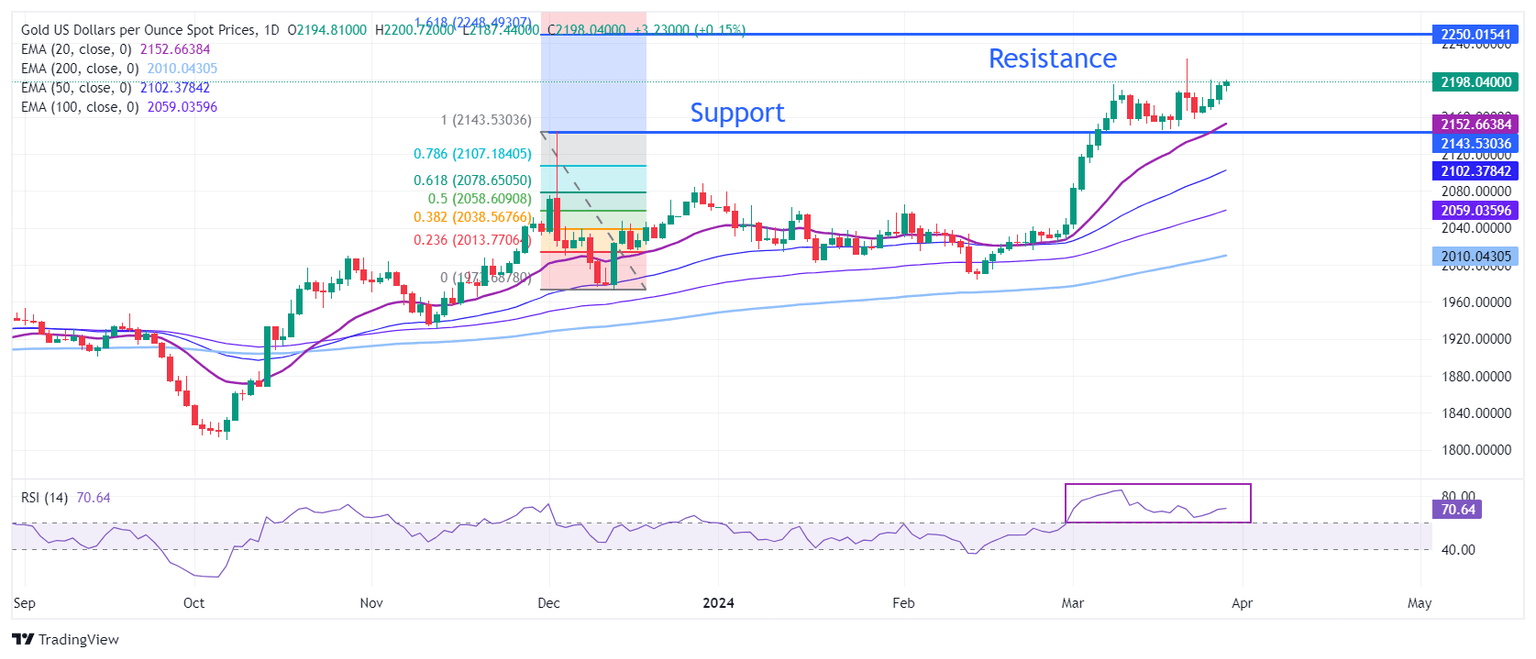

Technical Analysis: Gold trades above $2,220

Gold price advances above the crucial resistance of $2,220. The precious metal aims to recapture the all-time highs slightly above $2,220. All short-to-long term Exponential Moving Averages (EMAs) are sloping higher, suggesting strong near-term demand.

The Gold price could face a hurdle near $2,250, which coincides with the 161.8% Fibonacci extension, after breaking above the resistance of $2,220. The Fibonacci tool is plotted from December 4 high at $2,144.48 to December 13 low at $1,973.13. On the downside, December 4 high at $2,144.48 will support the Gold price bulls.

The 14-period Relative Strength Index (RSI) rebounds after cooling down to 64.00 from the extremely overbought zone.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.