Gold Price Forecast: XAU/USD remains confined in a range above $1,920 amid mixed clues

- Gold price remains offered despite risk-aversion, pullback in yields and the USD.

- Hawkish Fed’s outlook likely to dull gold’s appeal while Ukraine crisis to underpin.

- Gold Price Forecast: XAUUSD extends consolidation above $1,900.00.

Update: Gold continued with its struggle to gain any meaningful traction and witnessed subdued/range-bound price action for the second successive day on Thursday. The XAU/USD remained confined in a narrow trading band through the early European session and was last seen trading just below the $1,925 level, nearly unchanged for the day. The March 15-16 FOMC policy meeting minutes revealed deepening concern among policymakers that inflation had broadened through the economy and the need for tighter monetary policy. Many participants said that they were prepared to hike interest rates by 50 bps at upcoming meetings and reduce the central bank’s massive balance sheet to tighten financial conditions. This, in turn, was seen as a key factor that acted as a headwind for the non-yielding yellow metal.

The Fed's aggressive plans, along with fading hopes for a diplomatic solution to end the war in Ukraine, took its toll on the global risk sentiment. This was evident from a generally weaker tone around the equity markets and extended some support to the safe-haven gold. The anti-risk flow was reinforced by modest pullback in the US Treasury bond yields, which kept the US dollar bulls on the defensive and contributed to limiting the downside for the dollar-denominated commodity. Even from a technical perspective, the XAU/USD has been oscillating in a range over the past one-and-half-week or so. This further warrants some caution for aggressive traders and positioning for a firm direction.

Previous update: Gold price is in the hands of sellers so far this Thursday, having settled almost unchanged on the day on Wednesday.

The hawkish Fed minutes unraveled the world’s most powerful central bank’s plans to pare the balance sheet and deliver a 50-basis points (bps) rate hike at its May meeting. The Fed’s aggressive stance is worrying investors, as it could cripple the economic growth while the Fed combats soaring inflation.

The sell-off in the techs and real estate stocks on Wall Street caused its Asian peers also to lean bearish, offering a heavy blow to the risk-on trades. Therefore, the haven demand for the US bond dragged the yields lower, invariably triggering a minor pullback in the US dollar.

With the Fed’s aggressive tightening plans in full swing, gold price is failing to benefit from the renewed weakness in the yields, as well as, the dollar. Gold price is also shrugging off any demand for it as a safe haven, as policy normalization remains a net negative for the bright metal in the longer run.

Markets also remain jittery amid the ongoing escalation in the Russia-Ukraine conflict following the Western sanctions against Russia’s war crimes in Ukraine. Attention now turns towards the speeches from the Fed policymakers Evans, Williams, Bostic and Bullard, which could have a significant impact on gold price in the coming days.

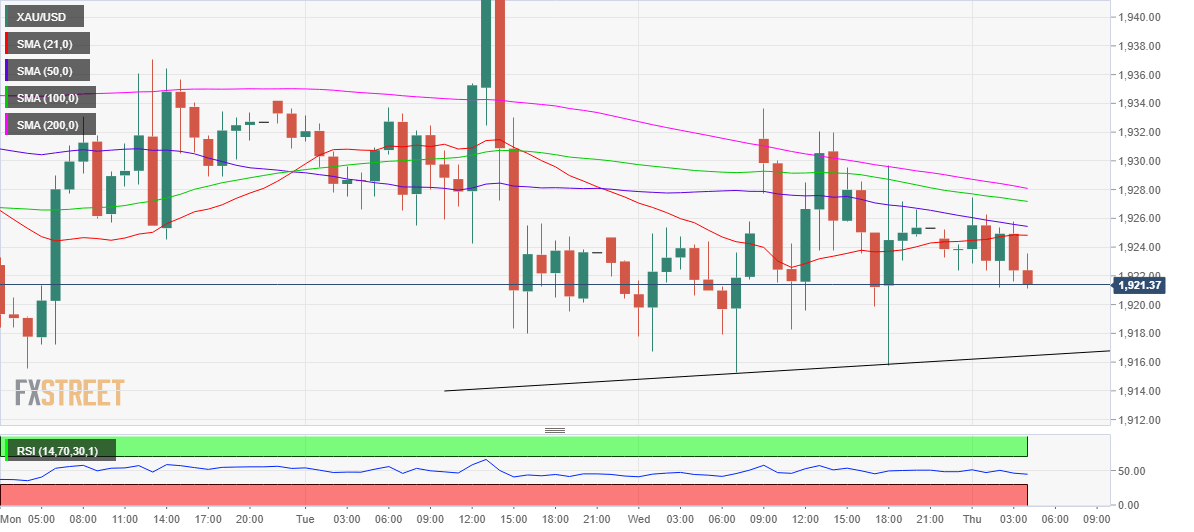

Gold Price Chart: Hourly

Gold’s hourly technical picture shows that the price is eyeing a sharp drop towards the rising trendline support at $1,916.

The Relative Strength Index (RSI) is looking south below the midline, justifying the bias to the downside.

If the abovementioned support is breached, then a test of the $1,900 mark remains inevitable.

On the upside, immediate confluence resistance is seen around $1,925, where the 21 and 50-Hourly Moving Averages (HMA) close in.

The next critical upside target is seen near $1,928, where the 100 and 200-HMAs align.

Further up, the $1,930 round level could challenge the bearish commitments.

Gold Price: Additional levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.