Gold Price Analysis: Recapturing $1800 critical for XAU/USD to unleashing additional upside – Confluence Detector

Gold (XAU/USD) is consolidating its latest leg up to fresh two-month highs just shy of the $1800 mark. The upbeat momentum in gold was revived by the renewed sell-off in the US Treasury yields amid an uncertain global economic outlook, thanks to the surging covid infections. Meanwhile, the ongoing decline in the US dollar also lent support to the yellow metal, although the further upside was capped by the recovery in global stocks.

Let’s see how is gold positioned technically?

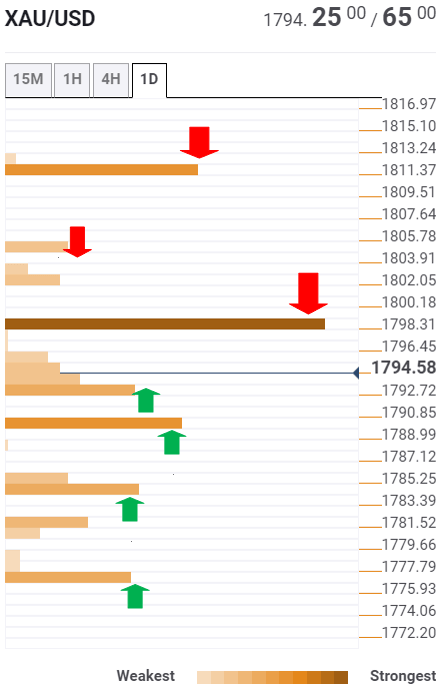

Gold Price Chart: Key resistance and support levels

The Technical Confluences Detector shows that gold needs to crack this critical resistance at $1798-1800 to unleashing the additional upside. That level is the convergence of the previous day high; pivot point one-week R1 and pivot point one-month R2.

The SMA100 one-day at $1804 could challenge the bullish commitment, as all eyes remain set on the $1811 upside target.

At that point, the Fibonacci 161.8% one-month coincides with the pivot point one-day R2.

On the flip side, the Fibonacci 23.6% one-day at $1792 likely limits the immediate downside.

The next best for the bears is seen at $1789, the confluence of the SMA5 four-hour and Fibonacci 38.2% one-day.

The intersection of the previous week high and SMA10 four-hour at $1784 could act as strong support.

The last line of defense for the XAU bulls awaits at $1776, the previous day low and SMA5 one-day.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.