Gold Price Analysis: Battle lines well-defined as XAU/USD awaits key US data – Confluence Detector

Gold (XAU/USD) is holding onto the overnight recovery gains, underpinned by dovish Fed Chair Powell and President-elect Biden’s $1.9 trillion stimulus plan. The sell-off in the US Treasury yields amid Fed’s dovish monetary policy prospects seems to bode well for the non-yielding gold.

Also, broad-based US dollar weakness amid weak jobs data collaborates with the pullback in the metal. Despite gold’s bounce, investors remain cautious heading into critical US Retail Sales and Michigan Consumer Sentiment releases.

How is gold positioned on the charts?

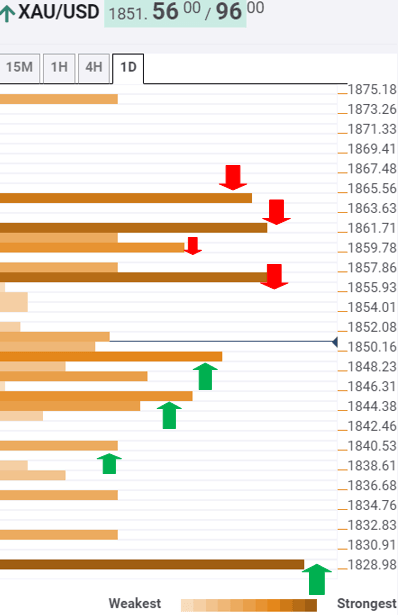

Gold Price Chart: Key resistances and supports

The Technical Confluences Indicator shows that gold has powerful resistance to clear at $1857 (Fibonacci 38.2% one-month) if it wants to take on the upside.

However, its not going to be an easy task for the bulls, as a cluster of resistance levels around $1860/61 would challenge their commitment. That area is the confluence of the Fibonacci 23.6% one-week and pivot point one-day R1.

Further north, the convergence of the SMA50 one-day, SMA200 four-hour and Bollinger Band four-hour Upper at $1864 is the level to beat for the bulls.

To the downside, an immediate cap is seen at $1849, which is the intersection of the SMA5 one-day, SMA100 one-hour and previous high four-hour.

The next significant cushion awaits at $1845, the SMA5 four-hour. A break below the latter could expose the Fibonacci 38.2% one-day at $1840.

The bears will need to crack a couple of minor supports before testing the fierce line of defense at $1829, where the previous week low meets the previous day low.

Here is how it looks on the tool

About Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.