Gold price could be on the verge of a significant correction, Fed meeting will be decisive

- Gold price falls back into the hands of the bulls following the ECB events.

- XAUUSD is now at a critical juncture in the bearish cycle where a significant correction could play out.

- The Federal Reserve meeting will be an important event for rate and gold traders.

Gold price is higher by 1% in midday New York trade and has recovered from the fresh lows of $1,680.93 after sliding from $1,718.39 to Thursday's highs. The yellow metal was pressured even as the US dollar weakened early on Thursday, with the ICE dollar index last seen down below the 107 figure but in the middle of the day's range of 106.415 and 107.323. The day has been turbulent due to the European Central Bank that raised interest rates for the first time in more than a decade as it seeks to tame inflation.

ECB lifts the lid on rates, gold price rallies

The ECB took the well-telegraphed plunge and raised rates. Seeking to tame inflation, the ECB had for weeks flagged a 25 basis point hike, until earlier this week, when sources told Reuters the central bank was weighing a bigger move. This came to fruition on Thursday when the central bank hiked by 50bps and also announced a bond protection plan, called the Transmission Protection Instrument (TPI), that is designed to cap the borrowing costs across the region in an effort to help heavily indebted countries like Italy, whose coalition government fell after the resignation of Prime Minister Mario Draghi. The outcome for XAUUSD was bullish despite the two-way trip in the euro and US dollar. Gold rallied from the day's lows and the bulls committed to the upside, buying the dip throughout the hours ensuing the ECB event.

Read more: Eurozone rate hike: A big step for the ECB, but a small help for the euro

