Gold Price Analysis: XAU/USD bears eye a decisive break below $1871 – Confluence Detector

Gold (XAU/USD) licks wounds after hitting fresh monthly lows below $1870 on Wednesday. The yellow metal fell amid resurgent haven demand for the US dollar, as partial lockdowns implemented in Germany and France threatened to derail the global economic recovery.

“Sell everything mode” returned to markets amid renewed coronavirus fears, as gold tumbled alongside stocks. The metal closed below the critical 100-DMA support of $1887 on a daily basis for the first time since March. Let’s take a look at the charts to see if gold will resume its downtrend.

Gold: Key resistances and supports

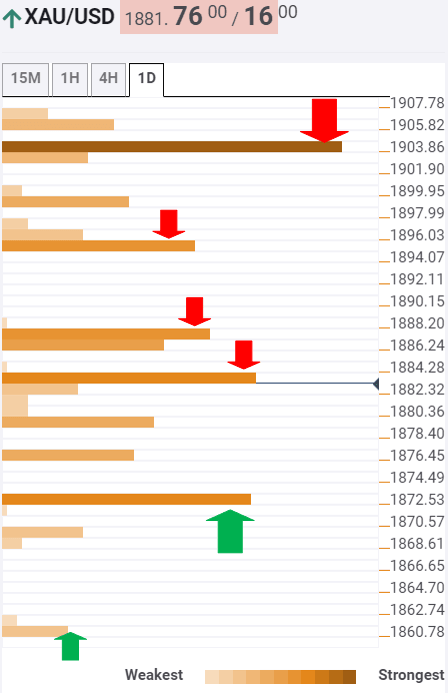

The Technical Confluences Indicator shows that the yellow metal is flirting with the $1884 barrier, which is the confluence of the SMA5 four-hour and Fibonacci 23.6% one-month.

The next upside cap appears at $1887, where the pivot point one-week S1 coincides with SMA100 one-day.

Further up, the intersection of the previous week low and SMA10 four-hour at $1895 will offer some resistance.

Acceptance above $1904 is critical to ease off the bearish pressure in the near-term. That level is the powerful confluence of Fibonacci 38.2% one-month and SMA10 one-day.

On the flip side, a sustained move below $1871 cushion, the convergence of the pivot point one-week S2 and Fibonacci 161.8% one-week), will open floors for a test of $1860 (pivot point one-day S1).

Here is how it looks on the tool

About Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.