Gold Price Analysis: XAU/USD set to challenge $1,800 as investors sour on Gold

- Gold is extending declines on moody markets going risk-off.

- Interest rate concerns driving the price of bullion as Treasury yields climb.

- Gold spot prices set to challenge eight-month lows if downside resumes.

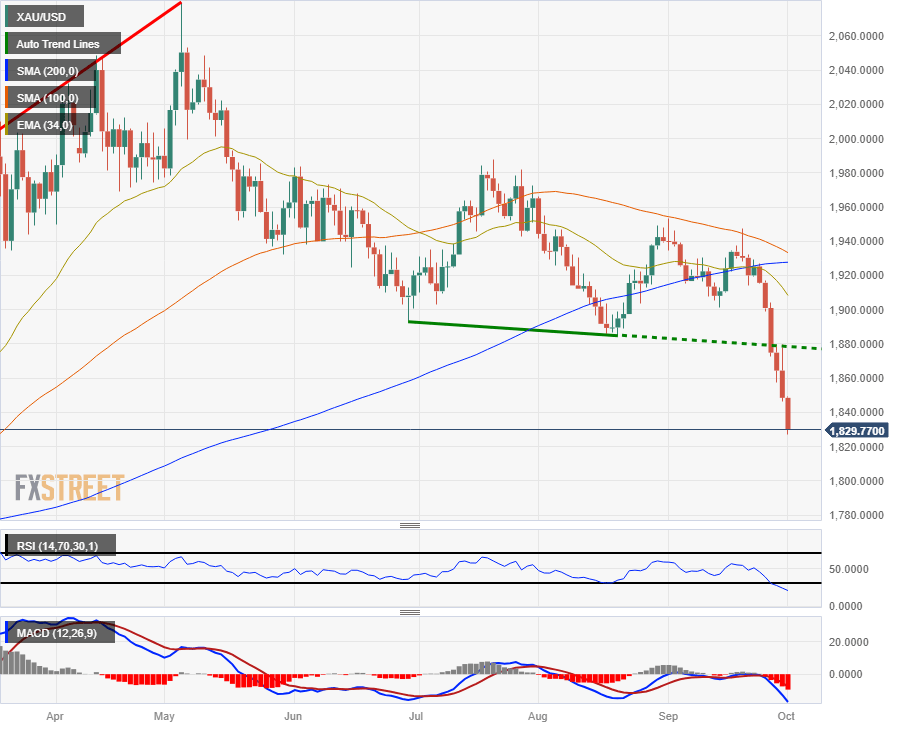

The XAU/USD is down $20 per ounce for Monday, declining to $1,830.00 on the charts as Gold continues its decline. Gold spot prices are set to close in the red for the sixth consecutive trading day, and the XAU/USD has closed flat or bearish for nine of the last ten daily candles.

Gold remains significantly oversold on the charts as investors flock to safer havens in the face of rising interest rates and US Treasury yields consistently tapping into new highs.

Gold traders will be quick to note that much of the downside for XAU/USD is largely based on market concerns of a global economic slowdown, and if broader market sentiment is able to shrug off the jitters, Gold spot could easily see a rebound.

While the Federal Reserve (Fed) is set to hold interest rates higher for longer, it would take a notable appreciation in inflation expectations moving forward to drive the Fed into a new rate hike cycle, and investors will be hoping that a lack of upside shifts in the Fed's rate expectations, or the "dot plot", will cap further losses for the precious metal.

XAU/USD technical outlook

Gold spot prices are firmly bearish on Monday, down 1% from the day's open near $1,830.00 and the XAU/USD has so far entirely failed to mark in any kind of rebound after last Friday's decline from $1,880.00.

Daily candlesticks sees Gold so bearish that it is firmly breaking technical indicators: the Relative Strength Index is at its most oversold since 2018, with a reading of 20.55, and the Moving Average Convergence-Divergence (MACD) histogram is at its lowest reading since the first quarter of 2023.

Gold spot has declined over 6% from September's peak at $1,947.00, and if bulls fail to stage a successful relief rally from here it will see the XAU/USD heading into red territory for the year, below the year's floor of $1,804.76.

XAU/USD daily chart

XAU/USD technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.