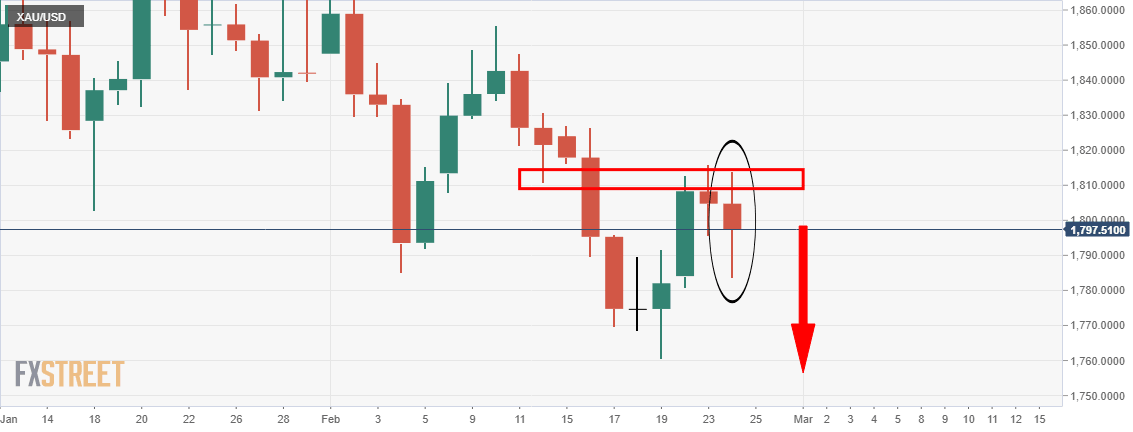

Gold Price Analysis: Bears about to burst out of their cage to target $1,745.80

- Gold is ripening for a short side trade setup given the recent price action.

- Bears can target a measured target of $1,745.80 once 4-hour conditions confirm the bearish bias.

Further to the prior analysis, Gold Price Analysis: Bears engaging below firm resistance, targetting $1,750, gold has indeed broken below 1800 and reached the $1,790 target, in fact printing a low beyond there at $1,782.50.

Prior analysis, daily chart

The market at this juncture would now be expected to move deeper into test $1,790.

In doing so, the focus will be on a downside extension towards $1,750 in a continuation of the daily downtrend and bearish late summer 2020 cycle:

Live market

The daily chart shows that the price has started to carve out the road to the downside.

At this juncture, bears can start to monitor for bearish structure from the 4-hour chart and engage at an optimal entry point once higher probability conditions have been met:

4-hour price action

The price structure is still too neutral until the resistance at the bullish M-formation's neckline proves resilient because. On the next test, the price can easily move higher.

However, on repeated failures at the resistance, MACD will turn negative confirming the bullish bias and technical environment.

Bears will then have the additional conviction needed to engage with the downtrend and target a measured -272% Fibonacci retracement of the daily correction and target of $1,745.80.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.