Gold Price Analysis: Breakout extends beyond $2,050 as dip proves buy opportunity – Confluence Detector

Gold has been edging higher but seems shy of staging a major breakout. The precious metal is pushed higher by the failure of American politicians to reach an agreement on extending federal unemployment benefits and other emergency programs. That implies a bigger package down the road – and more importantly for XAU/USD more monetary stimulus.

Update: The dip has been proving to be a substantial buying opportunity, as XAU/USD broke out late on Tuesday and has been extending its gains ever since. At the time of writing, the precious metal hit a peak of $2,039.76 and its consolidation has been minimal – hovering around $2,035.

Update 2: XAU/USD has hit a new all-time high of $2,055.65 after the ADP Non-Farm Payrolls missed with only 167,000 jobs gained and a forward-looking indicator also points to job losses. The employment component of the ISM Non-Manufacturing Purchasing Managers' Index has indicated a loss of jobs in July. That implies further fiscal and monetary stimulus, weakening the dollar and favoring gold.

For the latest updates on technical confluence related to gold prices, see:

- Gold: Buy the dips circa $2008 after a correction from record highs

- Gold: Temporary pullback before moving to $2100 – TDS

On the other hand, hopes for a coronavirus vaccine remain robust as Novavax and other companies are moving forward to provide immunization. Stocks, bonds, and precious metals are looking for a new direction.

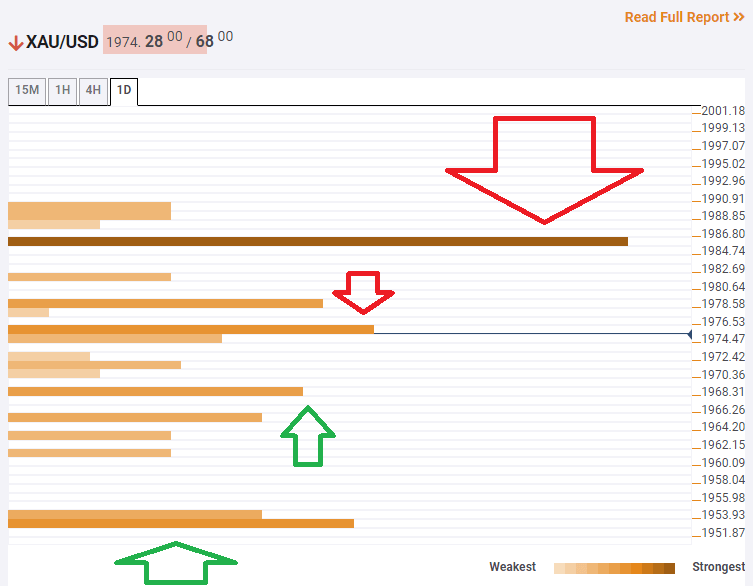

How is gold positioned on the charts? Significant hurdles loom over XAU/USD, implying another attempt to push the precious metal to the upside seems futile. However, after extending the downward correction, gold may be ready for the next bullish move – as fundamentals continue pointing higher.

The Technical Confluences Indicator is showing that gold is initially capped at $1,975, which is a cluster including the Simple Moving Average 5-15m, the SMA 10-1h, the Bollinger Band 15min-Middle, the BB 1h-Middle, and several other SMAs.

The most significant resistance is at $1,985, which is the all-time high and also where the BB 4h-Upper and Fibonacci 23.6% one-day converge.

Some support awaits at $1,968, which is the confluence of the SMA 100-1h, the previous 4h-low, and the SMA 5-one-day.

A more considerable cushion is at $1,952, which is the meeting point of the Fibonacci 38.2% one-week and the BB 4h-Lower.

All in all, the path of least resistance is to the upside.

Key XAU/USD resistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.