Gold Price Forecast: XAU/USD drops towards $1,980 as hawkish Fed bias, sour sentiment favors US Dollar

- Gold price takes offers to reverses the previous day’s corrective bounce.

- Geopolitical fears surrounding China, Russia joins hawkish Fed bets and fears of US government default to roil the risk appetite.

- Risk-aversion underpins US Dollar and yields while weighing on XAU/USD ahead Fed Beige Book.

Gold price (XAU/USD) bears the burden of the US Dollar rebound as it drops back below $2,000, around $1,990 after renewing its intraday low with $1,987 mark during early Wednesday in Europe.

In doing so, the bright metal takes clues from the risk-off mood, mainly linked to Russia and China, as well as the US debt payment default fears. Furthermore, upbeat US Treasury bond yields and hawkish Federal Reserve (Fed) talks also underpin US Dollar’s rebound and weigh on the XAU/USD price.

UK’s warning that Russian hackers targeting Western critical infrastructure and the fears surrounding the US-China tension about Taiwan, due to the US House China Committee’s discussion about the Taiwan invasion scenario, weigh on the risk profile. On the same line could be the Reuters’ news suggesting that US consumers are starting to fall behind on their credit card and loan payments as the economy softens.

Furthermore, the likely drag on the US debt ceiling decision due to US President Joe Biden’s hesitance in lifting debt limits. Additionally, Bloomberg released news suggesting China’s role in the Russia-Ukraine war, which in turn adds strength to the risk-off mood and propels the US Dollar, which in turn drowns the Gold price.

On a different page, the markets are almost certain of 0.25% Fed rate hike in May and the same joins the recently easing odds favoring the rate cut in 2023 to portray the hawkish bias about the US central bank. Behind the moves are Friday’s US Consumer-centric figures and Monday’s US activity data, as well as the latest upbeat comments from St. Louis Federal Reserve President James Bullard, Richmond Fed President Thomas Barkin and Atlanta Fed President Raphael W. Bostic. However, recently downbeat US housing data prod the Fed hawks and put a floor under the Gold price.

Amid these plays, the S&P 500 Futures dropped 0.30% intraday while reversing from the highest levels since early February whereas the US two-year Treasury bond yields jump to a fresh high in one month. Further, the US 10-year bond coupons also rise to 3.61% and allow the US Dollar Index (DXY) to print 0.20% intraday gains while poking 102.00 level.

Moving on, Gold traders should rely on the risk catalysts, mainly surrounding geopolitics and the US debt ceiling, for immediate directions as today’s economic calendar appears mostly empty with only Fed Beige Book on the watch. That said, the likely increase in the risk-aversion and hawkish Fed bets could weigh on the XAU/USD prices.

Technical analysis

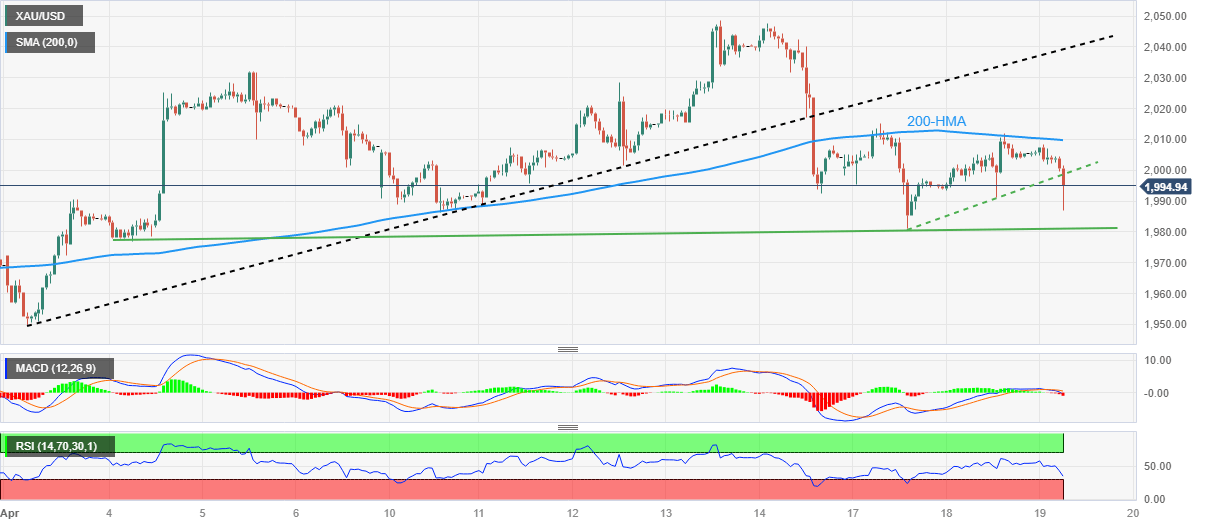

With the Gold price’s latest weakness, it marks another U-turn from the 200-Hour Moving Average (HMA), which in turn joins the bearish MACD signals to direct the XAU/USD bears toward a two-week-old ascending support line near $1,980.

However, the RSI (14) line is oversold and hence the quote’s further downside past $1,980 appears less likely, which if happens could direct the XAU/USD price in the direction of the monthly low of around $1,949.

Meanwhile, a two-day-old ascending trend line, previous support near $1,999, restrict the immediate rebound of the Gold price.

Following that, the 200-HMA level of around $2,010 can challenge the XAU/USD buyers.

Above all, the Gold price remains on the bear’s radar unless the quote stays below the previous support line from April 03, close to $2,040 at the latest.

Gold price: Hourly chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.