Gold Price Forecast: XAU/USD grinds higher past $1,950 amid downbeat United States data

- Gold Price defends the week-start bounce off short-term key support confluence, seesaws of late.

- XAU/USD benefits from softer United States PMI data, Factory Orders amid downbeat US Dollar and Treasury bond yields.

- Risk catalysts eyed amid an unimpressive economic data line for the Gold traders.

Gold Price (XAU/USD) stays on the front foot around $1,961, after an upbeat start of the week, as the bullion traders seek more clues to extend the latest rebound during early Tuesday in Asia. That said the precious metal cheered downbeat United States statistics and dicey markets to regain upside momentum the previous day. Adding strength to the XAU/USD rebound was its inability to crack the short-term key support confluence surrounding $1, 940 (stated in the technical analysis).

Gold Price rises on downbeat US data, easing hawkish Federal Reserve bets

Gold Price began the week on a front foot, after snapping a three-week downtrend, as weak United States data weigh on the Federal Reserve (Fed) bets and the US Dollar on Monday. That said, On Monday, US ISM Services PMI declined to 50.3 for May versus 51.5 expected and 51.9 prior whereas growth of the Factory Orders also deteriorated during the stated month to 0.4% versus 0.5% market forecasts and 0.9% previous readings. It should be noted that the final readings of S&P Global Composite PMI and Services PMI also marked softer figures for May.

Following the data, the market’s bets on the Fed’s June rate hike dropped from around 80% in the middle of the last week to nearly 25%. The same could have joined an absence of the Fed talks to weigh on the US Treasury bond yields and the US Dollar. That said, the US Dollar Index (DXY) dropped and reversed the early-day gains to end in the red with minor losses around 104.10.

It should be noted, however, that International Monetary Fund (IMF) Managing Director Kristalina Georgieva suggested during the weekend that the Fed needs to do more to tame inflation, which in turn probed the Gold buyers.

China data, United States banking concerns also favor XAU/USD bulls

Apart from the softer US data and yields, upbeat statistics from China, one of the world’s biggest Gold consumers, also allowed the XAU/USD to remain firmer. On the same line were concerns about the US banks.

That said, China’s Caixin Services PMI matches 57.1 market forecasts for May versus 56.4 previous readings.

Elsewhere, chatters were making rounds that the large banks in the United States need to hold more capital to avoid the risk of default seemed to have dented the market sentiment. While portraying the same, Wall Street benchmarks closed in the red, which in turn joined downbeat US data and allowed the Gold price to remain firmer.

Looking forward, a lack of major data/events on Tuesday may help the Gold buyers to take a breather. However, growing pessimism among the Fed hawks can keep the XAU/USD bulls hopeful.

Gold Price technical analysis

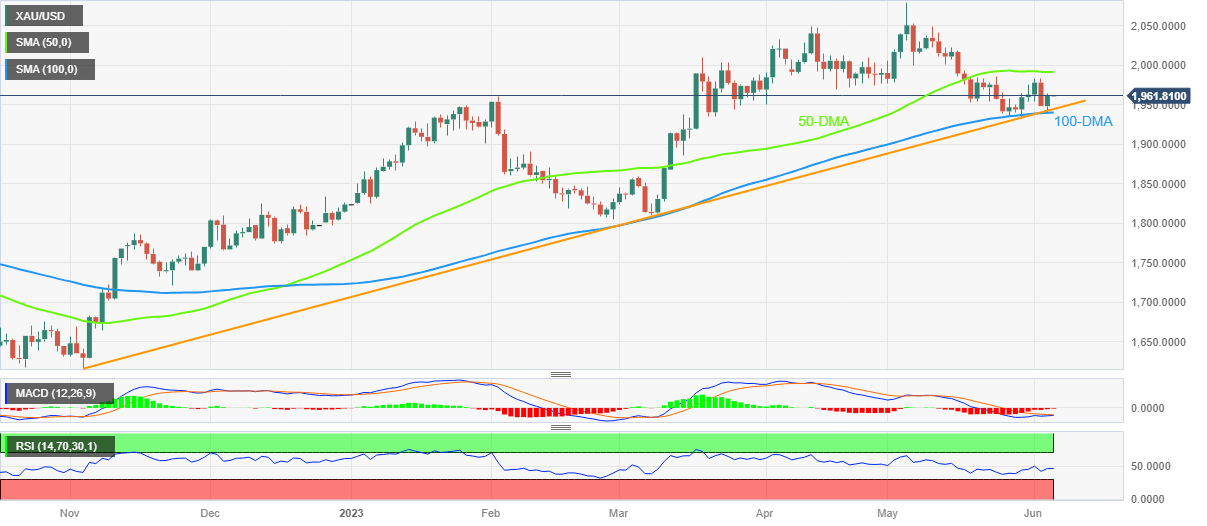

Gold Price (XAU/USD) repeatedly bounces off a convergence of the 100-DMA and an upward-loping support line from early November 2022, around $1,940 by the press time.

Adding strength to the XAU/USD recovery expectations is the near-50.0 level of the Relative Strength Index (RSI) line, placed at 14, as well as an impending bearish signal on the Moving Average Convergence and Divergence (MACD) indicator.

Even so, the 50-DMA hurdle of around $1,990 and the $2,000 round figure challenge the Gold buyers before giving them control.

On the contrary, the Gold Price daily closing below $1,940 support confluence can quickly fetch the metal towards the $1,900 round figure.

In a case where the Gold Price remains bearish past $1,900, the early March swing high of around $1,860 and the yearly low marked in February near $1,804 will be in the spotlight.

Overall, the Gold price is likely to remain firmer unless breaking the $1,940 level.

Gold price: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.