Gold Price Analysis: XAU/USD eyes 38.2% Fib retracement support

- Gold's weekly chart momentum studies have turned bearish.

- The metal risks falling to key support at $1,836.

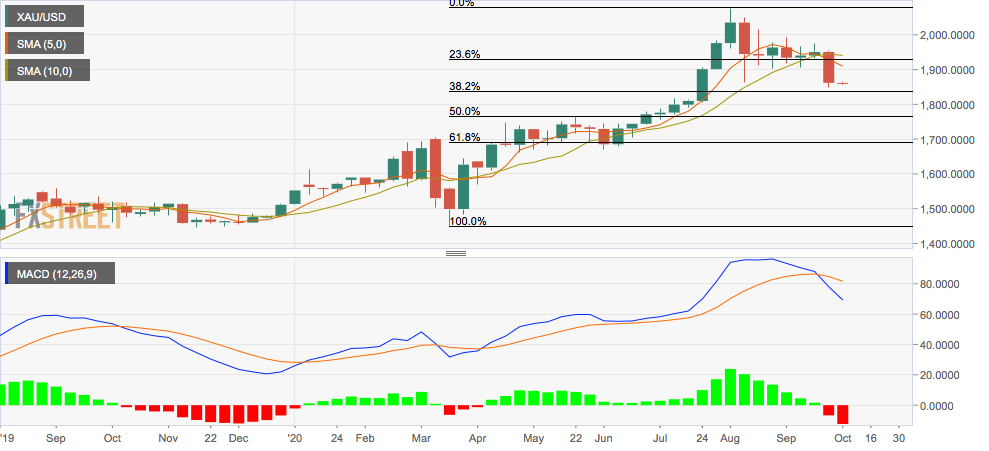

Gold looks set to extend its recent decline to $1,836 – the 38.2% Fibonacci retracement of March to August rally – as crucial technical indicators have rolled over in favor of the bears.

The weekly chart MACD histogram, an indicator used to gauge trend strength and trend changes, is now printing a deeper bar below the zero line, a sign of the strengthening of the downward momentum.

The 5- and 10-week simple moving averages have produced a negative crossover.

Further, last week's bearish marubozu candle shows bearish sentiment is quite strong.

As such, a drop to support at $1,836 looks likely. A close above the last week's high of 1,966 is needed to invalidate the bearish outlook.

At press time, gold is trading largely unchanged on the day at $1860 per ounce. Prices fell by over 4% last week as the US dollar's broad-based recovery rally gathered pace.

Weekly chart

Trend: Bearish

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.