Gold Price Forecast: XAU/USD turns on a dime, but ECB now eyed

- Gold is feeling the pressure on a much more hawkish Fed, but much was priced in already.

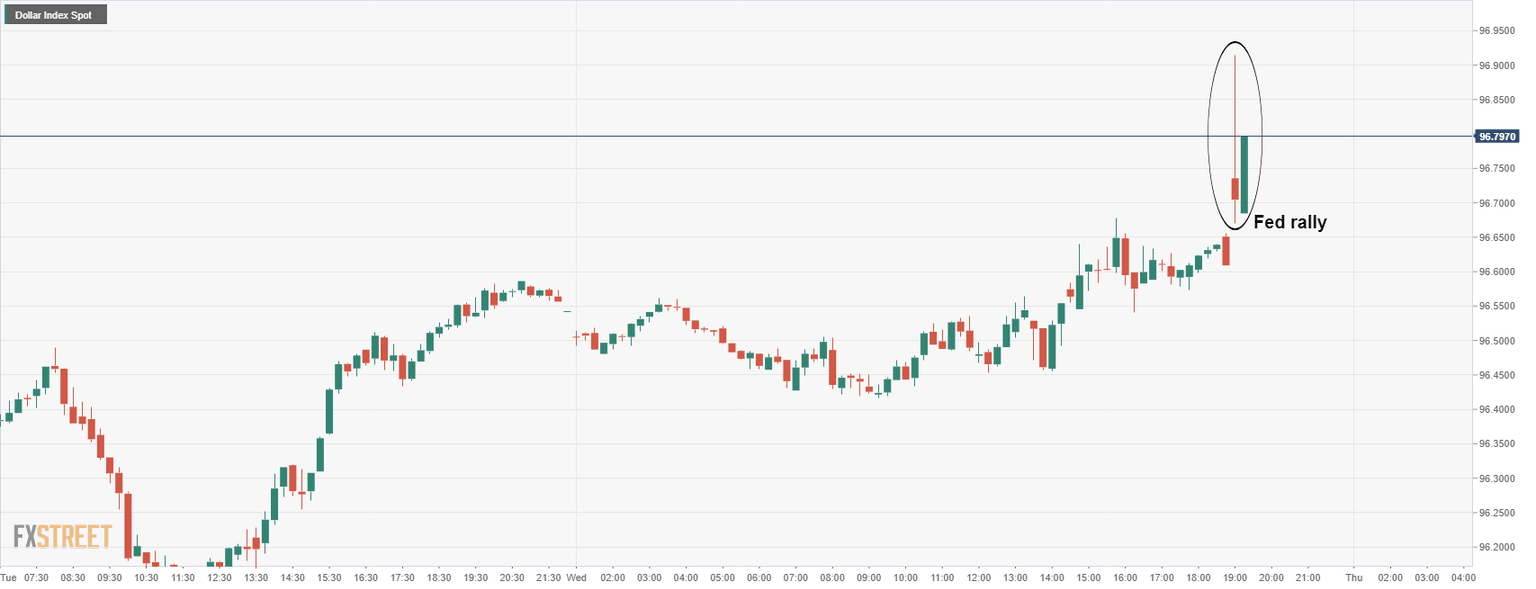

- US dollar has rallied 30 points in the DXY on an uber hawkish Fed but is stalling.

- Fed's dot plot is far more hawkish with 3 rate hikes in 2022 and 2023. The taper has been doubled.

Update: Gold, XAU/US, has reversed course dramatically since the Federal Reserve statement and an initial spike in the greenback that drove gold to fresh New York session lows. now trading at $1,780, the price is around 1.6% higher than the lows of the session where $1,753 was printed on the back of an uber hawkish statement and dot plot.

The moves have left the retail market digging for reasons as to why this has occurred in a move that does not seem to align with the implications of the central bank divergences as well as the risks associated with global growth when considering the coronavirus.

As explained below, much of the hawkishness was already foreseen and given the time of year, flows can be irregular and counterintuitive to the hard fundamentals. Forex volatility was already moving up the Y-axis as per the following DBCVIX USD Volatility Idx:

Traders were quick to take profits on the knee-jerk ahead of Super Thursday where the Swiss National Bank, European Central Bank and Bank of England all meet to decide upon their monetary policy and make subsequent announcements.

However, given the magnitude of divergence between, say, the BoE to the Fed and the ECB to the Fed, the dollar will likely be underpinned on the expected outcomes. This could turn the price of the greenback and gold on a dime should investors move in to sweep up some last minute takings before the holiday season.

End of update

Gold, XAU/USD has extended the day's losses on an uber hawkish Federal Reserve statement and announcements of a doubling of its tapering of QE and a seismic shift in the dot plot. The median forecast is now showing three hikes in 2022 and 2023. In the September Dots, the median saw only one hike by end-2022 (0.375%).

The Federal Reserve statement acknowledges that job gains have been solid and it has dropped the transitory language with respect to upside inflation pressures.

Fed futures printing in a 100% chance of a Fed hike as soon as May and 50% for a March rise, with 90% for April.

Key takeaways from the Fed statement

- FOMC monthly taper pace $30 billion vs $15 billion prior.

- ''In assessing monetary policy, will continue to monitor incoming information for the economic outlook.''

- ''Prepared to adjust stance of monetary policy as appropriate if risks emerge that impede its goals.''

- ''Job gains have been solid in recent months, and the Unemployment Rate has declined substantially.''

See also: Summary of Economic Projections

Watch live: Fed's Powell coming up, top of hour

Federal Reserve Chairman Jerome Powell holds a news conference after Federal Open Market Committee concluded its two-day meeting.

This shift to three rate hikes in 2022 will very much support the notion of the Fed moving into tightening mode. Therefore, there will be plenty of interest as to how the Fed now refers to inflation - after Powell said its description as transitory should be 'retired. This will be the key theme during the presser and the price of gold will be determined by it.

''Certainly, while the above suggests a hawkish tone from the Fed, the market is already pricing an aggressive tapering and the first hike in May 2022,'' analysts at TD Securities argued.

''This leaves a balance of risks tilted towards the upside for the near-term precious metals outlook, particularly as our macro strategists expect enough slowing in inflation and growth to delay the start of the hiking cycle.''

Gold technical analysis

However, from a technical perspective, while the price is being supported, the wick is going to be a target for the bears for the sessions ahead. A break of $1,750 will open the risk of a far deeper move to the downside and $1,700 could come under pressure over the coming weeks.

This will depend on the US dollar's trajectory. The initial move was a strong bid but it has since settled as follows:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637751991211407117.jpeg&w=1536&q=95)