Gold Price Analysis: Nears descending triangle resistance

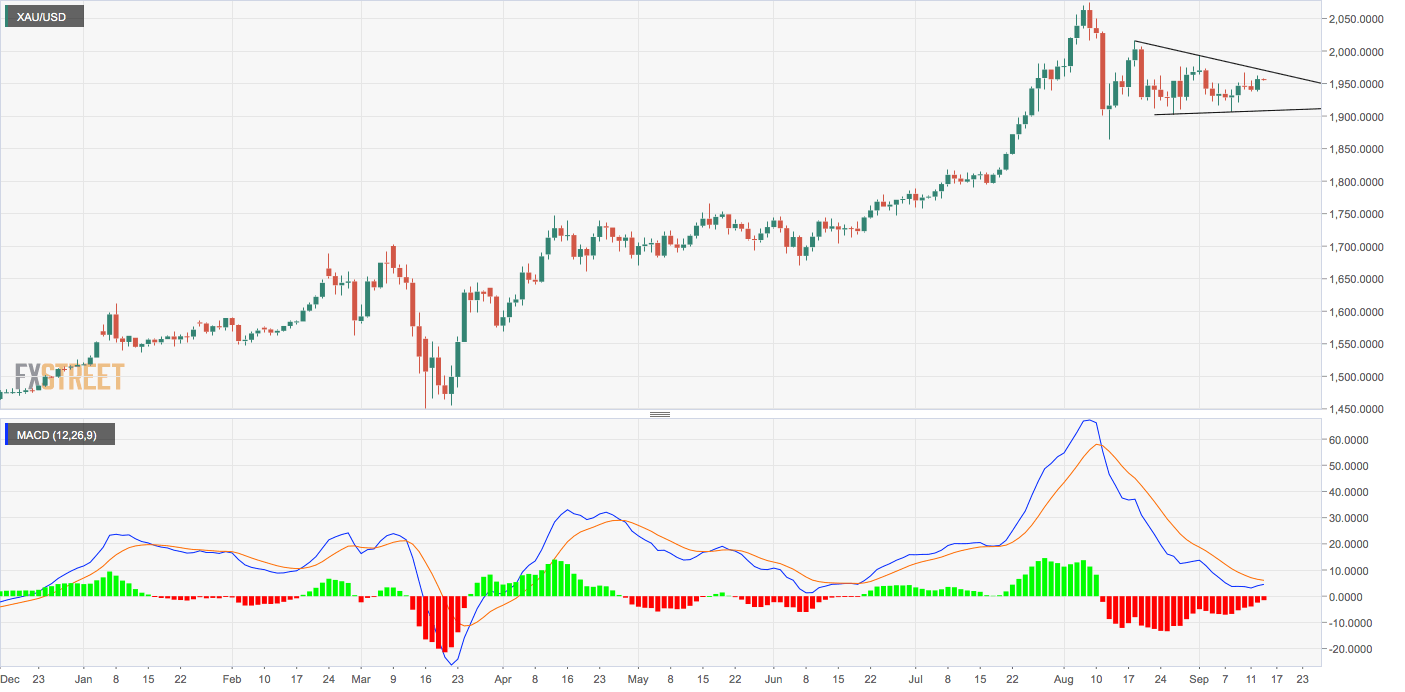

- Gold has carved out a descending triangle on the daily chart.

- The yellow metal is currently trading near the upper end of the triangle.

Having jumped 0.89% on Monday, gold is now closing on the upper end of the four-week-long descending triangle pattern seen on the daily chart,

A close above the triangle resistance, currently at $1,970, would imply revival of the broader uptrend and expose the record high of $2,075 reached on Aug. 7. On the way higher, the yellow metal may encounter resistance at $$1,992 (Sept. 1 high) and $2,016 (Aug. 18 high).

A breakout looks likely as the MACD histogram has charted higher lows, a sign of weakening of downward momentum.

On the downside, the triangle support at $1,909 is the level to beat for the bears. At press time, gold is trading near $1,955 per ounce.

Daily chart

Trend: Bullish above $1,970

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.