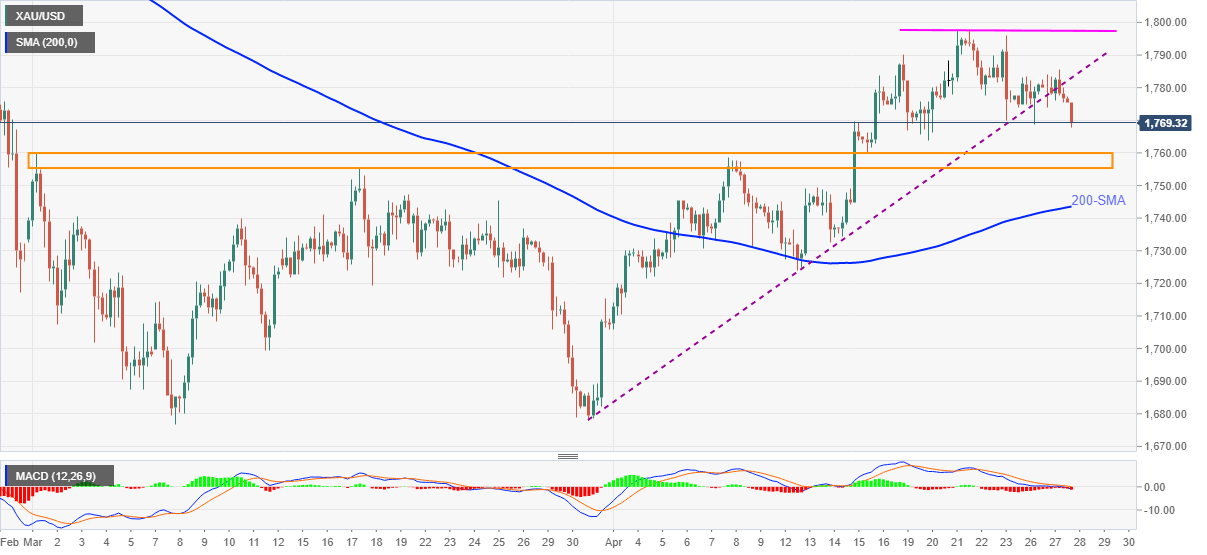

Gold Price Analysis: XAU/USD bears cheer break of monthly support line below $1,800

- Gold refreshes weekly low while extending the previous day’s losses.

- Downbeat MACD, trend line break favor short-term sellers.

- Two-month-old horizontal area, 200-SMA to test the bears.

Gold drops to the fresh one-week low of $1,767.68, down 0.43% intraday, during early Wednesday.

In doing so, the bright metal justifies the previous day’s downside break of an ascending support line from March 31. Also supporting the gold sellers are the bearish MACD signals.

However, an area comprising tops marked since March around $1,760–55, becomes the key support.

Also likely to challenge the bullion’s further weakness could be 200-SMA level near $1,743.

On the flip side, the support-turned-resistance line around $1,783 guards the quote’s immediate upside ahead of the “double top” formation near $1,798.

Even if the commodity prices cross $1,798, the $1,800 round figure will probe the further upside.

Gold four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.