Gold Price Forecast: Bears back in town as markets digest FOMC, USD goes bid

- Markets offer a mixed reaction to the Minutes and gold is steady.

- The US dollar is on the verge of a critical move towards daily resistance.

- Gold's bearish Doji and the confluence of resistance leaves the bias bearish.

Tokyo session update:

The price of gold is sat in a tight range and slightly down in the day by 0.13% as the US dollar perks up towards a critical resistance zone on a longer-term basis, reversing the sell-off post-FOMC minutes.

The greenback retreated from 4-1/2-month highs to trade little changed on Wednesday after minutes of last month's Federal Reserve meeting suggested there was no consensus about the timing of a tapering of its asset purchases under the US central bank's quantitative easing program.

The minutes also said most participants "judged that the Committee's standard of 'substantial further progress' toward the maximum-employment goal had not yet been met."

The lack of urgency sent US yields a touch lower along with the greenback.

US yields ended around flat on the day. The 2-year government bond yields traded at 0.22%, and 10-year government bond yields traded at 1.26%.

However, in recent trade, the DXY has perked up with the 93.43 critical level on sight as the price trades at 93.324 at the time of writing.

Gold bears looking for a break of 1,780 for the coming hours.

End of update.

The minutes of the prior Federal Open Market Committee meeting for July 27-28 have been released and have shown that officials felt recent inflation readings likely temporary but most they feel it could be appropriate to start tapering the asset purchases this year.

In response, the US stock market is sinking towards the lows of the day, US yields and the US dollar are being pressured with the greenback moving in on the psychological round 93.00 level in the DXY and gold prices are supported.

At the time of writing, XAU/USD is trading at $1,784 and has been holding in a range of between $1,777.43 the low and $1,7933.83 the high.

It is a mixed reaction to minutes that, on one hand, underpin the hawkish message at the Fed and the need to monitor risks in economic data that could lead to higher and longer than expected inflation.

On the other hand, the minutes outline the importance of ensuring that there should be no link between tapering and the timing of rate rises:

''Many participants noted that, when a reduction in the pace of asset purchases became appropriate, it would be important that the Committee clearly reaffirm the absence of any mechanical link between the timing of tapering and that of an eventual increase in the target range for the federal funds rate,'' the minutes stated.

However, the minutes do not signal that there was an imminent need to taper which potentially leaves the Jackson Hole as the market's wild card still; It is still no clearer if a taper announcement will be made at the event.

''Fed officials have increasingly been pointing to tapering starting before too long, with many hawks making the case for a formal tapering announcement in September. However, the hawks appear to be a vocal minority with many more, most likely including the Chair, favouring waiting until at least November before announcing taper,'' analysts at TD Securities explained.

The trajectory of the US dollar and yields around the event will be critical for the precious metals markets and a headwind for the bulls in bullion.

For the time being, however, the US dollar can remain bid against most major currencies due to the concerns about the global economy that has forced investors to seek safety in the greenback.

Additionally, the greenback has been thrown a lifeline in the recent dovishness at the Reserve Bank of Australia as well as the Reserve Bank of New Zealand which underscores the divergence between the Fed and other global central banks.

The US dollar smile theory is still something that is very much in play and the DXY is embarking on a critical level of technical resistance confluence on the longer-term, charts, a break of which could lead to some serious upside for the greenback.

Meanwhile, analysts at TD Securities argue that ''the balance of risks for the complex may have been altered as the latest positioning data highlights that the technical breakdown fueled a substantial accumulation of shorts, with central banks and physical buyers likely to have been on the bid.''

''In response to the sharply stronger price action thereafter, CTAs are likely to cover shorts in gold, creating additional upside flow.''

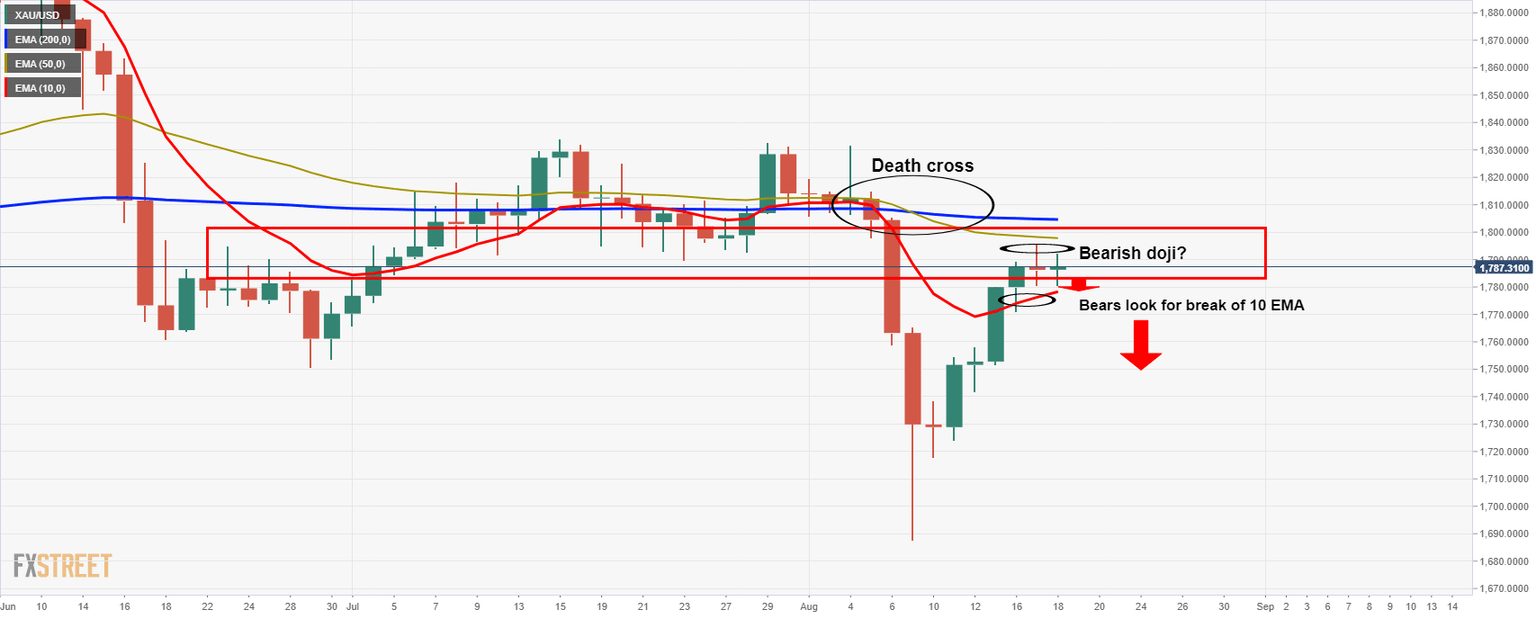

Gold technical analysis

The death cross is regarded as a bearish moving average formation with the 50 moving below the 200 DMA.

However, since October 2001, selling gold after a death cross has failed more than it has succeeded.

Meanwhile, the Bearish Doji Star appears in an uptrend and belongs to the bearish reversal patterns group.

The prior day's Doji candle formation, as well as today's forming Doji, could be the catalyst for supply in the coming days.

However, traders will be looking for additional confirmation such as a subsequent break below the 10 EMA and confluence of the 4-hour support of 1,770.

Meanwhile, a break of resistance opens risk back into the 1,800s.

However, failures will likely lead to a downside continuation of the broader bearish trend to target the 50% mean reversion and the confluence of the 200-day Smoothed MA near 1,755 and then 1,677 daily swing lows will be key in this regard.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.