Gold Price Forecast: XAUUSD extends consolidation above $1,900.00

XAUUSD Current Price: $1,925.54

- A deepening crisis in Eastern Europe fuels fears of skyrocketing inflation.

- US government bond yields keep rallying as global indexes dip into the red.

- XAUUSD is technically neutral, bulls may lose conviction on a break below $1,890.00.

Spot gold trades around $1,925.54 a troy ounce, still unable to attract investors as per trading in quite a limited intraday range. XAUUSD has been flat for over a week, with daily candles showing little to no bodies, as the risk-averse environment boosts demand for both safe-haven assets.

The greenback is generally stronger on Wednesday amid inflation-related concerns and mounting tensions between Western nations and Russia. The US and the EU are announcing new sanctions on Moscow’s commodities, despite the European dependence on gas and oil from the Eastern nation. The crisis, which exacerbates bottlenecks, is putting more pressure on already high inflation. In turn, central bankers from around the globe are tightening their monetary policies.

At the same time, government bond yields soar, while the yield-curve hints at recession. The yield on the 10-year US Treasury peaked at 2.66%, its highest since early 2019. Stocks, on the other hand, are on the backfoot, with US indexes reaching fresh weekly lows.

XAUUSD Technical Outlook

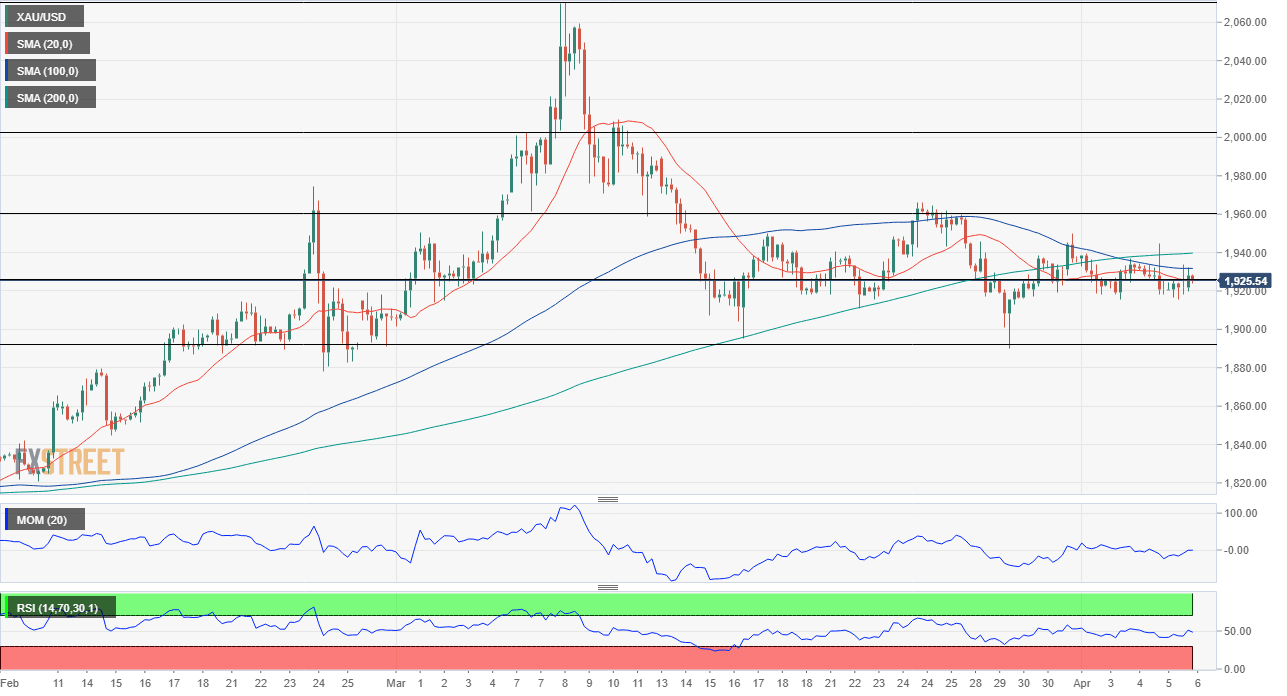

From a technical point of view, the bright metal has limited bullish potential, offering a neutral stance in its daily chart. A mildly bearish 20 SMA provides dynamic resistance, with the price consolidating just below it. The longer moving averages maintain their bullish slopes well below the current level, while technical indicators are still stuck around their midlines.

The near-term picture also reflects the absence of directional strength. Gold Price is below its moving averages, all of them confined to a tight range. Technical indicators, in the meantime, turned lower after briefly surpassing their midlines and are still confined to neutral levels. The bright metal can turn bearish on a break below 1,890.05, March monthly low, while bulls will likely be more comfortable if XAUUSD overcomes 1,949.80.

Support levels: 1,915.40 1,903.40 1,890.05

Resistance levels: 1,938.50 1,949.80 1,961.00

View Live Chart for the XAU/USD

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.