Gold Price Analysis: XAU/USD edging closer to $1,800

- Gold prices remain under pressure in Wednesday trading.

- XAU/USD downside pressure is mounting from rising US Treasury yields.

- Gold traders awaiting a downturn in US economic data to help bolster XAU/USD bids.

XAU/USD briefly rose tp $1,830.65 on Wednesday before getting pushed back down to the floor and is currently waffling near $1,820.00.

Analysts have been lowering their year-end forecasts for spot Gold prices, with still-high expectations of higher-for-longer rates from the Federal Reserve (Fed).

US data came in mixed on Wednesday, with the ADP Employment Change numbers for September missing expectations and declining to 89K from the previous 180K (revised upwards from 177K); US ISM Services Purchasing Managers Index (PMI) numbers printed at-expectations, ticking down slightly from 54.5 to 53.6, but the reading still leaves the US economy in a healthy position, and markets are still pricing in a 24$ chance of one more rate hike from the Fed before the end of the year.

Gold bugs will be looking forward to Friday's US Non-Farm Payrolls (NFP) report, which is forecast to show labor figures declining from 187K to 170K. A miss for the headline figure could see Gold catch some much-needed lift on the charts, while a meet-or-beat scenario will see Gold continuing to flub.

Read more Gold analysis:

With a significantly higher-than-expected ISM manufacturing index and a surprisingly pronounced rise in job vacancies – there appears to be no end to the series of positive US economic data. Gold is under considerable pressure accordingly.

– Commerzbank

For as long as the market continues to expect a ‘soft’ landing in the US, no price recovery is likely to happen for now. After all, this would imply that it will take longer for any interest rate cut to be forthcoming.

– Commerzbank

Gold fell below the $1,870 key technical support level, which leaves the door open for even more declines.

– TDS

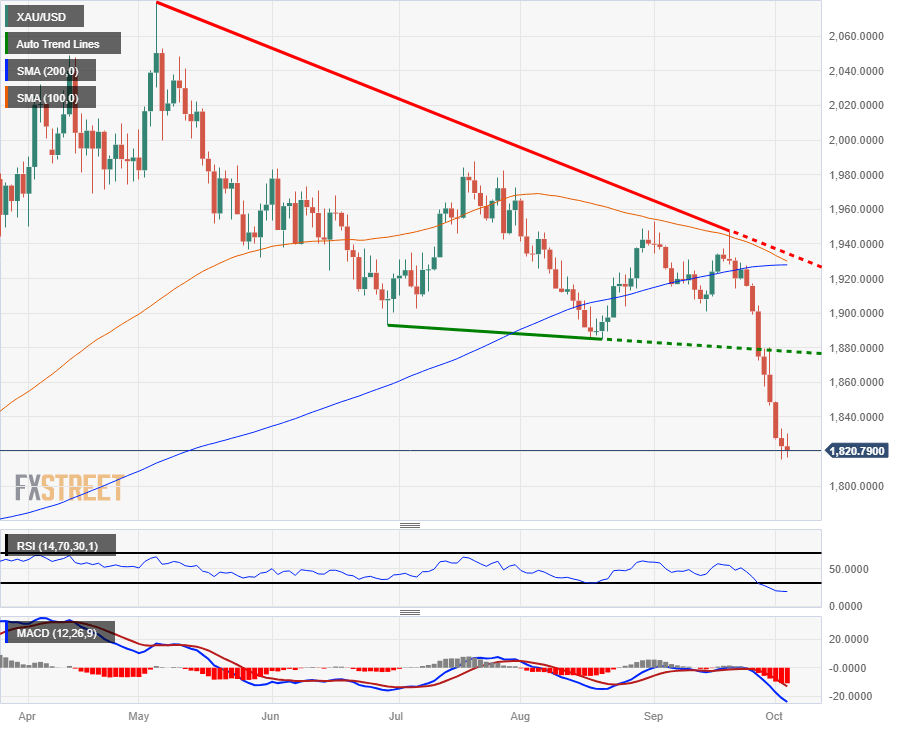

XAU/USD technical outlook

Gold has closed bearish for ten of the last eleven consecutive trading days, and is down 6.5% from the last swing high at $1,948.00. XAU/USD has seen downside momentum continue to accelerate, and is in the red around 12.5% from 2023's peak near $2,080.00.

One more bearish push will see Gold prices turn negative for the year, with 2023's bottom dangerously close to current price action near $1,809.46.

XAU/USD daily chart

XAU/USD technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.