Gold Price Forecast: XAU/USD bulls step in at a 61.8% golden ratio

- Gold stalls at a 61.8% ratio ahead of FOMC minutes.

- Gold bulls seek a meanwhile bullish correction depending on the outcome of the FOMC minutes.

The Gold price is higher on Wednesday buoyed by a weaker greenback that retreated across the board on Tuesday and remains offered in Asia. Investors are looking past worries about China's COVID flare-ups ahead of Wednesday's Federal Open Market Committee Minutes.

Equities and high-beta currencies were favoured overnight, putting the US Dollar to the bottom of the leaderboard and supporting gold prices a touch higher. The DXY index, that measure the greenback vs. a basket of currencies was last seen below the overnight highs and scraping the bottom of the 107's.

The S&P 500 was closing at its highest level in 2-1/2 months. The Dow Jones Industrial Average rose 397.82 points, or 1.18%, to 34,098.1, the S&P 500 gained 53.64 points, or 1.36%, to 4,003.58 and the Nasdaq Composite added 149.90 points, or 1.36%, to 11,174.41. US stock futures were little changed on Wednesday as investors braced for the latest Federal Reserve meeting minutes that could guide the US rates outlook.

Meanwhile, supportive of Gold, there are prospects of a pivot from the Federal Reserve due to recent cooler-than-expected inflationary data within economic releases, notably the last US Consumer Price Index. A rally in bonds also pushed the 10-year yield down 6bps to 3.77%, helping support investor appetite. Market participants are awaiting the minutes of Fed's Nov. 1-2 policy meeting due at 1900 GMT.

On Tuesday, Kansas City Fed President Esther George said the Fed may need to raise interest rates to a higher level and hold them there for longer in order to successfully moderate consumer demand and bring down high inflation. Fed Bank of Cleveland President Loretta Mester explained that getting inflation down remains the most critical.

