Gold Price Forecast: XAU/USD senses hurdles around $1,930 as market mood sours, yields extend gains

- Gold price has sensed selling interest around $1,930.00 as a risk-off profile has emerged.

- Rising yields on US Treasuries have provided a cushion to the US Dollar Index.

- US firms are hoping for a bleak economic outlook amid rising interest rates by the Fed.

Gold price (XAU/USD) has sensed barricades while attempting to cross the critical resistance of $1,930.00 in the Asian session. The precious metal has witnessed selling interest as investors are turning risk averse in the interest rate policy week. The Federal Reserve (Fed) is set to announce its first interest rate decision of CY2023 on Wednesday.

S&P500 futures show losses in the Asian session, expressing escalating caution in the market sentiment. The US Dollar Index (DXY) has recovered sharply after a correction to near 101.50. A recovery in the USD index is supported by rising returns on US Treasury bonds. The 10-year US Treasury yields have climbed to near 3.53%.

In addition to the Fed’s monetary policy, investors will keep an eye on the United States Automatic Data Processing (ADP) Employment data, which is expected to drop vigorously to 86K vs. the former release of 235K. Rising interest rates by Fed chair Jerome Powell to tame the Consumer Price Index (CPI) has trimmed the overall demand, which has squeezed labor demand by firms amid a bleak economic outlook.

Gold technical analysis

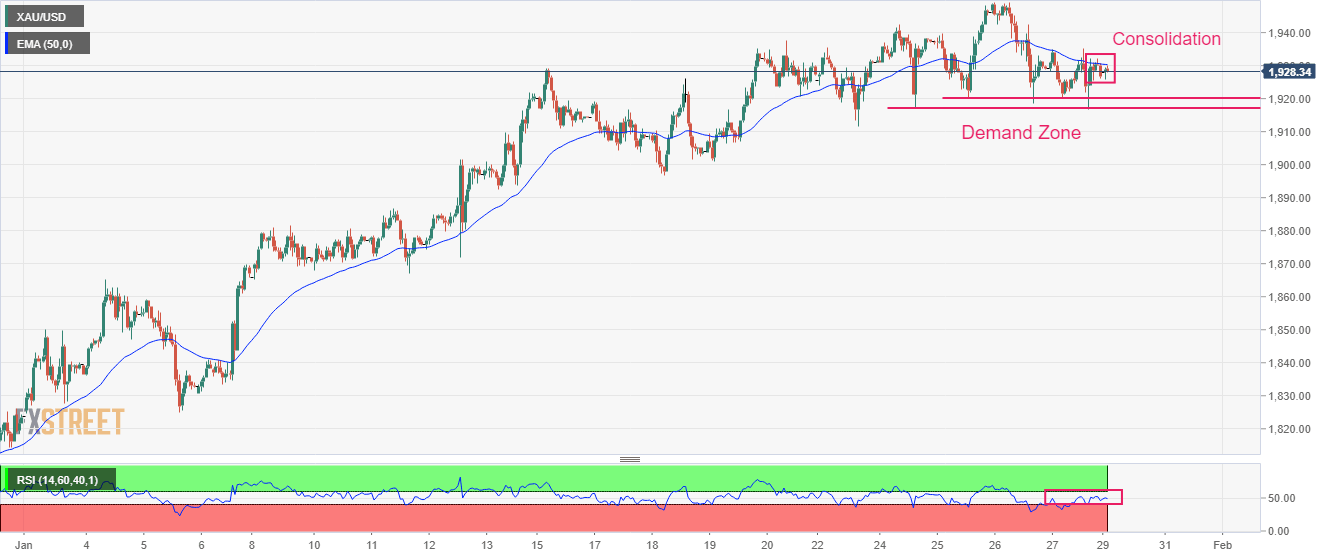

Gold price is juggling in a small range bounded consolidation on an hourly scale that indicates volatility contraction. The 50-period Exponential Moving Average (EMA) at $1,930.00 had been a significant barricade for the Gold bulls. The demand zone in a $1,917-1,920 range will support the asset ahead.

The Relative Strength Index (RSI) (14) oscillates in a 40.00-60.00 range, indicating that investors are awaiting a fresh trigger for a power-pack action.

Gold hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.