- Gold price consolidates the two-day recovery, as focus shifts to Fed.

- Evergrande fears ease, risk appetite returns and DXY retreats.

- Gold bears in driver's seat as focus shifts to FOMC.

Gold price remains in the green for the fourth day in a row, consolidating the two-day recovery from over one-month lows of $1742. The bulls turn cautious and refrain from placing fresh bets ahead of the all-important Fed monetary policy decision, with increased expectations that Jerome Powell and company could offer a tapering timeline. If the Fed refrains from making any announcement on tapering, gold price could see buying resurgence, although the gains could be capped by the calm from China Evergrande and risk-on action in the US stocks.

Read: Will gold find acceptance above this key level? Evergrande, Fed in focus

Gold Price: Key levels to watch

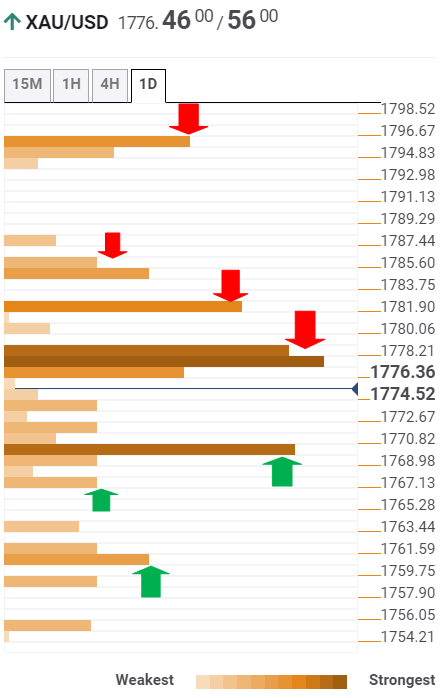

The Technical Confluences Detector shows that gold is failing to find acceptance above a stack of strong resistance levels around $1778, which is the intersection of the Fibonacci 61.8% one-month, Fibonacci 23.6% one-day and SMA50 four-hour.

Gold bulls will regain complete control above the latter, paving way for a test of $1782, where the SMA10 one-day and the previous day’s high converge.

The next relevant upside target is envisioned at $1785; the meeting point of the Fibonacci 61.8% one-week and the pivot point one-day R1.

If the buying interest intensifies, then a rally towards $1794 cannot be ruled out. At that point, the SMA50 one-day coincides with the pivot point one-day R2.

Alternatively, a strong cushion is seen at $1769, the intersection of the SMA5 one-day and Fibonacci 38.2% one-week.

The Fibonacci 61.8% one-day at $1766 will be the next downside target for sellers.

The last line of defense for gold bulls is aligned at $1761, the Fibonacci 23.6% one-week.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.