Gold technical analysis

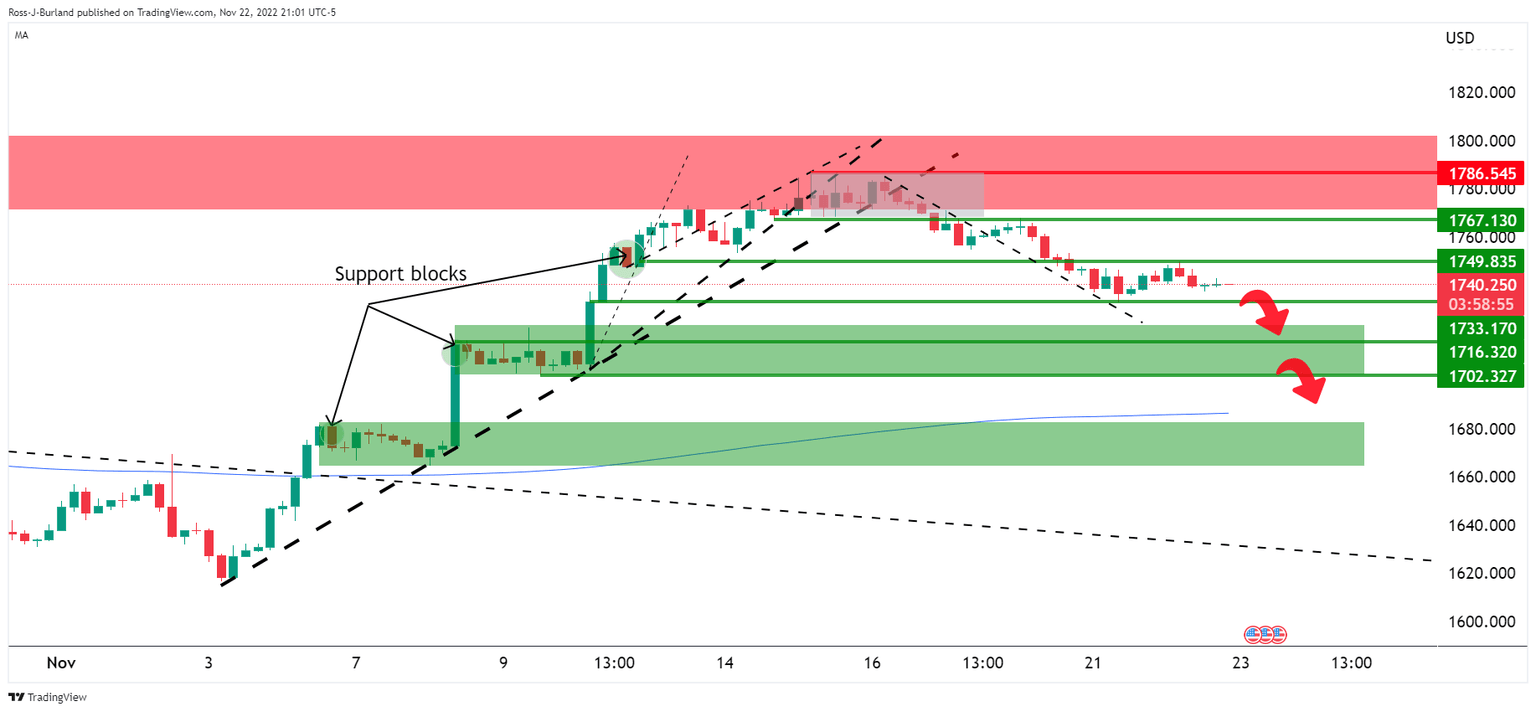

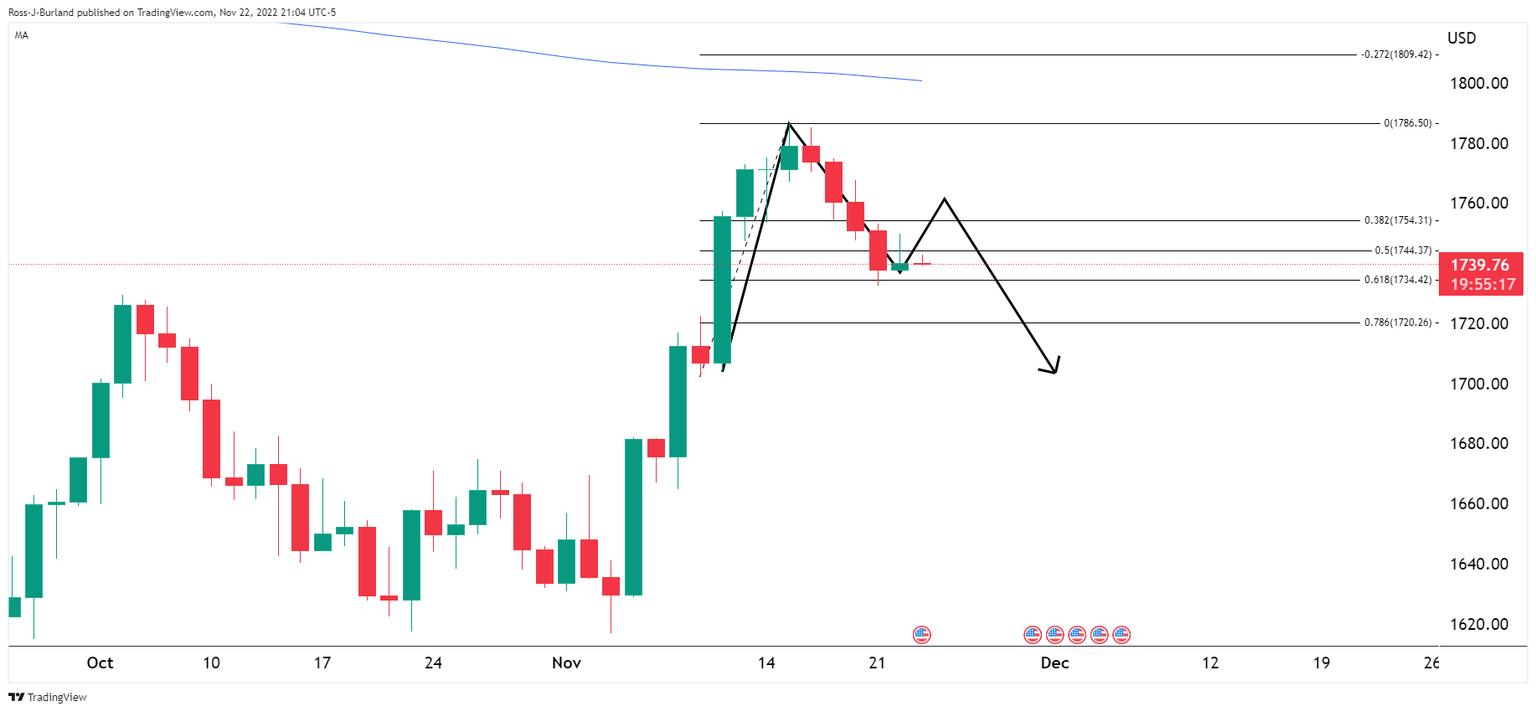

A deeper correction has taken on the $1,750 level as per the confluence of the 38.2% Fibonacci and has subsequently moved in on the 61.8% ratio:

This could lead to a meanwhile bullish correction depending on the outcome of the FOMC minutes and sentiment surrounding the Fed.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.