Gold Price Analysis: XAU/USD extends sideways grind above $1,900

- A combination of factors assisted gold to gain some positive traction on Monday.

- Dovish Fed expectations, inflation fears acted as a tailwind for the commodity.

- The upbeat market mood capped any further upside amid holiday-thinned liquidity.

- The market focus now shifts to Friday's release of the US monthly jobs data (NFP).

Update, May 31: The XAU/USD pair registered its first weekly close above $1,900 since early January on Friday and started the new week in a relatively calm manner. Although gold managed to inch higher to $1,910 during the European trading hours, it struggled to preserve its bullish momentum in the second half of the day. With trading conditions thinning out due to the Memorial Day holiday in the US, XAU/USD seems to have gone into a consolidation phase and was last seen moving sideways around $1,905. Earlier in the day, the data from Germany showed that the Harmonized Index of Consumer Prices (HICP), the European Central Bank's preferred gauge of inflation, rose to 2.4% annually in May from 2.1% in April but this data failed to have a meaningful impact on gold's valuation.

Inflation fears, dovish Fed remain supportive

The US data released on Friday showed that the core PCE Price Index – the Fed's preferred inflation gauge – jumped 3.1% YoY in April. The reading was considerably above the central bank's nominal 2% target and validated the higher inflation narrative. Gold, which is extensively used as a hedge against inflation, drew its strength from rising inflationary pressure.

Investors now seem aligned with the Fed's stubbornly dovish view that the recent spike in prices should prove temporary. Hence, the latest inflation read did little to shift Fed rate hike expectations. This was evident from a fresh leg down in the US Treasury bond yields, which was seen as another factor that extended some support to the non-yielding gold.

The combination of factors acted as a headwind for the US dollar, which further inspired bullish traders and remained supportive. A weaker greenback tends to benefit dollar-denominated commodities, including gold. That said, the underlying bullish sentiment in the financial markets kept a lid on any further gains for the safe-haven XAU/USD, at least for the time being.

The market already seems to have digested US President Joe Biden’s proposed $6 trillion budget plan for the fiscal year 2022 that was unveiled on Friday. Given that markets in Britain and the United States are closed for a holiday, relatively thin liquidity conditions further held investors from placing aggressive bets.

Focus shifts to Friday's NFP report

The major trigger for gold this week would be important US macro data scheduled at the beginning of a new month, especially the closely-watched US monthly jobs data. The popularly known NFP report is scheduled for release on Friday and expected to show that the US economy added 621K jobs in May. The unemployment rate is expected to edge lower to 5.9% during the reported month from 6.1% in April. Another blockbuster data could fuel speculations for an earlier than anticipated Fed lift-off and trigger a meaningful corrective slide for the gold.

Technical analysis

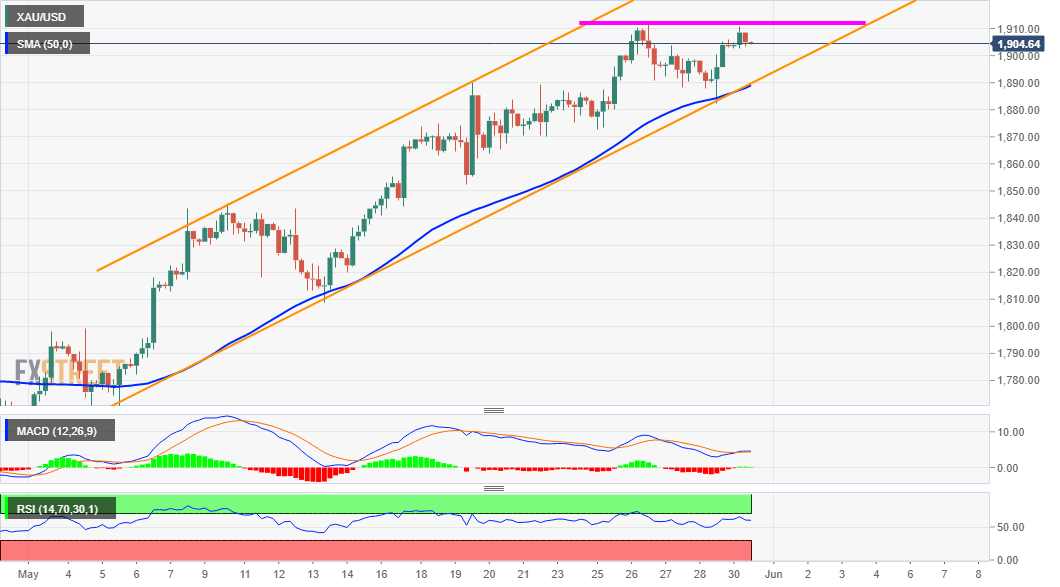

Looking at the technical picture, gold has been trending higher along an upward sloping channel since the beginning of this month. This points to a well-established short-term bullish trend and supports prospects for additional gains. That said, RSI (14) on the daily chart is flashing overbought conditions and seemed to be the only factor capping the upside for the commodity.

Hence, it will be prudent to wait for some strong follow-through buying beyond multi-month tops, around the $1,1912 region before positioning for any further gains. Gold might then accelerate the momentum further towards challenging the trend-channel resistance, currently around the $1,940 region. Bulls are more likely to pause near the mentioned barrier, which if cleared decisively should pave the way for an extension of the upward trajectory.

On the flip side, any meaningful slide below the $1,900 mark might still be seen as a buying opportunity and remain limited near the trend-channel support, around the $1,888 region. This coincides with 50-period SMA on the 4-hourly chart. Sustained weakness below might prompt some long-unwinding and accelerate the corrective fall further towards the $1,870-68 horizontal support. Some follow-through selling has the potential to drag gold towards the $1,852-50 support en-route the very important 200-day SMA, around the $1,845-44 region.

Previous updates

Update: Gold edged higher during the first half of the trading action on Monday and inched back closer to multi-month tops, albeit lacked any follow-through buying. The commodity was last seen trading around the $1,904-05 region, nearly unchanged for the day.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.