- Gold is under pressure as the greenback attempts to correct ahead of Retail Sales.

- XAU/USD bears eye a run to $1,800 if $1,810 breaks.

Update: Gold, (XAU/USD) is on the verge of a break higher as it moves in on the daily highs and back above Thursday's close. The yellow metal is up some 0.18% at the time of writing as the US dollar moves lower on the session by some 0.17%.

The greenback cannot seem to sustain a correction and that is playing into the hands of the gold bulls. At a low of 94.681, the DXY index is 2 pips away from a fresh breakout low following the sell-off this week in the index. Should the index penetrate 94.50, then 94 te figure will be next in line and this would be expected to give the gold bulls a lifeline on the approach to $1,850.

Potential catalysts for the day ahead will come in the US session with Fed's New York president, John Williams. and US Retail Sales. Then, the Fed will move into its blackout period until the next interest rate decision later this month. This leaves US data in focus.

Analysts at TD Securities explained that Retail Sales probably fell in December, even with higher prices boosting nominal values. ''Spending was likely held down by the fading of fiscal stimulus, payback for earlier-than-usual holiday shopping, and Omicron. We look for a notable 1.4% MoM decline in total sales (consensus: -0.1%) and a larger 2.0% retreat for the control group (consensus: flat). Real as well as nominal spending was likely still up solidly on QoQ basis and strongly on a YoY basis.''

End of update

The price of gold in Asia is under pressure as the US dollar stabilises following a series of down days for the greenback. XAU/USD is trading around $1,820 and down some 0.1% while the DXY index attempts to correct from the depths of the late December to YTD sell-off.

The US dollar, as measured by the DXY index, sold off from 96.90 to a recent low of 94.66. In as many weeks, XAU/USD has climbed over 4%. However, in what could be more of a technical move, the yellow metal had failed to capitalise on the fall of US yields and the greenback on Thursday.

DXY dropped 0.4% and the US 10-year yield was down 2.5bps at 1.718%. ''Sustained weakness in the US dollar failed to push gold prices higher, as investors look concerned about Fed’s hawkish move to contain inflation,'' analysts at ANZ Bank argued.

However, this would not explain why the greenback and yields keep falling. Instead, the bond market appears to be repricing the pace of the Fed's balance sheet run-off following less hawkish rhetoric from Fed members, Jerome Powell, the chairman, and Philly Fed President Patrick Harker.

On Thursday, Harker said he sees the Fed starting to shrink its balance sheet “in late 2022 or early 2023” after the central bank has raised its target rate sufficiently, to around 1 per cent from near zero. The comments echoed that of Powell who said the Fed could start to shrink its balance sheet later this year at his confirmation hearing before the Senate Banking Committee.

"At some point, perhaps later this year, we will start to allow the balance sheet to run off, and that's just the road to normalising policy," he said, adding the US economy "no longer needs or wants" the Fed's very highly accommodative policies.

These comments come in contrast to that of other more hawkish officials, such as the Atlanta Fed President Raphael Bostic. "There is a risk inflation is likely to be elevated for an extended period of time and we need to respond directly, clearly and aggressively," Bostic told Reuters in an interview on Monday.

Bostic explained that the central bank should be aggressive with regards to the balance sheet as well, allowing its holdings to decline by at least $100 billion a month, and with plans to quickly pull at least $1.5 trillion out of financial markets that he considers pure "excess liquidity."

The day ahead

For the day ahead, we will hear from Fed's New York president, John Williams. Then, the Fed will move into its blackout period until the next interest rate decision later this month. This leaves US data in focus. In this regard, Retail Sales will be of interest today.

Analysts at TD Securities explained that Retail Sales probably fell in December, even with higher prices boosting nominal values. ''Spending was likely held down by the fading of fiscal stimulus, payback for earlier-than-usual holiday shopping, and Omicron. We look for a notable 1.4% MoM decline in total sales (consensus: -0.1%) and a larger 2.0% retreat for the control group (consensus: flat). Real as well as nominal spending was likely still up solidly on QoQ basis and strongly on a YoY basis.''

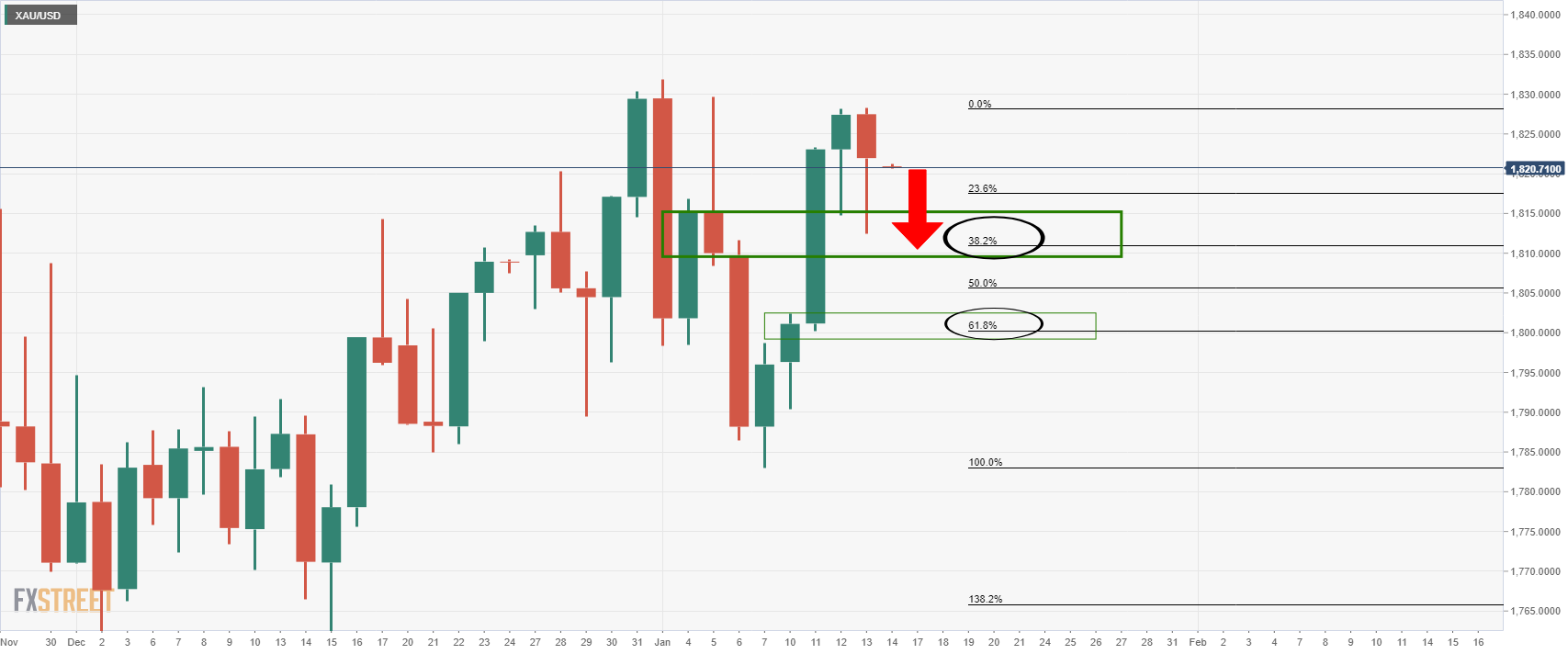

Gold technical analysis

If the US dollar rebounds from here, gold would be expected to be pressured towards critical support as follows:

The 38.2% Fibo near $1,810 guards $1,800 and the 61.8% Fibo.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.