Gold Price Forecast: XAU/USD cheers USD weakness above $1,800

- All eyes turn to the US data this week to determine the likely timings of a taper, or not to taper.

- The US dollar will depend on this week's calendar in the US and so too will the price of gold.

- On the upside, a break of the 1,840s opens risk to $1,870. On the downside, bears look to clear below $1,769.

Update: Gold (XAU/USD) takes the bids to refresh intraday high around $1,815, up 0.20% on a day, during early Tuesday.

After a sluggish start to the day, not to forget downbeat weekly opening, gold regains upside momentum as the US Dollar Index (DXY) fails to extend the previous day’s rebound from a two-week low, down 0.07% intraday around 92.64 at the latest. In addition to the greenback weakness, cautious optimism in the markets and mildly bid S&P 500 Futures, not to forget a three-day downtrend of the US 10-year Treasury yields, also favor gold buyers of late.

Behind the moves could be the recently easing virus numbers from Asia–Pacific, after refreshing the multi-day tops, as well as China’s downbeat activity numbers that back the need for easy money policies.

However, gold traders remain cautious ahead of Friday’s US jobs report as Fed Chair Jerome Powell announced tapering but refrained from details and booster investor sentiment on Friday.

The price of gold is sitting at $1,810 in early Asia following an overnight down day of some 0.38%.

XAG/USD had travelled between a low of $1,807.78 and $1,823.27 highs.

The US dollar remains subdued also, following on from a virtual annual Jackson Hole Symposium 2021 on Friday.

DXY, an index that measures the US dollar against a basket of six major rival currencies, suffered an outside down day on Friday due to a more dovish than expected rhetoric from the Fed's chairman, Jerome Powell.

There was a long build-up to Friday's speech and there was anticipation in the markets for more clues of the timings of a taper of the Fed's Quantitative Easing.

However, nothing new came from the event which resulted in an unwinding of additional speculative long US dollar positions, at least in the spot market.

The main takeaway, which risk assets cheered, came from Powell's explicit pronouncement of the disconnect from QE tapering and eventual interest rate rises.

Powell stated that “the timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff”.

As a consequence, the index is now on track to test the August 13 low near 92.471 with a low on Monday scored at 92.598.

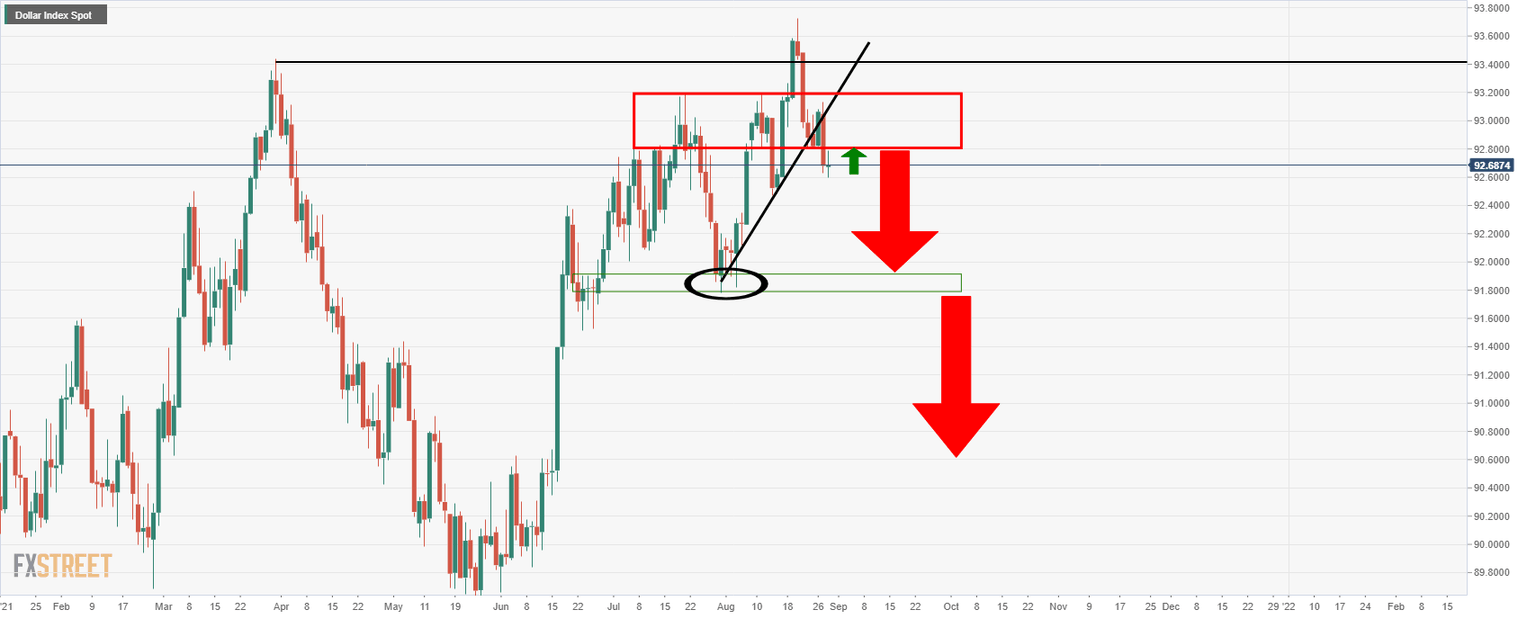

A break below would set up a test of the July 30 low near 91.782:

(Daily chart)

Meanwhile, gold speculative bulls will be positioning for more to go to the index's downside considering the outcome of the speech and considering how speculators increased their net long US dollar positions in the prior week.

