Gold Price Analysis: XAU/USD in stasis, impending death cross may be a bear trap

- The US dollar weakness fails to lift gold.

- An impending death cross may mark a major bottom.

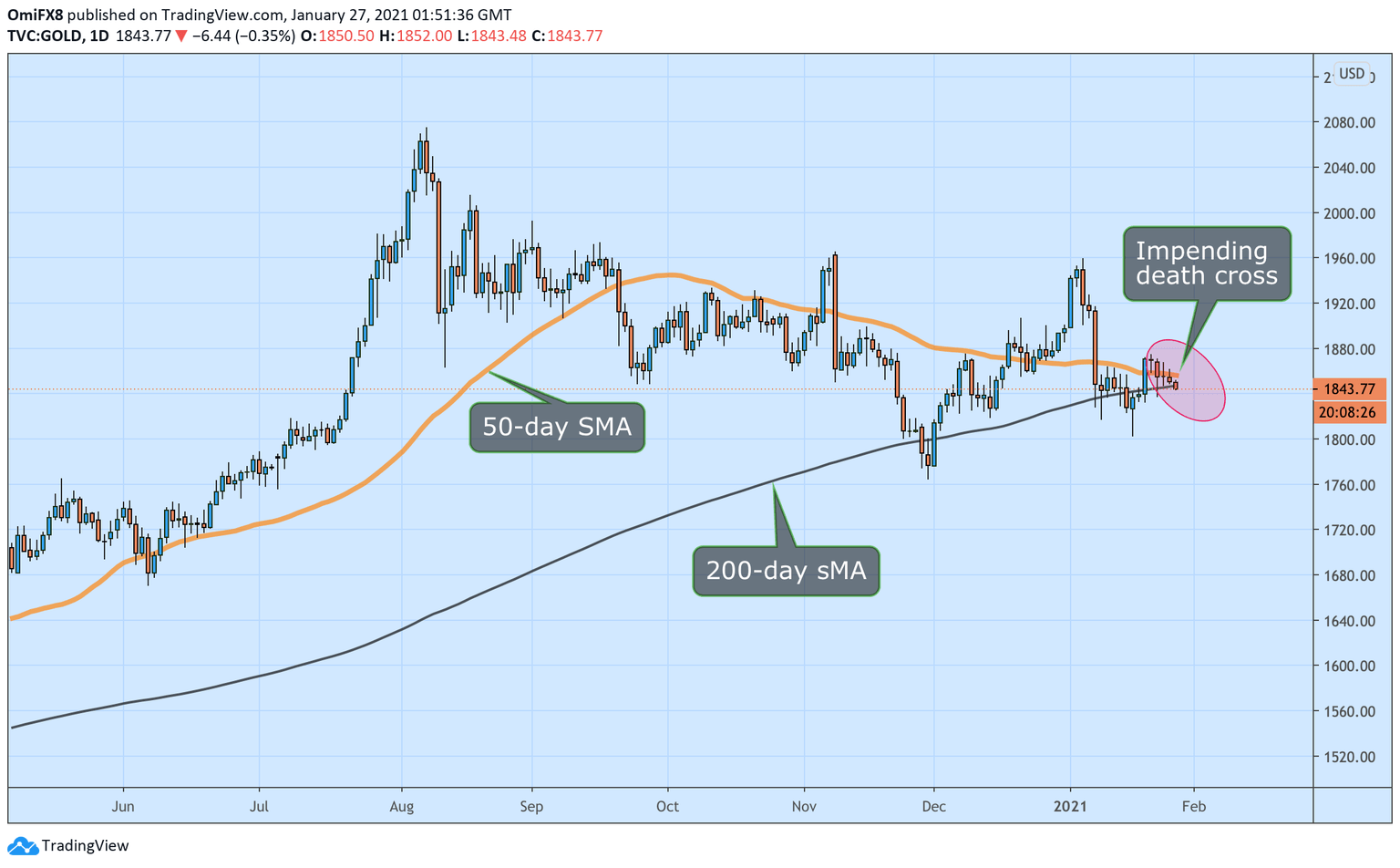

Gold lacks clear directional bias despite an improved risk appetite and weakness in the US dollar. The yellow metal's daily chart shows key averages are set to chart a bearish crossover.

At press time, gold is trading near $1,845 per ounce, having dropped by 0.24% on Monday.

The US President Joe Biden announced on Tuesday that his administration is boosting weekly vaccine supply, weakening the selling pressure in stocks, and pushing the anti-risk dollar lower. Additional bearish pressure likely emerged from the International Monetary Fund's upward revision of the 2021 global growth forecasts.

The dollar index, which tracks the greenback's value against majors, fell 0.27% to 90.27 on Tuesday and is trading flat near that level at press time. So far, however, the dollar weakness has failed to propel gold higher.

The bulls need quick progress, as the 50-day Simple Moving Average (SMA) is on track to cross below the 200-day SMA in the next couple of days. That would confirm a death cross, a long-term bearish indicator.

However, crossovers are lagging indicators, as SMAs are based on historical data and often mark major bottoms/tops. The metal's downtrend from the record high of $2,075 reached in August may bottom out with the impending death cross.

A move above the lower high of $1,875 created on Jan. 21 is needed to confirm a short-term bullish reversal. Meanwhle, the Jan. 18 low of $1,802 is the level to beat for the sellers.

Daily chart

Trend: Neutral-to-bullish

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.