Gold Price Analysis: XAU/USD risks falling to $1,765 as Fed fear grows– Confluence Detector

- Gold has been drifting away from $1,800 as Fed fear grips markets.

- The Confluence Detector is showing XAU/USD's battle lines.

- Gold Weekly Forecast: XAU/USD looks to extend rebound ahead of FOMC Minutes

Will the Federal Reserve announce it will taper down its bond purchases in its next meeting? Gold bulls dread the moment in which the world's most powerful central bank begins printing fewer dollars. Ahead of the critical meeting next month, the Fed publishes minutes from its previous decision, and that could rock markets. Concerns about covid are also weighing on the mood.

How is XAU/USD positioned on the charts?

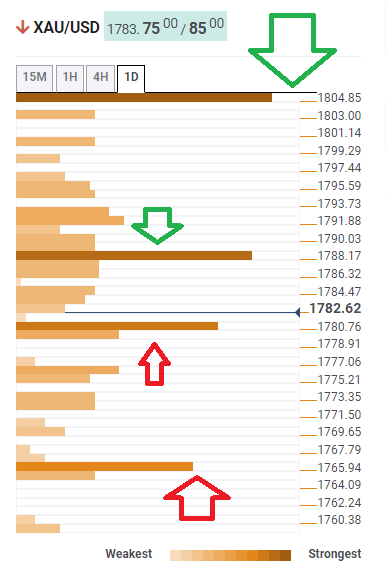

The Technical Confluences Detector is showing that gold is hovering above critical support at $1,780, which is the convergence of the previous week's high, the previous daily low, the Pivot Point one-day Support 1, and more.

If the yellow metal fails to cling onto that level, it could extend its falls until $1,765, which is a cluster of lines including the PP one-day S3 and the previous month's low.

Resistance is at $1,788, which is the confluence of the Simple Moving Average 200-15m, the Bollinger Band 1h-Middle, the SMA 10-1h, the SMA 5-4h and more.

Further above, the upside target in case the Fed is dovish, awaits at $1,804, which is where the Fibonacci 161.8% one-day hits the price.

XAU/USD resistance and support levels

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.