Gold Price Analysis: XAU/USD eyes $1716 downside target ahead of US CPI – Confluence Detector

Gold (XAU/USD) has reversed the early bounce and resumes the two-day decline, as Treasury yields regain upside momentum amid rising inflation expectations. The renewed uptick in the yields strengthened the recovery in the US dollar, as all eyes remain on the critical US CPI release for March.

Gold’s fate will hinge on the US inflation numbers, as it will offer fresh insights on the strength of the economic recovery and the Fed’s monetary policy outlook.

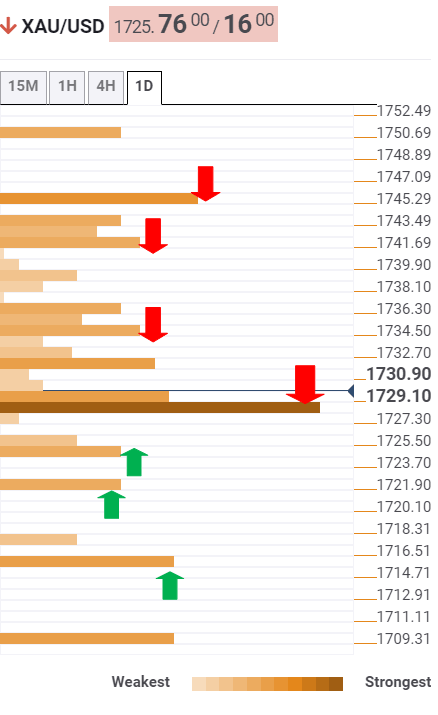

Meanwhile, let’s take a look at the key technical levels for trading gold.

Gold Price Chart: Key resistance and support levels

The Technical Confluences Detector shows that gold has breached the key support around $1730, the confluence of the previous day low, Fibonacci 61.8% one-month and SMA200 four-hour.

The next relevant support is seen at $1725, where the pivot point one-week S1 lies.

The previous week low at $1721 could offer additional comfort to the XAU bulls. A firm break below the last could trigger a sharp drop toward the pivot point one-day S2 at $1716.

Alternatively, recapturing the abovementioned $1730 hurdle is critical to reviving the upside momentum.

The XAU bulls will then need to battle out a dense cluster of resistance levels around $1735, where the Fibonacci 61.8% one-week coincides with the Fibonacci 38.2% one-day and SMA5 four-hour.

Further north, the intersection of the SMA100 one-hour and SMA5 one-day at $1742 will offer stiff resistance.

The previous day high at $1745 is likely to be a tough nut to crack for the XAU buyers.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.