Gold Price Forecast: Megaphone advocates XAU/USD volatility above $1,690, US data, Fed in focus

- Gold price remains sidelined after falling the most in two months.

- Mixed sentiment allows XAU/USD bears to take a breather after US CPI-led slump.

- Megaphone formation signals further widening of bearish trend amid hawkish Fed bets, recession woes.

Gold price (XAU/USD) seesaws around $1,700 as bears take a breather after a volatile day, thanks to the US inflation data. Mixed concerns over inflation and China join a light calendar to portray the metal’s inaction during early Wednesday morning in Europe.

Having witnessed the biggest daily fall in gold, as well as the heaviest stock rout in two-year, mainly due to the US Consumer Price Index (CPI) data, US President Joe Biden mentioned, “I'm not concerned about the inflation report released today.” The US leader also added that the stock market does not always accurately represent the state of the economy.

Also challenging the XAU/USD bears are hopes of more stimulus from China and expectations of a solution to the European energy crisis. In that regard, European Union (EU) Chief Ursula von der Leyen’s plans for the energy price capping and US Trade Representative Katherine Tai’s EU visit to meet European Commission Vice President Valdis Dombrovskis also favor cautious optimism.

Alternatively, hawkish hopes of the Fed and headlines surrounding Taiwan exert downside pressure on the metal prices. Reuters mentioned that Taiwan hosts multiple foreign lawmakers in Washington to push China sanctions while the Financial Times (FT) said that the US lawmakers are bracing for a vote on financing arms for Taipei.

Amid these plays, the US Treasury yields dribble around the multi-day top marked the previous day while S&P 500 Futures print mild gains at the latest.

Moving on, the gold price may witness inaction ahead of the US Producer Price Index (PPI) and Thursday’s August month US Retail Sales. Above all, next week’s Federal Open Market Committee (FOMC) will be a crucial event for the pair traders to watch for clear directions.

Technical analysis

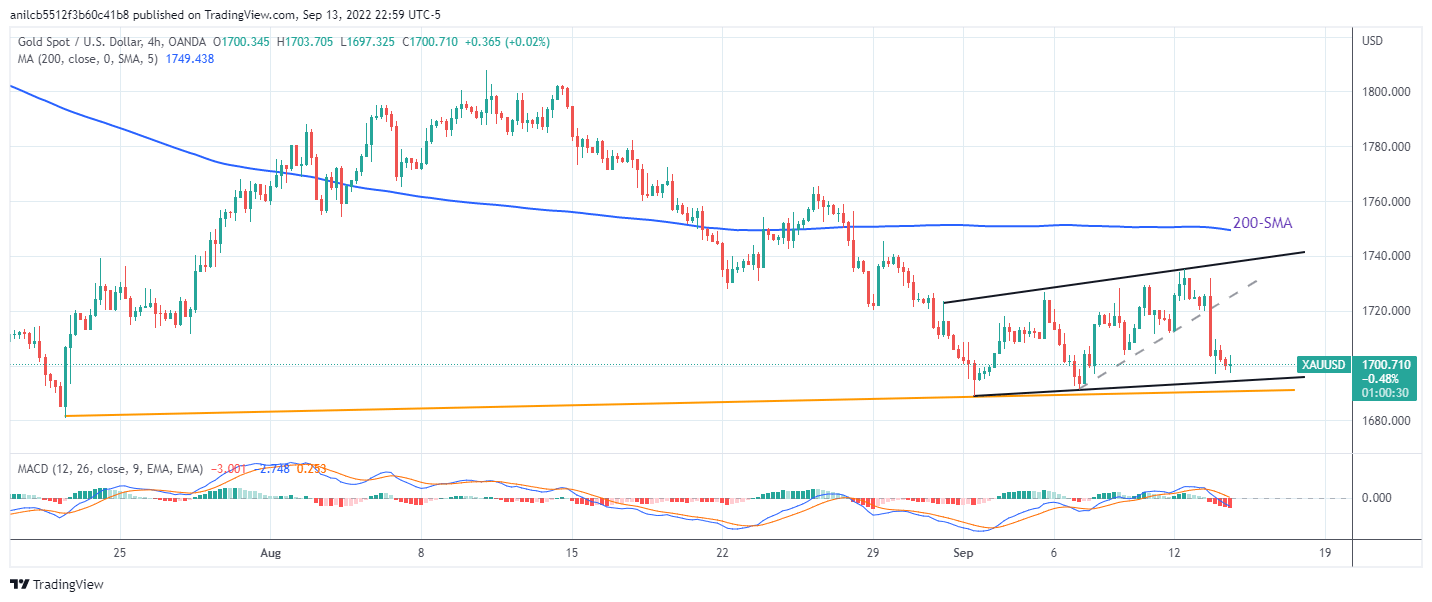

Gold price holds lower ground inside a two-week-old trend widening formation called megaphone.

That said, the bearish MACD signals suggest the quote’s further weakness but the lower line of the stated megaphone and an upward sloping support line from July 21, close to $1,695 and $1,690 in that order, could restrict the short-term downside of the metal.

Alternatively, recovery moves may initially aim for the immediate support-turned-resistance line, around $1,725, ahead of challenging the technical formation’s upper line near $1,738. Also acting as an upside filter is the 200-SMA surrounding $1,750.

Overall, XAU/USD is likely to remain on the bear’s radar even if the downside room appears limited.

Gold: Four-hour chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.