- Gold is breaking higher as the US dollar rebound loses steam.

- The US Treasury yields retreat ahead of the Retail Sales release.

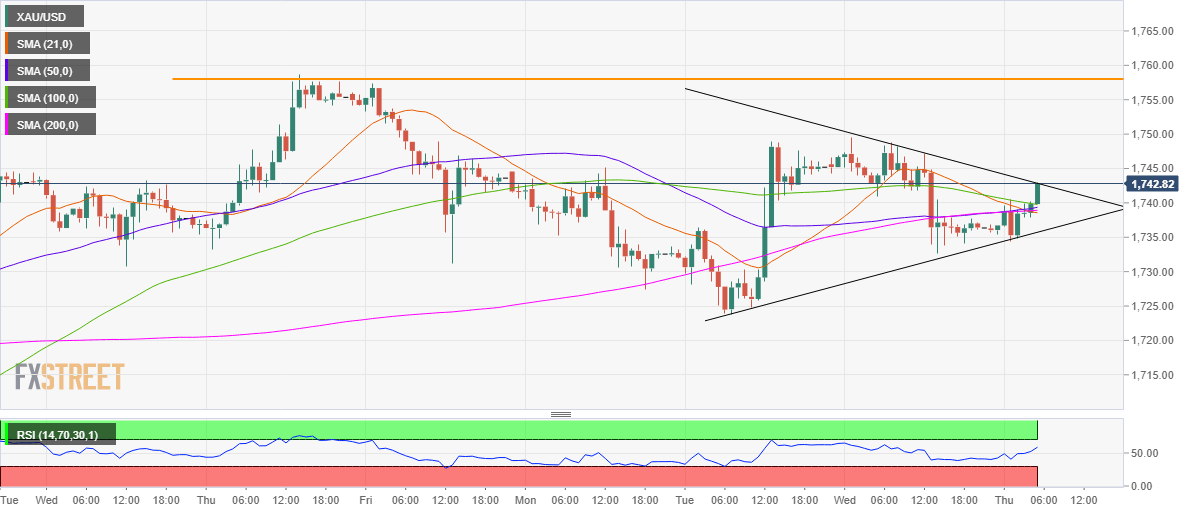

- XAU/USD is teasing symmetrical triangle breakout on the 1H chart.

Gold (XAU/USD) is extending its rebound from Wednesday’s low of $1733, looking to recapture the $1750 psychological barrier ahead of the all-important US Retail Sales report.

The renewed uptick in gold is mainly driven by a pause in the tepid bounce staged by the US dollar earlier in the Asian session. Further, a retreat in the US Treasury yields amid a cautious market mood also underpins the non-yielding gold.

Adding to it, the prospects of the US sanctioning the Russian debt tempers the appetite for riskier assets while benefiting the safe-haven gold. Meanwhile, ongoing US-China tensions also render supportive to the yellow metal.

Gold: Technical outlook

Gold is on the verge of confirming a symmetrical triangle breakout on the hourly chart should the price close the candlestick above the falling trendline resistance at $1743.

If the upside break materializes, XAU bulls could attempt another run to recapture the $1750 psychological level, above which the horizontal trendline (orange) resistance at $1758 could be tested.

The Relative Strength Index (RSI) backs the case for additional upside, given that it points north at 58.84, as of writing.

Gold Price Chart: One-hour

However, if the bears manage to fight back control, the metal could fall back towards a critical confluence support area at $1739, comprising of the downward-sloping 100, 50 and 200-hourly moving averages (HMA).

The next relevant cap is seen at the rising trendline (triangle) support, currently at $1736.

A sustained break below the latter could trigger a triangle breakdown, opening floors for a test of the April 13 low of $1724.

Gold: Additional levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US FBI has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.