Gold Price Forecast: XAU/USD approaches $1,800 mark amid weaker USD

- Gold struggled to capitalize on the previous day’s strong rally to near one-month tops.

- Hawkish Fed expectations turned out to be a key factor that capped gains for the metal.

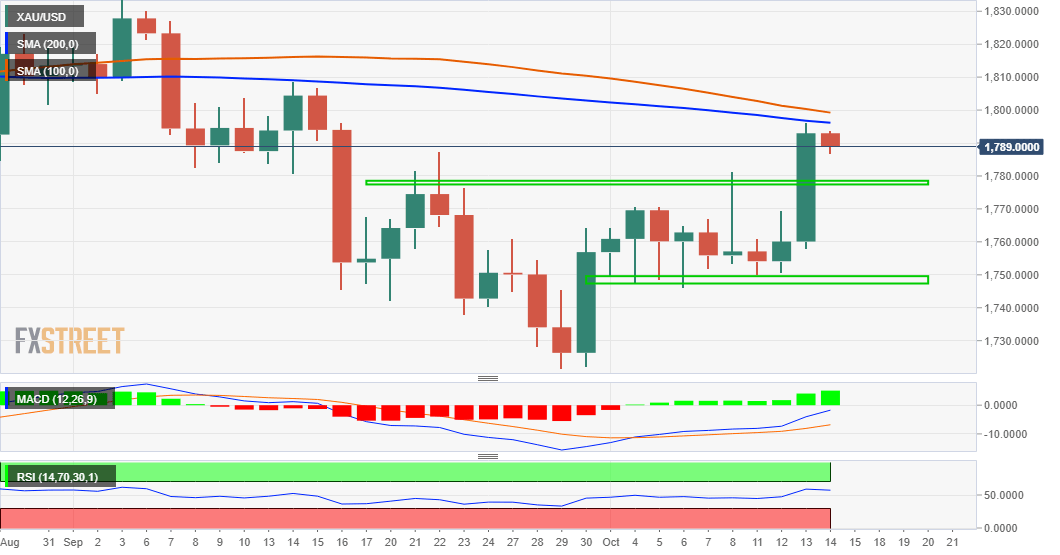

- Bulls now wait for a sustained move beyond the 100/200-day SMA confluence hurdle.

Update: Gold reversed an intraday dip to the $1,787-86 region and has now moved into the positive territory for the third successive day. The XAU/USD jumped to near one-month tops during the first half of the European session, with bulls now looking to build on the momentum beyond the very important 200-day SMA. The US dollar extended the previous day's retracement slide from 13-month tops, which, in turn, was seen as a key factor that acted as a tailwind for dollar-denominated commodities, including gold.

Apart from this, a further decline in the longer-dated US Treasury bond yields extended some additional support to the non-yielding yellow metal. This, to a larger extent, helped offset the risk-on impulse in the markets, which tends to undermine demand for the traditional safe-haven gold. It, however, remains to be seen if the XAU/USD can capitalize on the move or meets with fresh supply at higher levels amid firming expectations for an early policy tightening by the Fed. Nevertheless, a sustained strength beyond the $1,800 mark will be seen as a fresh trigger for bullish traders and set the stage for additional gains.

Previous update: Gold witnessed some selling during the Asian session on Thursday and eroded a part of the previous day's strong rally to the highest level in about a month. The XAU/USD, which is seen as a hedge against inflation, benefitted after the US CPI report showed a continuous rise in inflationary pressures. Against the backdrop of last Friday's disappointing NFP print, the data aggravated fears about the return of stagflation. This, along with a broad-based US dollar weakness, provided a strong boost to the dollar-denominated commodity.

The greenback witnessed a typical 'buy the rumour, sell the fact' kind of a reaction and reversed its weekly gains to 13-month tops following the report. A further decline in the longer-dated US Treasury bond yields was seen as another factor that weighed heavily on the buck. That said, expectations for an early policy tightening by the helped limit any further losses for the USD. The minutes of the FOMC monetary policy meeting held on September 21-22 reaffirmed that the US central bank remains on track to begin tapering its bond purchases in 2021.

Moreover, a growing number of policymakers were worried that inflation could persist, forcing investors to bring forward the likely timing of a potential Fed rate hike move. The markets now seem to have started pricing in the possibility of the so-called lift-off in September 2022 and kept a lid on any further gains for the non-yielding yellow metal. The overnight momentum faltered near the very important 200-day SMA, just ahead of the $1,800 mark, which should now act as a key pivotal point and help determine the near-term trajectory for gold.

Market participants now look forward to the US economic docket, featuring the release of Producer Price Index (PPI) and Weekly Initial Jobless Claims later during the early North American session. This, along with the US bond yields and speeches by influential FOMC members, will influence the USD price dynamics. Apart from this, the broader market risk sentiment might also provide some impetus and allow traders to grab short-term opportunities around gold.

Technical levels to watch

Bulls might now wait for a sustained move beyond the $1,796-99 confluence region, comprising of 100-day and 200-day SMAs before placing fresh bets. Some follow-through buying beyond the $1,806 area will reaffirm the positive outlook and lift the XAU/USD back towards the $1,818-20 intermediate hurdle en-route the $1,832-34 heavy supply zone.

On the flip side, any further decline is likely to find decent support near the $1,775 horizontal zone. Sustained weakness below might prompt some technical selling and turn gold vulnerable to accelerate the fall towards the $1,763-62 support zone. The next relevant support is pegged near the $1,750 region, which if broken decisively will shift the near-term bias back in favour of bearish traders.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.