Gold Miners Junior (GDXJ) next bullish cycle likely in progress [Video]

![Gold Miners Junior (GDXJ) next bullish cycle likely in progress [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/aurum-37842316_XtraLarge.jpg)

GDXJ, or the VanEck Vectors Junior Gold Miners ETF, is an exchange-traded fund that tracks the performance of small-cap gold mining companies. It provides investors exposure to junior gold mining companies, which are typically smaller and more volatile than their larger counterparts. This ETF offers a convenient way for investors to gain diversified exposure to the junior gold mining sector without having to select individual stocks. Below we update the Elliott Wave outlook for the ETF.

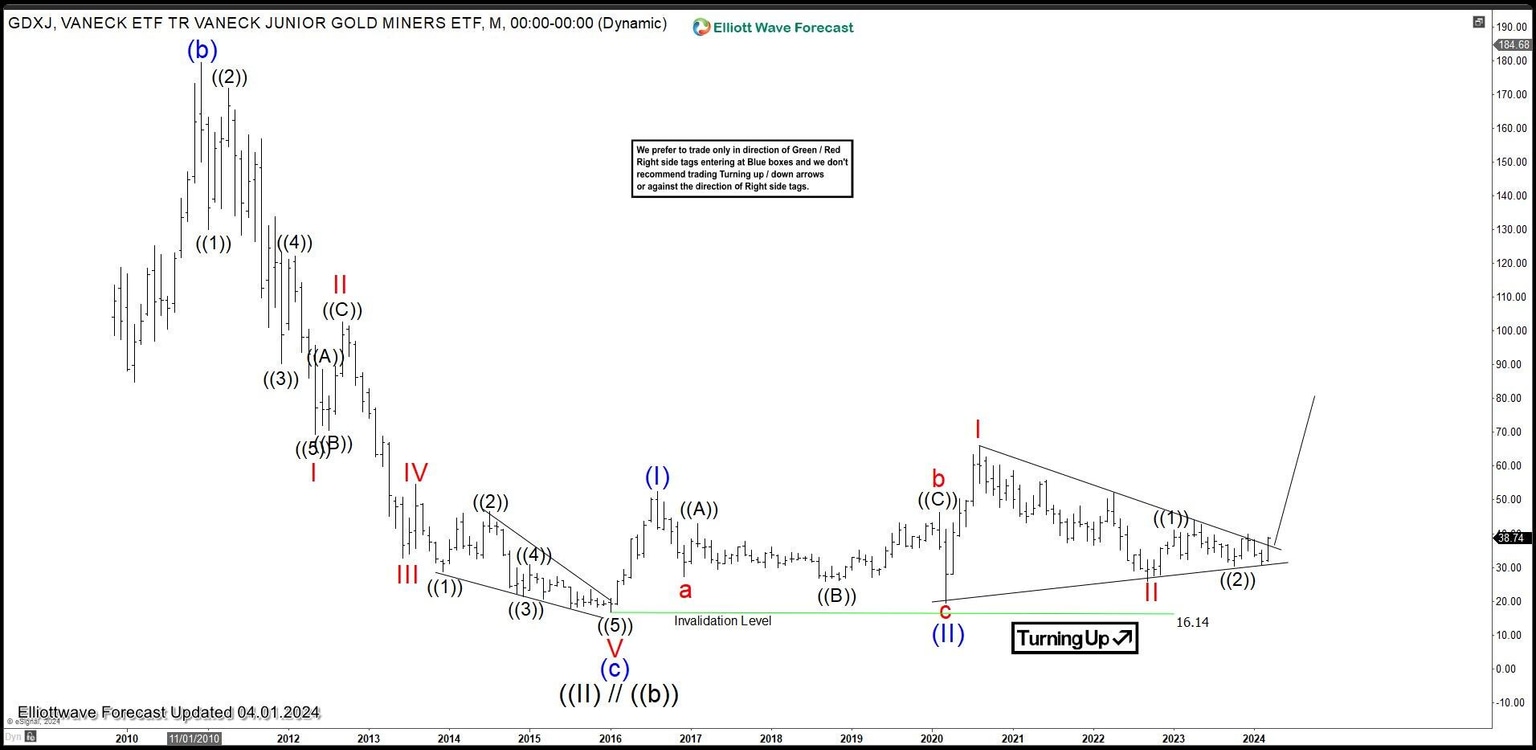

GDXJ monthly Elliott Wave view

Monthly chart of GDXJ above shows the ETF looks to have broken higher from multi year consolidation. Decline to 16.14 ended wave ((II)). Up from there, the ETF starts a new nesting impulse. Wave (I) ended at 52.5 and wave (II) pullback ended at 19.52. The ETF then nested higher with wave i of (III) ended at 65.95 and wave II ended at 25.80. While above 16.14, expect the ETF to continue higher.

GDXJ daily Elliott Wave view

Daily Elliott Wave Chart of GDXJ above shows the ETF ended wave II at 25.8. The ETF turns higher in wave III with internal subdivision as a 5 waves impulse. Up from wave II, wave ((1)) ended at 41.16 and pullback in wave ((2)) ended at 30.56 as an expanded flat. Up from there, wave (1) ended at 39.82 and dips in wave (2) ended at 30.89. As far as pivot at 25.8 low stays intact, expect the ETF to extend higher.

GDXJ four-hour Elliott Wave view

4 Hour Elliott Wave view of GDXJ above shows that wave 1 of (3) remains in progress. Up from wave (2), wave ((i)) ended at 32.77 and wave ((ii)) pullback ended at 31. The ETF resumed higher in wave ((iii)) towards 37.16 and wave ((iv)) ended at 35.24. Expect the ETF to continue higher to end wave ((v)) of 1. Afterwards, it should pullback in wave 2 to correct cycle from 2.14.2024 low before it resumes higher again.

GDXJ Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com