According to calculations by Reuters and US Commodity Futures Trading Commission data released on Friday, the value of the net long dollar position jumped to $8.50 billion in the week ended Aug. 24, compared with a net long of $1.06 billion the previous week.

This was the largest long position since March 2020.

Meanwhile, the week ahead will be critical in respect to the Fed chair's opinions.

The Nonfarm Payrolls will be the highlight.

Chair Powell made very clear, again, that while the Fed has probably got to the point where “substantial further progress” has been made on inflation “we have much ground to cover to reach maximum employment”.

Powell warned in his Jackson Hole speech that an “ill-timed policy move unnecessarily slows hiring and other economic activity and pushes inflation lower than desired”. In an environment of “substantial” labour market slack, this could be “particularly harmful”.

''With Chair Powell taking a less cavalier attitude to taper than some of his FOMC colleagues, we look for the USD to trade with a softer tone into the upcoming payrolls report which we expect will disappoint consensus,'' analysts at TD Securities said.

''That said, dips in the dollar should be shallow and well-marked; in the DXY, we think the post-June Fed 'range' lows near 91.50/00 should be solid support.''

The lead into Friday's jobs data may well also be key.

Wednesday's Manufacturing PMIs as well as the ADP jobs report and then Jobless Claims also have the potential to stir up volatility before Friday's showdown.

''If the outlook changes and the U.S. economy slows significantly, then it would be a likely game-changer for the dollar,'' analysts at Brown Brothers Harriman warned.

''The Fed would have no choice but to adjust its expected tapering path significantly. Yet even then, the dollar may hold up better than expected since a US recession would likely be part of a broader global downturn. It all goes back to relative performances.''

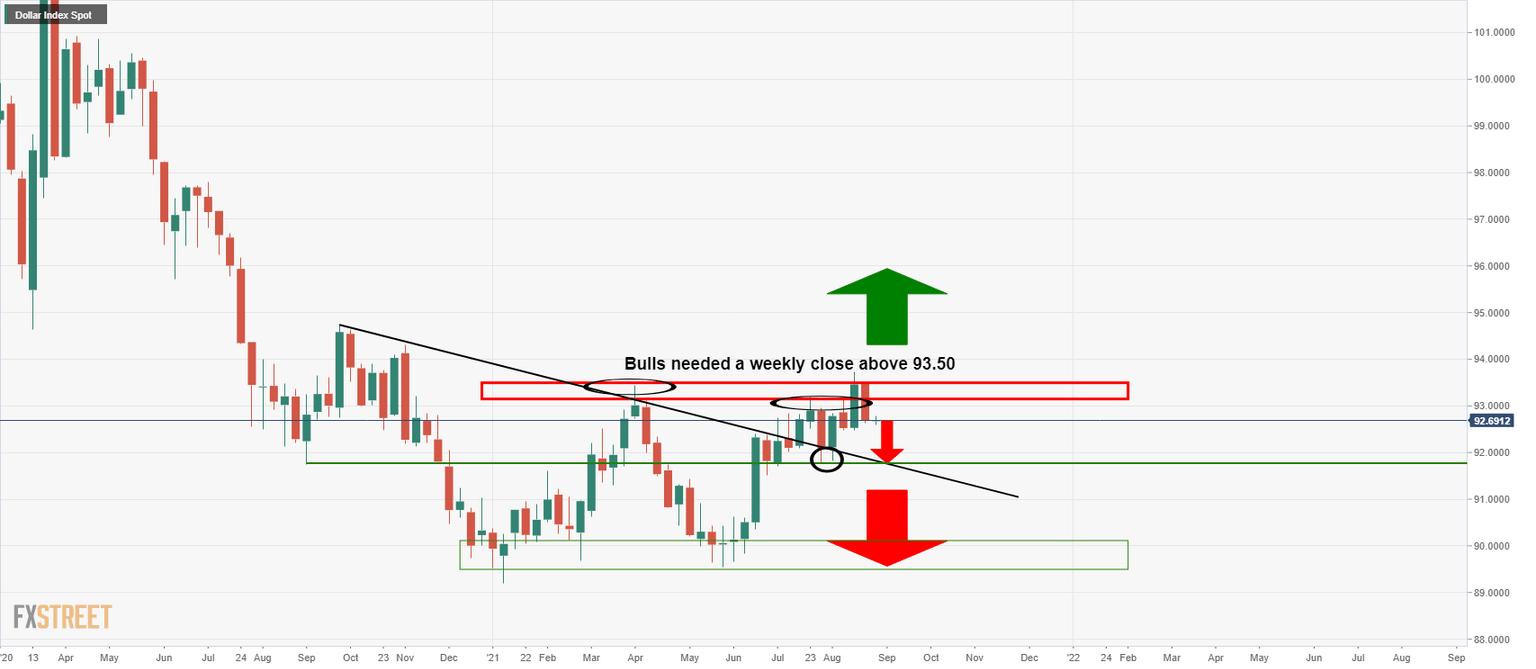

Should the data really disappoint, the DXY could be looking into the abyss from a longer-term perspective:

This would especially be true if the European Central Bank and the Fed be seen to be converging.

ECB’s Philip Lane was concrete at the Jackson Hole, basically, promising to calibrate the QE program to financial conditions BOTH in an upwards and in a downwards direction.

This currently means that the recent new all-time lows seen in EUR real rates could be used as an argument to tone down PEPP-purchases, potentially as soon as September.

Should such sentiment grab the front pages and be construed as the equivalent of a taper, the US dollar would be expected to struggle vs the euro, for which makes up almost 58 per cent (officially 57.6%) of the basket.

Gold technical analysis

Technically, the price of gold, while above 1,805, is now in bullish territory and eyes a run to test the 1,834s.

On the downside, gold bears would be in the clear below 1,769.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.