Gold Price Forecast: XAU/USD sees downside below $1,970 as USD Index rebounds and US banking woes ease

- Gold price is expected to display sheer weakness below $1,970.00 amid a recovery in the USD Index.

- Easing US banking jitters has trimmed the appeal for the Gold price as a safe-haven.

- The USD Index will remain in action amid the release of the US ISM Manufacturing PMI data.

Gold price (XAU/USD) is declining towards its crucial support of $1,970.00 in the Asian session. A solid recovery in the US Dollar Index (DXY) amid upbeat expectations that the Federal Reserve (Fed) will raise interest rates one more time by 25 basis points (bps) on Wednesday is impacting the Gold price. The precious metal might show a significant fall after a confident break below $1,970.00 as it has been acting as a major support from the past week.

S&P500 futures have recovered their entire losses generated in early Asia and has shifted into positive territory, portraying an upbeat market mood. Also, the demand for US government bonds looks solid. The 10-year US Treasury yields have dropped to near 3.43%.

The USD Index is expected to show a power-pack action on Monday amid the release of the United States ISM Manufacturing PMI (April) data. As per the consensus, the economic data is seen higher at 46.6 from the former release of 46.3. A figure below 50.0 is considered a contraction in manufacturing activities and consistency with consensus will make it the sixth consecutive contracting month.

The headlines that JP Morgan and PNC are submitting final bids for First Republic Bank in Federal Deposit Insurance Corporation (FDIC) auction has eased United States banking jitters, which has trimmed appeal for the Gold price.

Apart from that, New Orders data that indicates forward demand is seen expanding to 45.5 vs. the prior release of 44.3.

Meanwhile, consumer spending in the United States economy seems resilient despite higher interest rates from the Fed. A surprise jump in Employment Cost Index (Q1) to 1.2% indicates that labor market conditions are upbeat and the Fed has no other option than to continue paddling interest rates.

Gold technical analysis

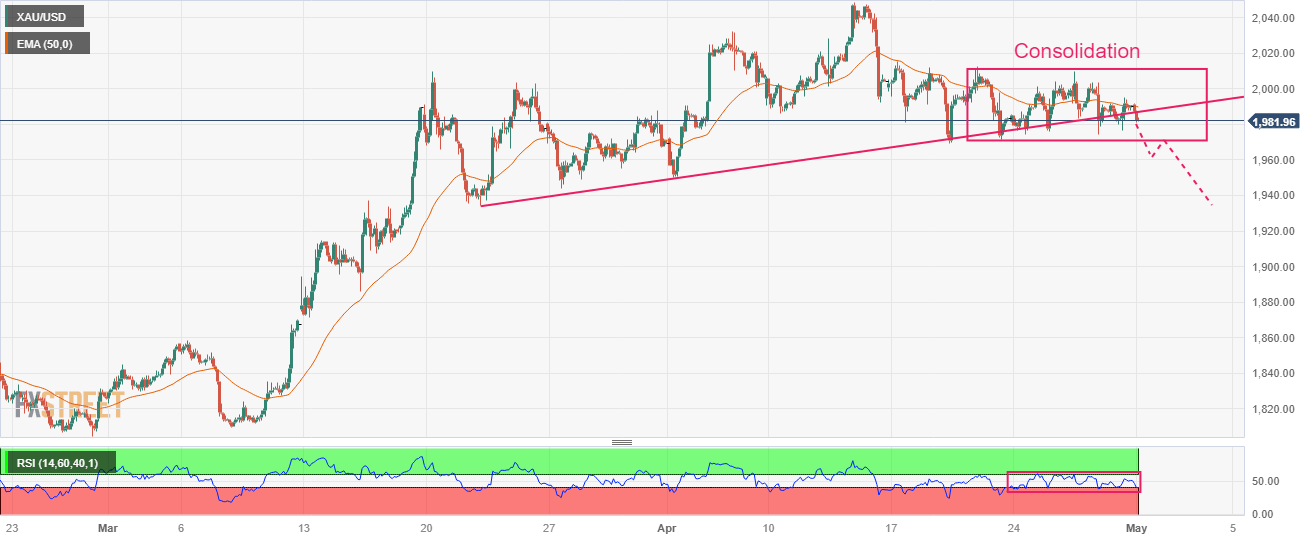

Gold price is consolidating in a narrow range of $1,971-2,021 from the past week as investors are awaiting the monetary policy by the Fed for a decisive move. Upward-sloping trendline March 22 low at $1,934.34 is acting as a cushion for the Gold bulls.

The 20-period Exponential Moving Average (EMA) at $1,990.28 is showing stickiness to the Gold price, indicating a lackluster performance.

Meanwhile, the Relative Strength Index (RSI) (14) is on the verge of slipping into the bearish range of 20.00-40.00, which will activate the bearish momentum.

Gold two-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.