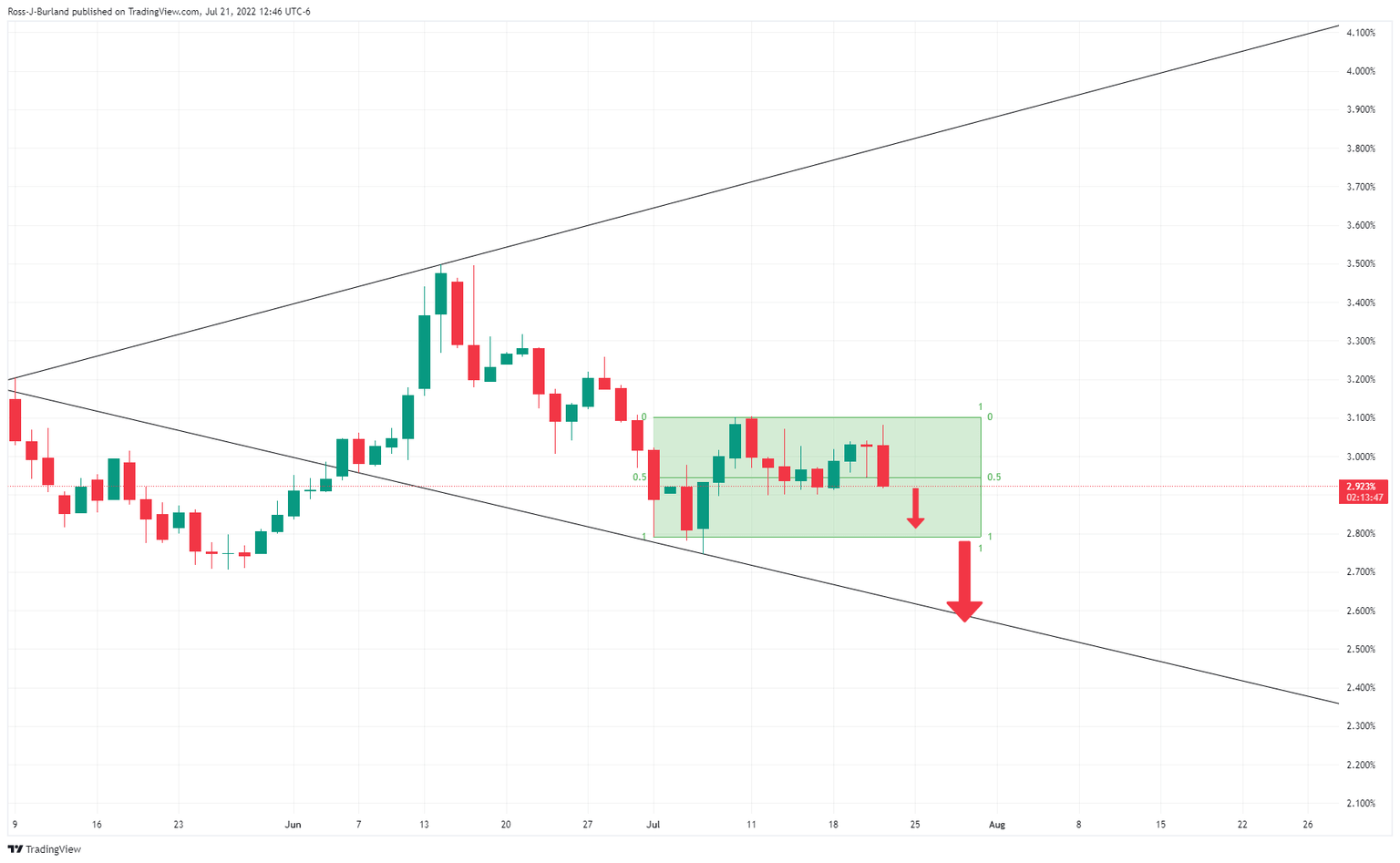

US bond yields fall in wake of ECB hasty normalization

Bullish for the gold price, US bond yields fell with the benchmark 10-year note below 3% after the first interest rate hike in 11 years by the ECB as concerns about runaway inflation trumped worries about growth. The two-year US Treasury yield was down to a low of 3.121% while the yield on 10-year Treasury notes fell to 2.917% which is back into the middle of the range for July as investors get set for the Federal Reserve interest rate decision on July 27 in which it is largely expected to hike rates by 75 basis points.

10-year yield broadening formation, bearish bias

Fed expectations

Fed chairman, Jerome Powell

For the Fed, which meets next Tuesday and Wednesday, many are of the opinion that the central bank will hike by 75 bps, especially now that the ECB rose rates by 50bps. The fed would also be expected to continue hiking rates by at least 50 bps hikes at each meeting in the remainder of the year. This would raise the target range for the federal funds rate to 3.75-4.00% by 2023 which is more than indicated by the FOMC’s dot plot (3.4%) and futures markets (3.55%).

''We think that the Fed is still underestimating the persistence in inflation, and has yet to acknowledge that a wage-price spiral has already started in the US,'' analysts at Rabobank argued. ''US CPI inflation rose to 9.1% in June and its core measure stands at 5.9%. At the same time, nominal wages have risen by 6.7% year-on-year in July according to the Atlanta Fed’s wage growth tracker. This does suggest that the wage-price spiral that the Fed still hopes to avert, is already here.''

Gold price outlook, all things considered

For the gold price, while today's surprise 50bp hike from the ECB has helped prices pare their losses as the USD weakens, analysts at TD Securities argue that the liquidation vacuum in gold will persist. ''Risks for a significant capitulation event are rising,'' the analysts said, and this, they say, is because ''prop traders have overtaken money managers as the dominant speculative force in gold markets.''

''Today, the behemoth position held by the average prop-trader is near twice its typical size, suggesting a substantial amount of pain is reverberating across gold markets as prices revert lower amid the most hawkish Fed regime in decades. Given this massive speculative length was established in 2020, and does not appear to be associated with a Fed or inflation narrative, this complacent position appears particularly vulnerable. Weakening prices may fuel additional selling into a liquidation vacuum, with every participant from Shanghai traders to ETF holders selling their length.''

