Gold Price Forecast: XAU/USD plunges amidst US economic resilience, high US bond yields

- Gold prices fall 0.80% as US economic data showcases resilience, led by strong retail sales and industrial production figures.

- Hawkish tones from Fed officials Mester and Barkin contribute to rising US Treasury bond yields, further pressuring gold prices.

- Upcoming speeches from New York Fed John Williams, Dallas Fed Lorie Logan, and Atlanta’s Fed Raphael Bostic may provide more insight into the economic outlook.

Gold price is erasing Monday’s gains, plunging 0.80%, as data from the United States (US) showed signs of resilience amidst a solid retail sales report. Industrial Production recovered in April, though manufacturing production stood at contractionary territory. The factors mentioned above and the US bond yields rising were a headwind for XAU/USD prices. At the time of writing, the XAU/USD is trading at $2000.91 after hitting a daily high of $2018.28.

Solid Retail Sales and Industrial Production data strengthen the greenback and XAU/USD dips

The US economic agenda revealed that Retail Sales rose by 0.4% MoM, below estimates of 0.8%, while excluding autos rose by 0.4% MoM, aligned with estimates. It should be said that both figures surpass March’s readings, which showed sales plunging. Annually based figures rose by 1.6% below the prior’s month 2.4% rise, suggesting an ongoing deceleration of the United States (US) economy.

In another data, the US Federal Reserve (Fed) reported that Industrial Production in April rose by 0.5% MoM, above estimates of 0%, while annually based, uptick to 0.2% from 0.1% in March. The same report showed that Manufacturing Production expanded at a 1% MoM pace, crushing forecasts of 0.1%, with motor vehicle production underpinning the figures.

On the data release, XAU/USD extended its losses and reached a two-day new low of $1998.17 before trimming some of its losses. US Treasury bond yields continued to rise as Federal Reserve officials led by San Francisco Fed President Loretta Mester and Richmond’s President Thomas Barkin sounded hawkish.

Mester said that the Fed cannot do much about slowing long-term economic growth but can “do its part” by tackling inflation. She emphasized the Fed’s commitment to getting inflation to the 2% target. In the meantime, Thomas Barkin said that if more increases are needed to bring down, he’s “comfortable with that.”

Upcoming events

Further Fed speaking is expected with New York Fed John Williams, Dallas Fed Lorie Logan and Atlanta’s Fed Raphael Bostic.

Gold Price Analysis: Technical outlook

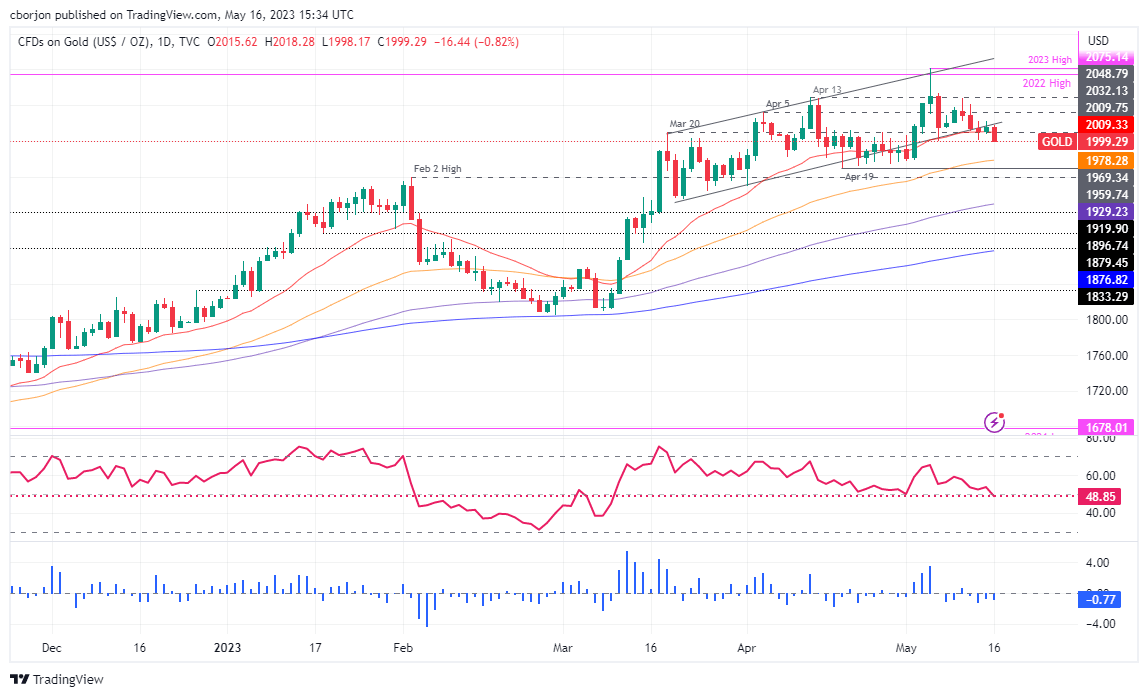

XAU/USD remains in a neutral bias, albeit exchanging hands above the 50, 100, and 200-day Exponential Moving Averages (EMAs), each at $1978.42. Nevertheless, since reaching a year-to-date (YTD) high of $2081.82, XAU/USD retraced sharply, below the April 13 high of $2048.79, which opened the door for a deeper pullback. Since then, XAU/USD has fallen more than 3.5%, with sellers eyeing to extend its losses past the $2000 mark. Once cleared, the next support for XAU/USD would be the 50-day EMA at $1978.43 before Gold tests the April 19 swing low of $1969.34.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.