Gold price dips as US Dollar soars ahead of Fed policy meeting

- Gold price dips to $2,150 as investors turn cautious ahead of Fed’s interest rate decision.

- The US Dollar advances on hopes that the Fed could delay rate-cut plans.

- 10-year US yields fall moderately but hold strength on lower expectations for the Fed reducing interest rates in June.

Gold price (XAU/USD) drops to $2,150 in Tuesday’s European session as a strong US Dollar weighs heavily on the precious metal. The appeal for Gold remains subdued amid uncertainty ahead of the Federal Reserve’s monetary policy decision and the release of the quarterly dot plot on Wednesday.

The Fed is widely expected to keep interest rates unchanged in the range of 5.25%-5.50% for the fifth time in a row, but uncertainty over rate-cut projections keeps the Gold price on the tenterhooks. Investors are scaling back bets that the Fed could begin reducing interest rates in June, putting further downside pressure on Gold.

Meanwhile, 10-year US Treasury yields have fallen slightly to 4.32% but remain broadly strong on hopes that the first Fed rate cut, which is currently anticipated in June, will be delayed. Higher-than-expected consumer and producer inflation data are casting doubts among investors that this policy pivot will indeed occur in June or will be further postponed.

Daily digest market movers: Gold price drops sharply while US Dollar moves higher

- Gold price falls sharply to the crucial support of $2,150. Investors turn risk-averse towards bullions ahead of the interest rate decision by the Federal Reserve, which will be announced on Wednesday.

- The CME FedWatch tool shows that after the conclusion of the two-day meeting, the Fed will keep interest rates unchanged. Investors are eagerly awaiting the quarterly dot plot, which shows projections for interest rates over time by Chair Jerome Powell and other officials. The dot plot will signal any change in projections for rate cuts this year.

- December’s dot plot indicated that Fed officials are anticipating three rate cuts in 2024. If the Fed dials down rate-cut projections, the Gold price could face significant downside pressure. Currently, the CME FedWatch tool shows a 60% chance that at least three rate cuts will be announced by 2024. The chances for at least three rate cuts were slightly below 80% before the release of the hot consumer and producer inflation data for February.

- In addition to the dot plot, the Fed will also release economic projections for inflation and economic growth. An upbeat economic outlook would strengthen the appeal of the US Dollar. The United States economy has been performing better on the grounds of consumer spending and labor market than any other country in the Group of Seven (G-7) economies.

- The US Dollar Index (DXY), which measures the US Dollar’s value against six rival currencies, rises to 104.00 amid improvement in safe-haven bid.

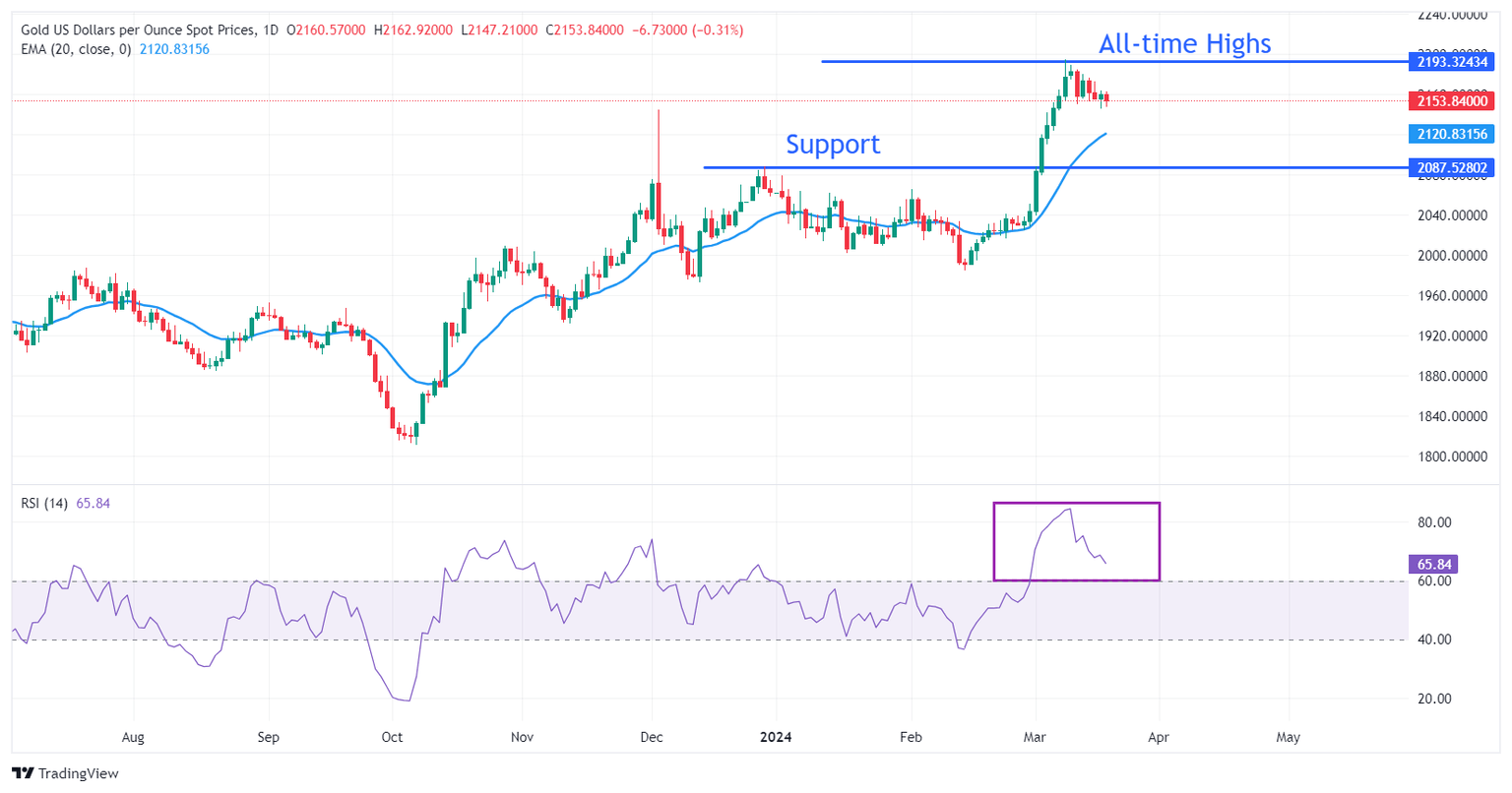

Technical Analysis: Gold price consolidates between $2,145-$2,165

Gold price faces pressure as the upside remains limited amid caution ahead of the Fed’s decision on interest rates. The precious metal trades broadly sideways, ranging between $2,145 and $2,165, and it is likely to break the consolidating trend after the Fed’s policy meeting.

The precious metal may continue its downside towards the 20-day Exponential Moving Average (EMA) at $2,097. After a wide divergence, the asset tends to face a mean-reversion move, which results in a price or a time correction.

On the downside, December 4 high near $2,145 and December 28 high at $2,088 will act as major support levels.

The 14-Relative Strength Index (RSI) retraces from its peak near 84.50, although the upside momentum is still active.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.