Gold Price Analysis: XAU/USD faces healthy resistance levels on road to recovery – Confluence Detector

Gold consolidates the minor bounce so far this Tuesday, as the US dollar takes a beating from the risk-on market mood, fuelled by the US-China ‘constructive talks’ on the phase one trade deal. Coronavirus vaccine hopes also weigh on the metal’s safe-haven appeal.

The slowdown of inflows into the gold exchange-traded funds (ETFs) also emerges as one of the key drivers behind the bright metal’s recent weakness. Let’s take a look at how gold is positioned technically ahead of the US CB Consumer Confidence data, as markets await the Fed Chair Jerome Powell’s speech at Jackson Hole Symposium due this Thursday.

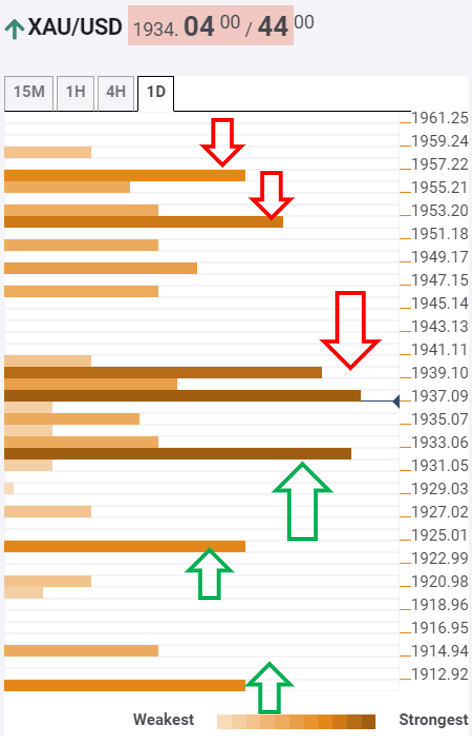

Gold: Key resistances and supports

The tool shows that gold is battling robust resistance at $1937, where the Fibonacci 23.6% one-week and SMA10 on four-hour intersect.

The next resistance awaits at $1939, the convergence of the Fibonacci 38.2% one-day and Bollinger Band 15-minutes Upper.

Acceptance above the latter could open doors towards the next significant barrier at $1952, the confluence of the Fibonacci 38.2% one-week and Bollinger Band one-hour Upper.

Further north, the critical resistance at $1956 needs to be taken out to re-ignite the buying interest in the spot. That level is Friday’s high.

To the downside, the immediate cushion is seen at the Fibonacci 23.6% one-month at $1932, below which the sellers will target $1924, the convergence of the intraday low and SMA200 four-hour.

The previous week low at $1912 will challenge the bears’ commitment if the downside pressure accelerates.

Here is how it looks on the tool

About the Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.