Gold Price Analysis: XAU/USD bears eyeing $1,827 as downside target – Confluence Detector

Gold has been able to stabilize after suffering a downfall late last week. The precious metal was whipsawed by a double-edged sword reaction to the special runoff elections in Georiga. Democrats won effective control of the Senate, allowing them to pass multi-trillion relief packages – thus boosting XAU/USD.

On the other hand, the prospects of higher government debt sent investors fleeing from bonds, resulting in higher returns on Treasuries. Gold reacted with a downfall. Moreover, the Federal Reserve seems reluctant to jump to the rescue, at last for now.

In the meantime, how is the yellow metal positioned on the chart?

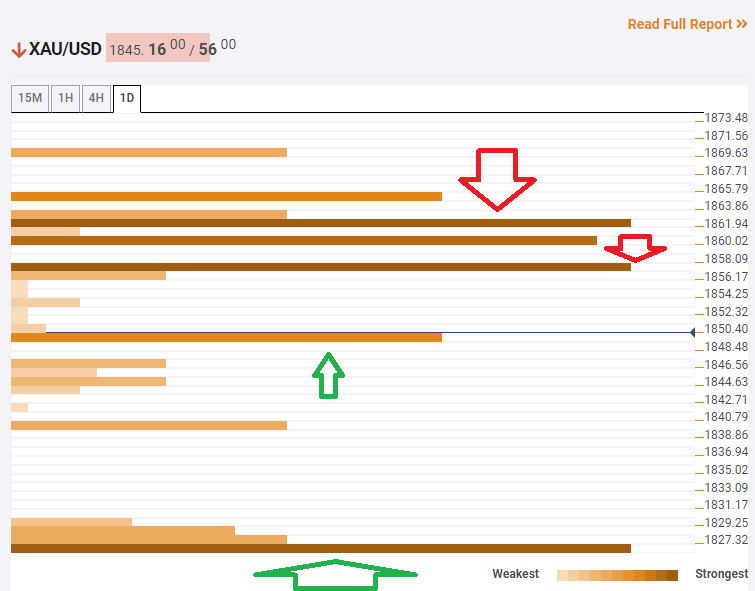

The Technical Confluences Indicator is showing that XAU/USD has some support at $1,849, which is the convergence of the Simple Moving Average 5-1h, the Fibonacci 23.6% one-day, and the previous 1h-low.

However, there is little support between that line and $1,827, which is the downside target for gold bears. The potent Bollinger Band one-day Lower and the Fibonacci 61.8% one-month meet there.

Resistance awaits at $1,857, which is the confluence of the previous 4h-high and the Fibonacci 38.2% one-month.

Further above, a minefield of lines awaits around $1,860. This includes the Fibonacci 23.6% one-week, the SMA 200-4h, the BB 1h-Upper, and others.

XAU/USD resistance and support levels

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.