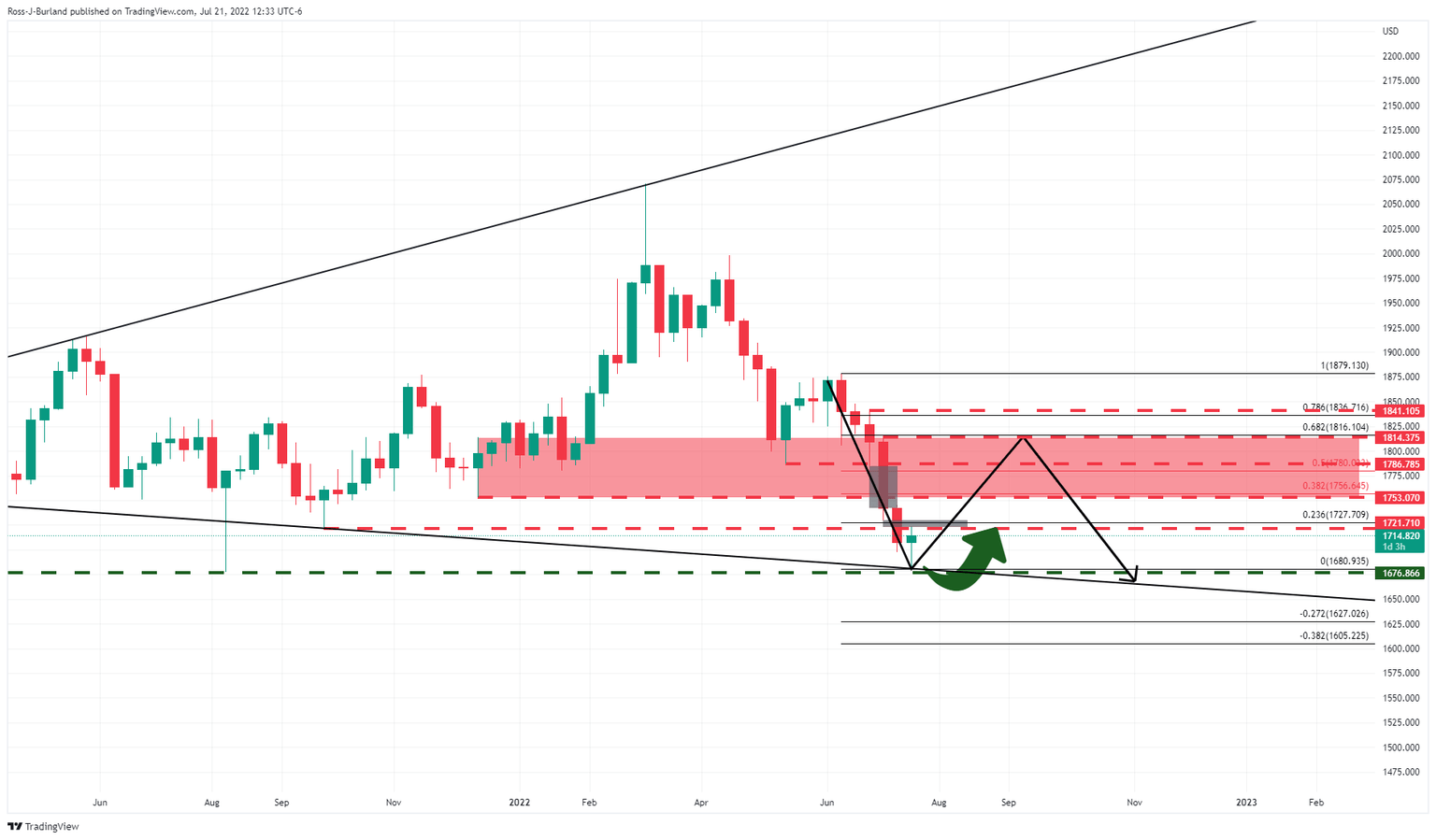

Gold price technical analysis

Gold price analysis, from a longer-term perspective, reveals the prospects of a correction from the weekly broadening formation's lower boundary as illustrated below:

XAUUSD has fallen a handful of dollars shy of the $1,677 pivot lows and bulls are moving in which could leave this week's candle as a bull hammer. A move into the grey areas as dawn on the chart above, which are spaces of price imbalance, will open the risk of a significant continuation higher triggering a series of buy stops along the way.

A 50% mean reversion guards the golden 61.8% ratio on a break of the psychological $1,800. On the other hand, a break of the said picot lows of $1,677 could play out first of all which could likely;y cause a flurry of volatility considering the number of orders that are sitting below.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.