Gold Price Forecast: XAU/USD portrays pre-NFP trading lull around $1,790

- Gold price remains sidelined within a choppy trading range, bulls struggle to keep reins around monthly high.

- US dollar rebound challenges the XAU/USD buyers ahead of the key US employment report.

- Chatters surrounding China, Taiwan and recession also entertain traders.

Gold price (XAU/USD) seesaws around the monthly top as traders depict the typical anxiety ahead of the key US jobs report on Friday. That said, the yellow metal seesaws near $1,788-95 area, around $1,791 by the press time of the early morning in Europe.

In addition to the pre-NFP caution, the market’s mixed concerns surrounding the global recession and the latest geopolitical headlines concerning Taiwan also contribute to the XAU/USD’s sluggish move. It’s worth noting that the options market flashes mixed signals and challenges the gold buyers.

The fears of a global economic slowdown seem to have ebbed amid the recent rebound in the US Treasury yields, which in turn propelled the US dollar and exert downside pressure on the gold price.

The US Dollar Index (DXY) snaps a two-day downtrend while printing mild gains around 106.00. The greenback gauge dropped during the last two days before tracing the yields to consolidate recent losses. It’s worth noting that the US 10-year Treasury yields stabilize around 2.069% after declining in the last two days. Even so, the US Treasury yields continued to portray the risk of recession as the difference between the 10-year and 2-year bond coupons remain the widest since 2000.

Elsewhere, geopolitical challenges emanating from the Taiwan Strait also challenge gold buyers as China reflects its dislike for US House Speaker Nancy Pelosi’s visit to Taipei. Recently, US Secretary of State Antony Blinken told an East Asia meeting, per West Official, that China’s reaction to US House Speaker Nancy Pelosi’s Taiwan visit had been "flagrantly provocative".

Talking about the mood in the options market, a one-month risk reversal (RR) of gold prices snaps a three-week downtrend on the weekly basis but drops for the third consecutive day if watched daily. It should be noted that the spread between the bullish and bearish bets, namely the call options and the put options, is known as the risk reversal (RR).

To sum up, gold prices remain sidelined but the negatives are more than the positives and hence today’s US employment report for July will be crucial for near-term directions. Should the employment data appear stronger, the US dollar rebound can extend and weigh on gold prices.

Technical analysis

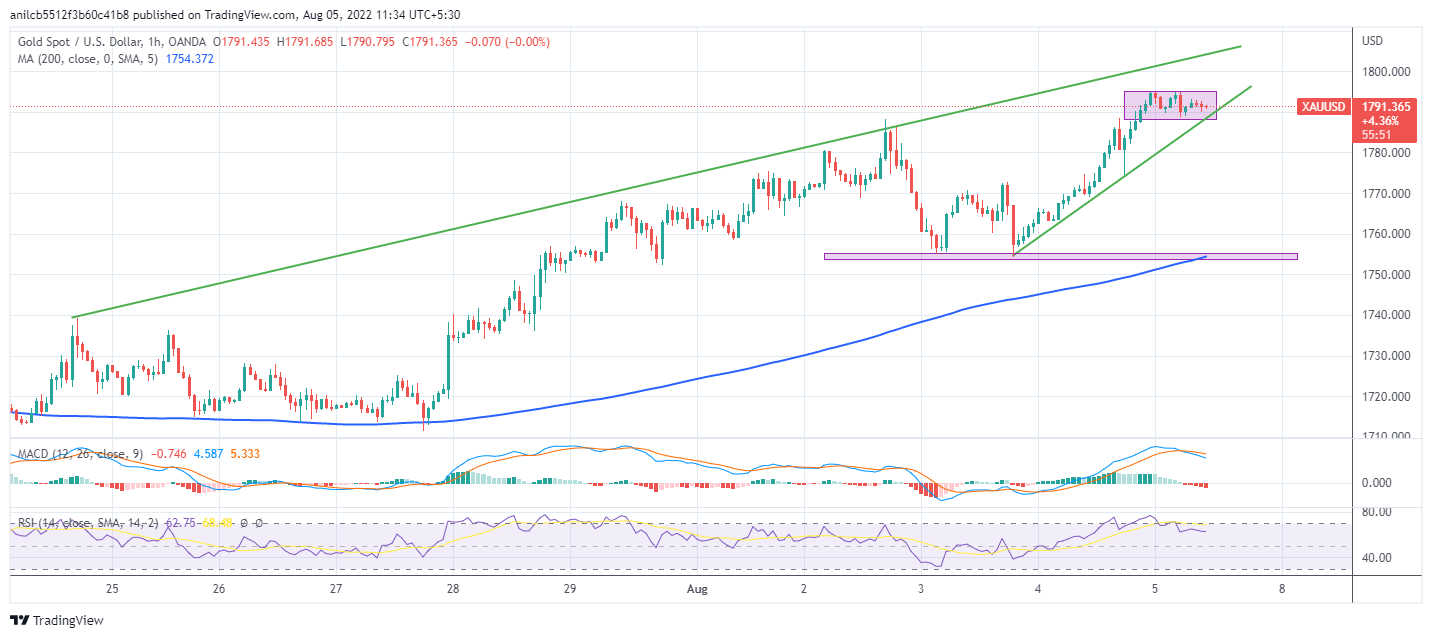

Gold price seesaws between $1,788 and $1,795 as buyers and sellers jostle near the monthly high amid overbought RSI conditions.

That said, the quote’s pullback moves need validation from a three-day-old support line, near $1,787, before directing the XAU/USD bears towards the double bottom marked on Wednesday, as well as the 200-HMA, around $1,754-55.

Alternatively, an upside break of $1,795 will need to successfully cross the $1,800 round figure to please XAU/USD buyers.

Even so, a fortnight-old resistance line near $1,805 could restrict short-term gold price run-up.

Gold: Hourly chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.