Gold Price Forecast: XAU/USD bulls moving in on the psychological $1,850

- The non-yielding metal edges up during the New York session, gains 0.29%

- The conflict between Russia and Ukraine escalates, triggering a risk-off market mood.

- XAU/USD Technical Outlook: Neutral-bullish, though a break under $1834 opens the door towards $1800.

Update: Gold, (XAU/USD), is headed for a positive close on Monday following a heavily risk-off session and a run for safer havens. At the time of writing, gold is up 0.3% after climbing from a low of $1,829.76 and reaching a high of $1,844.37 so far with eyes on the psychological $1,850 level.

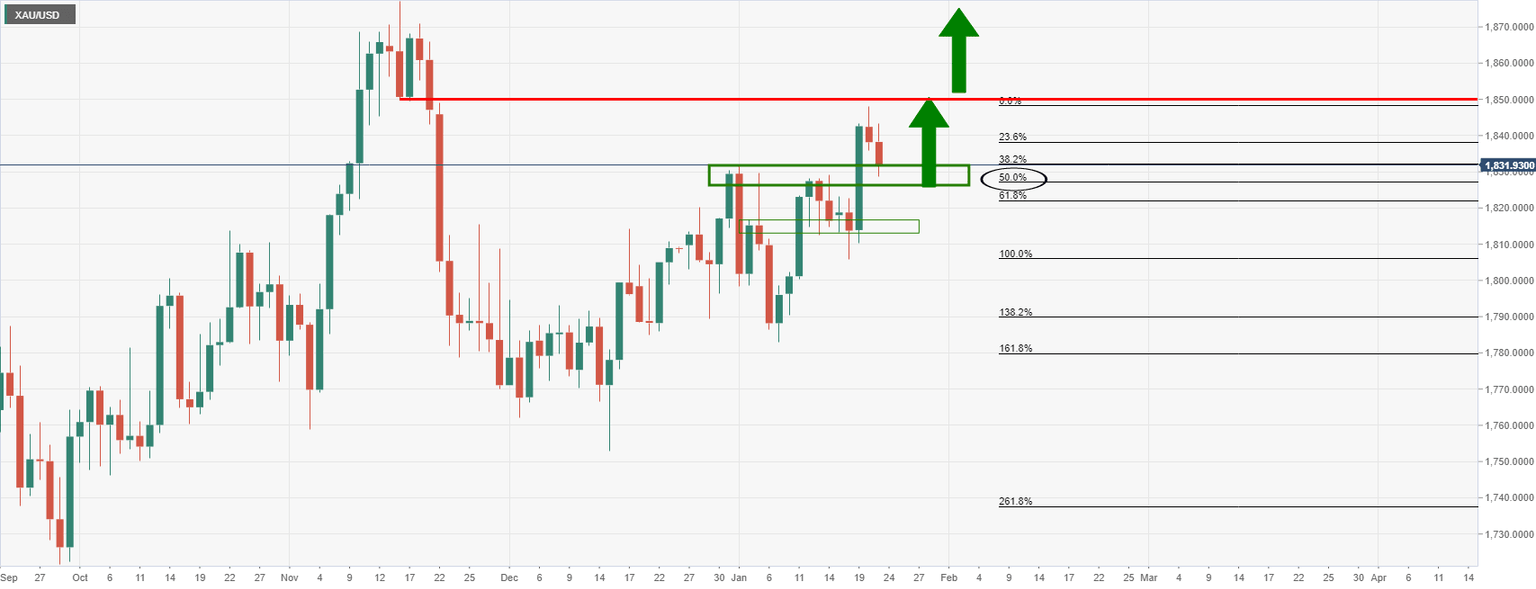

As per the pre-open analysis this week, Gold, Chart of the Week: Bulls pining for $1,850+, could be just a Fed away, the price has been moving in on critical resistance:

Gold, prior analysis

Gold, live market update

The price has popped higher for all of the reasons explained in the prior article below...

End of update

In the last two hours, the yellow metal has dropped almost $10.00 amid increasing tensions in the Ukraine – Russian conflict, alongside increasing woes of the US central bank tightening monetary policy conditions. Nevertheless, at writing, gold is trading in the green at $1833.33 a troy ounce.

On Monday, NATO said that it was putting forces on standby and reinforcing eastern Europe military presence, in what Russia denounced an escalation of tensions over Ukraine, according to Reuters. The move responds to Russia’s, which amassed an estimated 100K troops near the Ukrainian border. Russia denies that an invasion is planned, but the deployment of forces from the north, east, and south spurred a crisis similar to the Russian Crimean annexation.

Usually, in geopolitical crises, gold is the ultimate safe-haven asset. However, with the Federal Reserve monetary policy meeting ahead of Wednesday, investors preferred to stay sidelined, awaiting its outcome. Among other investment banks, Goldman Sachs forecast at least four rate hikes in 2022, leaving the Federal Funds Rate (FFR) at 1%.

At press time, the US 10-year Treasury yield is at 1.7245%, down five basis points, while the 10-year Treasury Inflation-Protected Securities (TIPS) sits at -0.628%. In the meantime, the US Dollar Index, a measurement of the greenback’s value vs. a basket of six peers, edges up 0.36%, sitting at 95.983.

XAU/USD Price Forecast: Technical outlook

Gold has achieved to stay above July 15, 2021, daily high at $1,834, in the last three trading days. XAU/USD is neutral-upward biased, as portrayed by the daily moving averages below the spot price, but its horizontal slope leaves the yellow metal under downward pressure.

To the upside, XAU/USD’s first resistance would be the January 20, $1,847.90, followed by Pitchfork’s top trendline around the $1850-60 area, followed by November 16, 2021, daily high at $1,877.18.

On the flip side, gold’s first support is January 21 daily low at $1,828.53. A breach of the latter would expose the Pitchfork’s mid-line around $1,820-25 area, followed by the January 18 daily low at $1,805.75.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.