Gold Price Analysis: XAU/USD yearns for acceptance above $1735 ahead of US data

- Gold treads water as a rise in Treasury yields cap the upside attempts.

- US dollar regains poise, tracking yields higher amid cautious mood.

- XAU bulls need to find a strong foothold above $1735, US data in focus.

Gold (XAU/USD) trades on the defensive ahead of the European open, wavering back and forth in a $7 range around $1735.

The upside attempts in the yieldless gold appear limited by the renewed buying interest seen around the US Treasury yields, which propels the dollar back towards the four-month highs across its main competitors.

After a brief corrective stint, the US rates have resumed their uptrend, thanks to the expectations of the Biden administration’s infrastructure spending plans. Meanwhile, encouraging comments from US Treasury Secretary Janet Yellen on the bond market also helped revive the bullish bias in the returns on the market.

The strength in the greenback could be also attributed to the rising haven demand, as surging covid cases in Europe prompt investors to seek shelter in the buck. Looking ahead, gold could continue its range play, awaiting fresh directional break from the key US economic data, including the US GDP revision, Core PCE Price Index and the weekly Jobless Claims. Markets will also pay attention to a slew of Fedspeak for fresh hints on the inflation and policy outlook.

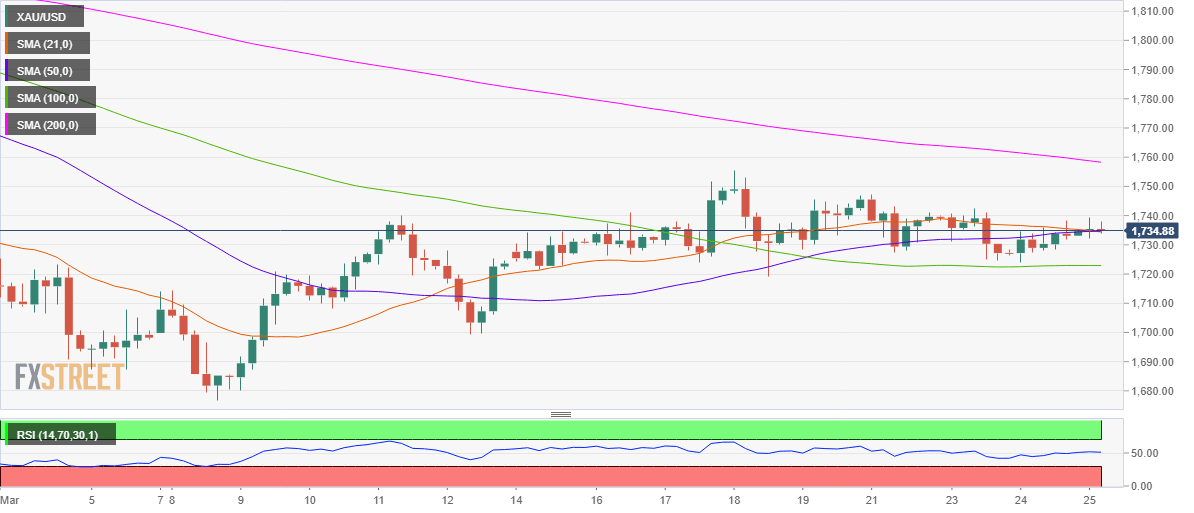

Gold Price Chart: Four-hour

From a near-term technical perspective, gold needs acceptance above the $1735 level, which is the confluence of the 21 and 50-simple moving averages (SMA) on the four-hour chart.

The next barrier for the XAU bulls would be the daily high at $1739, beyond which the weekly top of $1747 could be in sight.

The Relative Strength Index (RSI) trades flat just above the midline, keeping the buyers hopeful.

If gold traders fail to find a sustained footing above the $1735 level, sellers could return, targeting the 100-SMA support at $1723. The next downside cushion for the XAU bulls is seen at $1717, the previous week low.

Gold: Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.